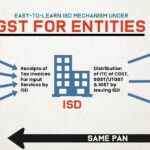

With the implementation of the goods and services tax (GST) in July 2017, businesses with multi-state GST registrations are under confusion about the process of distributing common input tax credits (ITC) available on services to lower net GST liability. Some of the entities have chosen the input service distributor (ISD) process to allocate the common […]