All taxpayers registered under GST are required to file their annual return for the financial year 2023-24 by December 31, 2024, except for certain exempted categories.

Before completing the annual return filing, taxpayers must first submit all monthly returns or quarterly returns, depending on whether they are part of the QRMP scheme.

This is because the GST annual return relies heavily on data that is auto-filled from these monthly or quarterly returns (as applicable).

Major Updates in the GST Annual Return (GSTR-9) for FY 2023-24

A CA professional highlighted a major update to the GSTR-9 form. Here are the significant changes in Input Tax Credit (ITC) Reporting-

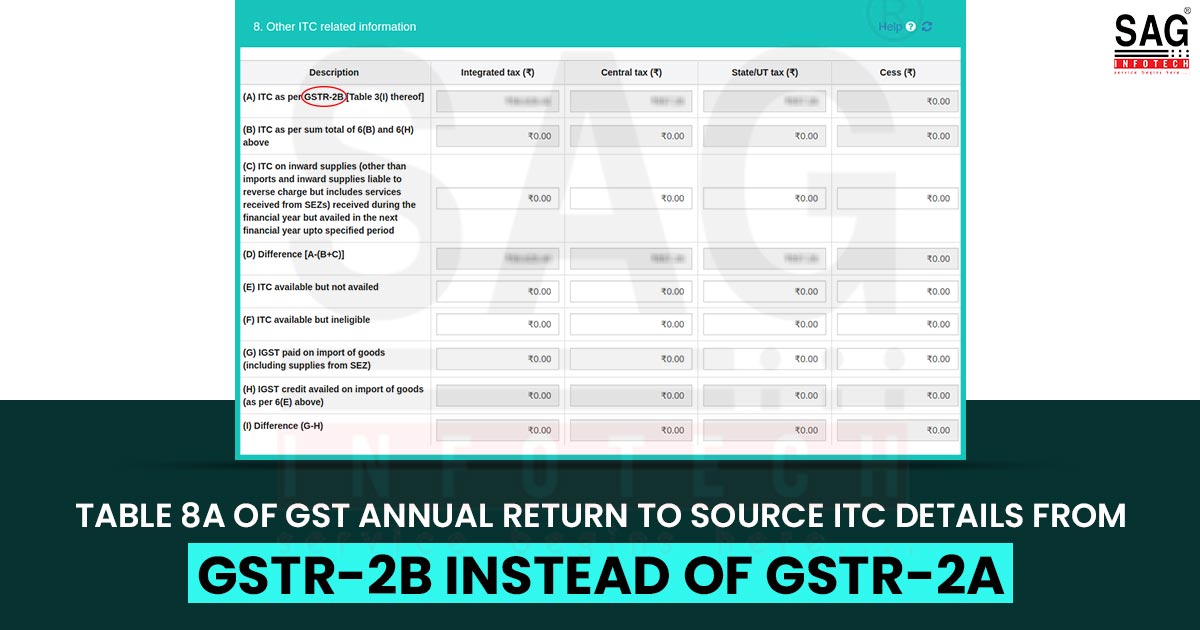

The most notable modification in the GSTR-9 form relates to the sourcing of ITC details in Table 8A. Previously, these details in Table 8A were furnished in GSTR-2A, which is a statement for inward supplies. Starting from FY 2023-24, however, Table 8A will fill its data from GSTR-2B.

GSTR-2B is an auto-generated statement that auto-populates invoice information uploaded by suppliers. This change aims to simplify the ITC reconciliation process, reducing manual effort for taxpayers.

These changes have considerable implications for taxpayers, particularly in ensuring accurate ITC claims and reconciliation. Taxpayers must encourage their suppliers to upload invoices without delay, as untimely submissions can cause mismatches in ITC data. Since GSTR-9 will now rely on GSTR-2B for input data, maintaining the accuracy and timeliness of GSTR-2B is essential for a seamless filing process.

Discrepancies might occur if the ITC claimed in GSTR-3B does not match GSTR-2B due to delayed invoice uploads by suppliers or other issues. Such mismatches necessitate additional reconciliation efforts, underlining the need for meticulous data management to avoid complications and ensure compliance.

GSTR-2B is an auto-drafted ITC statement generated for all GST-registered taxpayers based on suppliers’ submissions in their GSTR-1 filings.

Experts agree with the chartered accountant’s insights on the changes. They say that the revised instructions now mandate that Table 8A in GSTR-9 be based on GSTR-2B instead of GSTR-2A.

Additionally, ITC usage will be reported in Table 6 based on returns filed for the relevant financial year. Table 8A will reflect ITC data from GSTR-2B, and any differences between claimed ITC and auto-populated data will be displayed in Table 8D for reconciliation purposes.

Experts advise that suppliers must promptly upload invoices to ensure ITC is appropriately reflected in GSTR-9 for the related financial year. Taxpayers are advised to monitor GSTR-2B closely to capture and reconcile eligible ITC effectively because now it will be the basis for reporting in Table 8A.

GSTR-9 Form Deadline and Eligibility

GST-registered taxpayers with an annual turnover of up to ₹2 crore are exempt from filing the GST annual return for FY 2023-24.

An expert, explains that all GST-registered persons, excluding input service distributors, those paying taxes under TDS/TCS provisions, casual taxable persons, and non-resident taxable persons, must submit their annual return using Form GSTR-9. The majority of registered taxpayers fall within this filing requirement, as they do not fall under the bracket.

According to experts, taxpayers with an annual turnover exceeding ₹2 crore must file GSTR-9C, a reconciliation statement submitted alongside GSTR-9. For turnovers between ₹2 crore and ₹5 crore, filing GSTR-9C is optional, while taxpayers with turnovers above ₹5 crore must file it mandatorily.