In a recent decision taken by the Modi government has given a relaxation and a worthy package of Rs 27,413 crore to all the hill states of India. Under this package, industries in mountain states including Uttarakhand, Himachal Pradesh and Jammu and Kashmir will continue to get the facility of exemption in goods and services tax (GST) until March 2027. However, it is to be noticed that the industries will get this facility in the form of refunds.

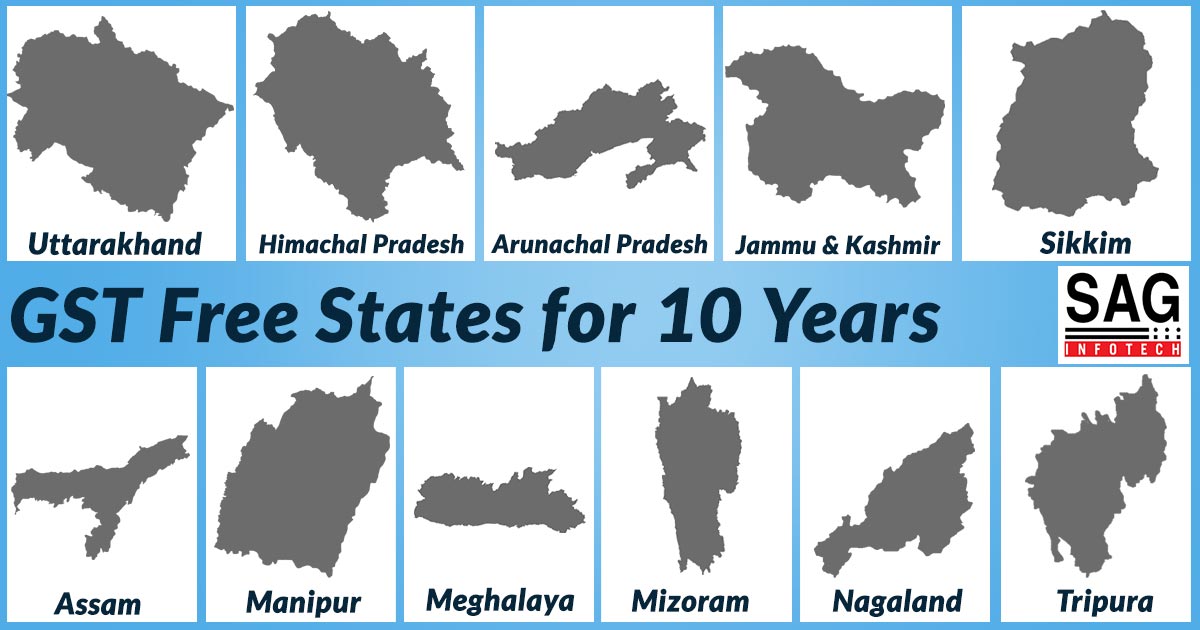

After implementation of GST from July 1, the situation was not clear about the facility of exemption in the indirect taxes to industries engaged in these states. Although the government has taken this step now, it will benefit 11 states, including eight states of the East. The proposal to this effect was approved at the meeting of the Cabinet Committee on Economic Affairs, headed by Prime Minister Narendra Modi.

Read Also: List of Goods and Services Not Eligible for Input Tax Credit

After the meeting, Finance Minister Arun Jaitley stated the decision and said that under the Framework Act, industries will continue to be facilitated by the tax refund till 31 March 2027. The government will issue refund amount of the industrial units in these states according to the budget allocated. The States which will get this facility includes Sikkim, Arunachal Pradesh, Meghalaya, Assam, Mizoram, Manipur, Nagaland and Tripura.

This will be done only for the remaining periods of ten years from the date they started commercial production for the help of industrial units. It is notable that there is no provision of exemption from indirect taxes under the law. However, if the centre or state government wants to give a discount to any of the industry then it can refund the amount. The Department of Industrial Policy and Promotion will release the detailed guidelines of this plan soon.

Recommended: GST Refund Procedure Under Goods and Services Tax India

Jaitley said that the industries will get refund facility through DBT. The benefit of this facility will be given to 4,284 companies and for this, the government has allocated an amount of Rs 27,413 crore and the amount will be available from 1st July 2017 to 31 March 2027. Prior to the implementation, these industries had the benefit of exemption from central excise duty. It is to be noticed that the Government has been running this scheme since 2007 to safeguard hilly states.

If I want to put up a manufacturing plant in Palampur now, Will I be entitled to the exemption of GST?

Please clarify my doubt.

No exemption is allowed for area-based activities. The exemption is on the type of supply in which you are involved.

If this exemption is available for new industry to be started ‘ or to an industry which started production in earlier exemption scheme on excise till March 31st, 2010 please clarify this point.

This will be done only for the remaining periods of ten years from the date they started commercial production with the help of industrial units.