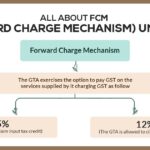

In this post, the discussion will be in the direction of the GST Forward charge mechanism, analyze its working, and discussion of its related advantages. Moreover, we shall discuss the FCM impact on small businesses and find out the methods to resolve the cost of compliance. The execution of the Forward charge mechanism (FCM) would […]