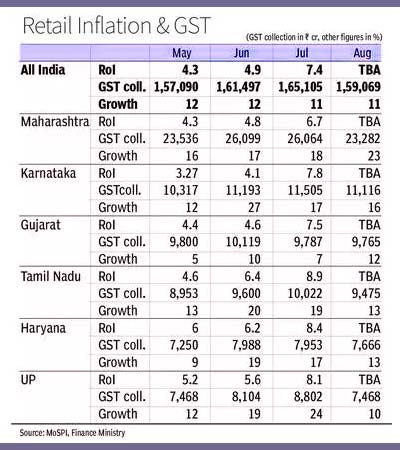

Consumption, in counted with inflation and compliance, significantly boosted the GST revenue in key States from February to July of this year. Most of these States experienced substantial double-digit growth, with Maharashtra leading not only in accordance with collection but also in growth.

Because GST functions on a consumption-based tax model, impacting prices of both input and output goods, it’s obvious that both wholesale and retail inflation play a crucial role in influencing GST revenue. Experts have identified a correlation between inflation and GST collection, and they anticipate that certain components of GST may be linked to the Wholesale Price Index (WPI) while others relate to the Consumer Price Index (CPI).

Retail inflation, as measured by the CPI, stood at 6.52 percent in January this year, later reducing to a low of 4.31 percent in May before rising to 7.44 percent in July. During this same period, the WPI dropped from 4.8 percent in January to -4.1 percent in June, slightly rising to -1.36 percent in July. Throughout these fluctuations, GST collections ranged from Rs. 1.50 to Rs. 1.6 lakh crore, reaching an all-time high of Rs. 1.87 lakh crore, partly due to year-end stock clearance efforts.

Anil K Sood, Professor and Co-founder of the Institute for Advanced Studies in Complex Choices, noted a strong positive correlation of 0.619 between WPI and GST collection from August 2021 to July 2023. Surprisingly, the correlation between Goods and Services Tax (IGST) (Customs) collection and WPI was even higher at 0.856, despite WPI declining.

As anticipated, the correlation between CPI and GST collections was relatively weak at 0.07, but it strengthened to 0.19 when considering lagged GST collection with a one-month delay. This supports the hypothesis that inventory levels and producers’ ability to pass on price increases to consumers play a role in the lag.

In many states with a CPI rate higher than the median (4 percent), there was also recorded higher growth in GST collection. Maharashtra, a top contributor to GST revenue with record growth, consistently had a CPI above the median throughout the year. However, Karnataka and Gujarat, also significant contributors, could not achieve growth like Maharashtra.

At the state level, the strength of the relationship depends on the state’s production and consumption structure. States with a significant share of processed food in their consumption basket are inclined to see increased GST collection with high retail food inflation due to higher GST incidence and producers passing on cost increases.

Read also: GST Dept. Collects INR 1,65,105 Crore Revenue for July 2023

Additionally, states with a higher share of commodities, especially imported ones, in their production and consumption basket exhibit a strong correlation between WPI inflation and GST collection. They also experience greater volatility in GST collection because WPI is more volatile than CPI.