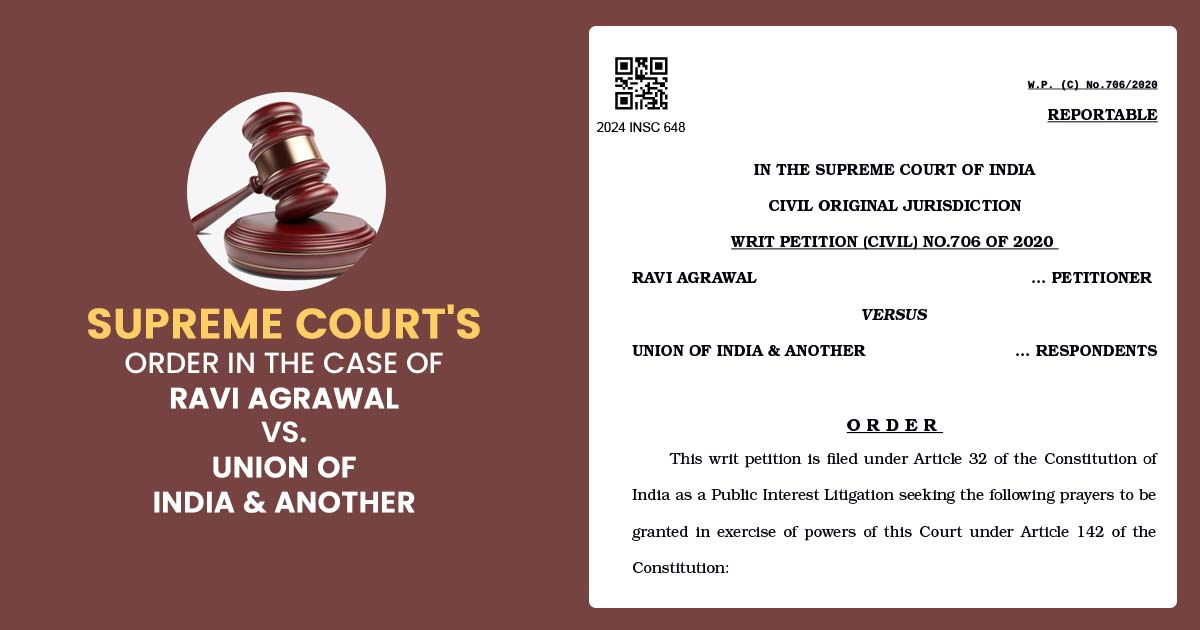

The blog discusses the legal elements for the condonation of the delay in the petition of GST, examining the related case laws and furnishing a complete technical discussion on the case. GST tax litigators are under pressure to furnish their appeals to the first appellate authority. It is expected that distinct appeals shall be filed […]