If Assessee has uploaded TDS return but there occur some mistakes while furnishing the TDS statement PAN is wrongly mentioned, short deduction of TDS amount, excess utilization of any challan etc. In that case, the assessee has to do online corrections in the TDS statement on “TRACES” (TDS Reconciliation Analysis and Correction Enabling System).

Steps for Online Corrections in TDS/TCS Statement

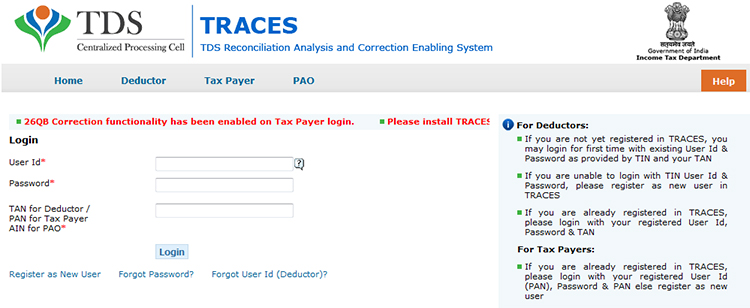

Step 1: Log in to TRACES website

Step 2: Go to “Request for correction” under “Defaults” by entering the relevant Quarter, Financial Year, Form Type, and Latest Accepted Token number. The correction category should be “Online”, and the request number will be generated

Step 3: The request will be available under “Track Correction Request” when the request status becomes “Available” Click on Available / In progress status to proceed with the correction and provide information of valid KYC

Step 4: Select the type of correction category from the drop-down as “Challan Correction”

Step 5: Make the required corrections in the selected file

Step 6: Click on “Submit for Processing” to submit your correction (Only available to admin user), and the request can be submitted via Digital signature of an Authorised person.

Step 7: A 15-digit token number will be generated and mailed to the registered e-mail ID

Online Corrections’ List of TDS/TCS

All types of corrections, like “Personal information, Deductee details and Challan correction” can be made using online correction functionality available from FY 2007-08 onwards, depending upon the type of correction.

| Type of Error or Defaults | Correction Type | Available from FY | DSC Required |

|---|---|---|---|

| If the challan is unmatched | Challan correction | FY 2007-08 Onwards | No |

| Add a new challan | Add a challan to the statement | FY 2007-08 Onwards | No |

| To clear the interest and late fee demand payment | Pay 220, interest, levy, late filing | FY 2007-08 Onwards | No |

| To move the deductee row | Request for overbooked challan (move the deductee row from the challan) | FY 2007-08 Onwards | No |

| To update PAN | PAN correction | FY 2007-08 Onwards | Yes |

| To add/modify the deductee row | Add/Modify deductee details | FY 2013-14 Onwards | Yes |

| To update personal details | Personal information | FY 2007-08 Onwards | Yes |

| To modify salary details | Add or delete salary details | FY 2013-14 Onwards | Yes |

Note: For the paper return, online correction cannot be done

Status of Online Correction Requests

- Requested: When the user submits a request for correction.

- Initiated: The request is being processed by TDS CPC

- Available: Request for correction is accepted, and the statement is made available for correction. The user can start correcting the statement. Clicking on the hyperlink will take the user to the validation screen. Once the user clicks on the request with ‘Available’ status, the status of the request/statement will change to ‘In Progress

- Failed: Request cannot be made available due to a technical error. The user can resubmit the request for the same details

- In Progress: The user is working on a statement. Clicking on the hyperlink will take the user to the validation screen

- Submitted to Admin User: Sub-user / Admin User has submitted a correction statement to Admin User

- Submitted to ITD: Admin User has submitted a correction statement to ITD for processing

- Processed: Statement has been processed by TDS CPC (either for Form 26AS or for defaults)

- Rejected: Statement has been rejected by TDS CPC after processing. Rejection reasons will be displayed in the ‘Remarks’ column.