India doing well in the ease of doing business criteria means an increase in foreign investments but India’s domestic industries are still getting at ease with GST.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

India doing well in the ease of doing business criteria means an increase in foreign investments but India’s domestic industries are still getting at ease with GST.

The long-awaited Multi-vehicle option for the e-Way bill has been finally introduced in the GST Portal. An E-way bill is now mandatory for vehicles transporting goods worth more than Rs. 50,000 in value.

The three and a half lakh e-Way bills generated each day in Coimbatore are an indication of the successful implementation along with large-scale acceptance by the taxpayer.

Recently, the GST council had decided to slash some more tax rates on around 54 services and 29 items in a meeting. Presently, there are 4 GST slab rates namely, 5 percent, 12 percent, 18 percent and 28 percent.

In a bid to give relief to the transporter over the issues related to the GST e way bill, the Allahabad high court had given statement according to which there is no need to carry a hard copy of a GST e way bill along with the goods.

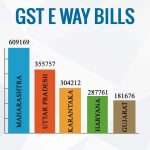

In a report and a tweet from the GSTN account had clearly stated that the Maharashtra tops in generating e way bills for the transportation of goods through motorized vehicles of value more than 50,000.

A centralised Authority for the advance ruling is under discussion, to maintain a single platform for all the rulings of similar nature done in the different states. The issues raised in different states must be of same nature get it noticed by the central appellate.

The GST E Way Bill has finally spread across India from 3rd June 2018 in its full glory. The E Way Bill is an online mechanism to be followed while transporting goods from one place to another.

GST E Way Bill is all set to roll out in almost all the states, and now its the turn of Jammu Kashmir & Tamil Nadu. Both the states will have GST intrastate e waybill from 1st June 2018 and 2nd June 2018 respectively.