Infant food products containing ingredients other than milk could face an 18 per cent Goods and Services Tax (GST), differing from the 5 per cent rate for pure milk products, according to a recent judgment by the Rajasthan Authority for Advance Ruling (AAR).

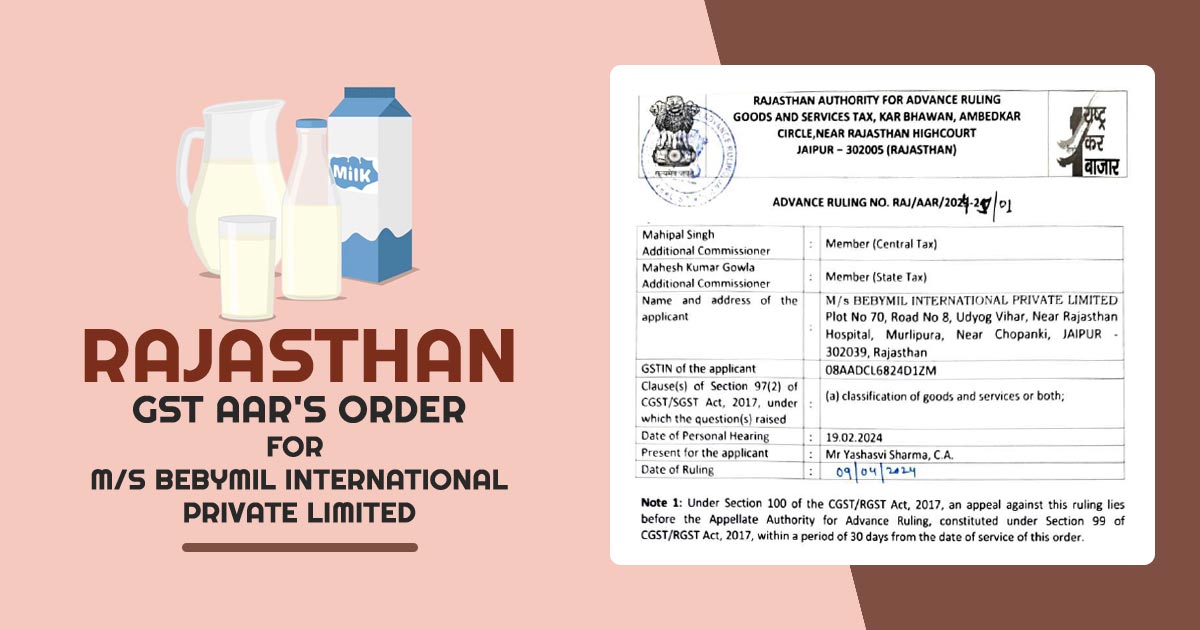

This ruling emerged from a request by Jaipur-based Bebymil, which sought clarity on the GST rate for its infant food products sold under the brand name Momylac. The products in question include infant milk formula mixed with cereals and protein supplements, designed as a substitute for mother’s milk.

Read Also: GST Rate on Milk, Paneer & Dairy Products with HSN Code

The GST rates for products are assigned based on their Harmonized System of Nomenclature (HSN) codes. The AAR noted that these products are classified under HSN code 1901, which covers items where milk is merely one of several ingredients. This is in contrast to HSN code 0402, which pertains specifically to milk products, explained Sandeep Sehgal, a partner at the tax and consulting firm AKM Global.

The AAR ruled that products falling under HSN code 1901 should be taxed at an 18 per cent GST rate. Sehgal highlighted that items classified under HSN code 0402 are subject to a lower GST rate of 5 per cent. He further stressed that the composition of ingredients in any product is crucial in determining its classification and the corresponding GST rate.

| Case Title | M/s Bebymil International Private Limited |

| GSTIN of the Applicant | 08AADCL6824D1ZM |

| Date | 09.04.2024 |

| Applicant | Mr Yashasvi Sharma |

| Rajasthan GST AAR | Read Order |