The Ministry of Corporate Affairs (MCA) has fined a private limited company and its director ₹2.5 lakh because they failed to appoint an Internal Auditor, which is a requirement for businesses to ensure proper financial management.

In accordance with Section 138 of the Companies Act, 2013, and as stipulated in Rule 13(1)(c) of the Companies (Accounts) Rules, 2014, companies are mandated to appoint an Internal Auditor. Failure to adhere to this requirement can result in financial penalties, underscoring the importance of compliance with statutory obligations in corporate governance.

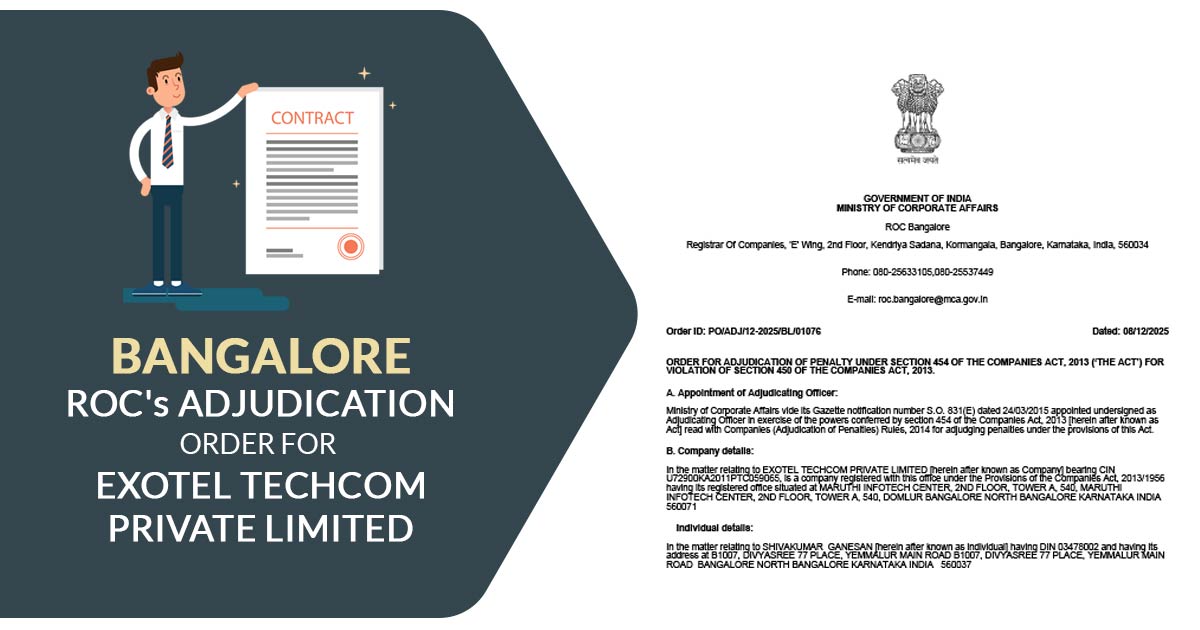

According to the order dated 08.12.2025, the ROC held that since Exotel Techcom Private Limited’s (i.e., the Company’s) turnover crossed the defined threshold, it was directed to appoint an internal auditor from FY 2022-23 onwards; however, the appointment was made only on 14.11.2024.

Recommended: How ROC Software Solves Key Challenges in Annual Audits

The registrar reported a persistent default lasting 958 days.

From the order, the company itself submitted a suo-motu application dated 09.01.2025, considering the lapse. It mentioned that it had not appointed an internalauditor for FY 2022-23 and FY 2023-24, even though such an appointment was compulsory.

Thereafter, the ROC issued an SCN, after the hearing dated 20.08.2025, which was attended by the authorised representative of the company. Information on additional turnover was filed via the practising company secretary dated 25.08.2025 as directed during the hearing.

The submissions were analysed by ROC. It concluded that the turnover of the company had surpassed Rs 200 crore in FY 2021-22. The same makes the company obligatory to appoint an internal auditor from FY 2022-23.

Read Also: Penalty Charges for Non-compliance with Filing MCA Forms

With the appointment of the auditor post time period, the registrar held the company and its officer in default, obligated for a penalty for the period 01.04.2022 to 14.11.2024 (958 days).

Hence, it charged a penalty of Rs 2 lakhs on the company and Rs 50,000 on its director.

Read ROC Bangalore Official Order ID PO/ADJ/12-2025/BL/01076

| Company Name | Exotel Techcom Private Limited |

|---|---|

| Total Penalty | INR 2.50 Lakh |

| Order ID | PO/ADJ/12-2025/BL/01076 |

| ROC Bangalore | Read Order |