The details that are to be mentioned in the e-form must be updated by the date of AGM. Towards the concern of AGM, if it is not executed or AGM is performed post to the last date of the AGM, engaging the extension of the mentioned time, then the details are to be furnished up to the last date of the AGM or the last date of the AGM post the extension according to the prescribed case.

Via electronic mode, this form MCA 21A will come on record, excluding any processing in the Registrar of Companies’ office. You must note that all the credentials in the e-form are true according to the records. There is no rule towards which e-form gets submitted again.

Towards the same MCA E-Form 21A, there will be no attachment that can be furnished via addendum services.

Note: The guidelines are not mentioned towards the fields that are easy to understand. Check out the concerned provisions related to the Companies Act 1956 and provisions attached to the mentioned points in this e-form

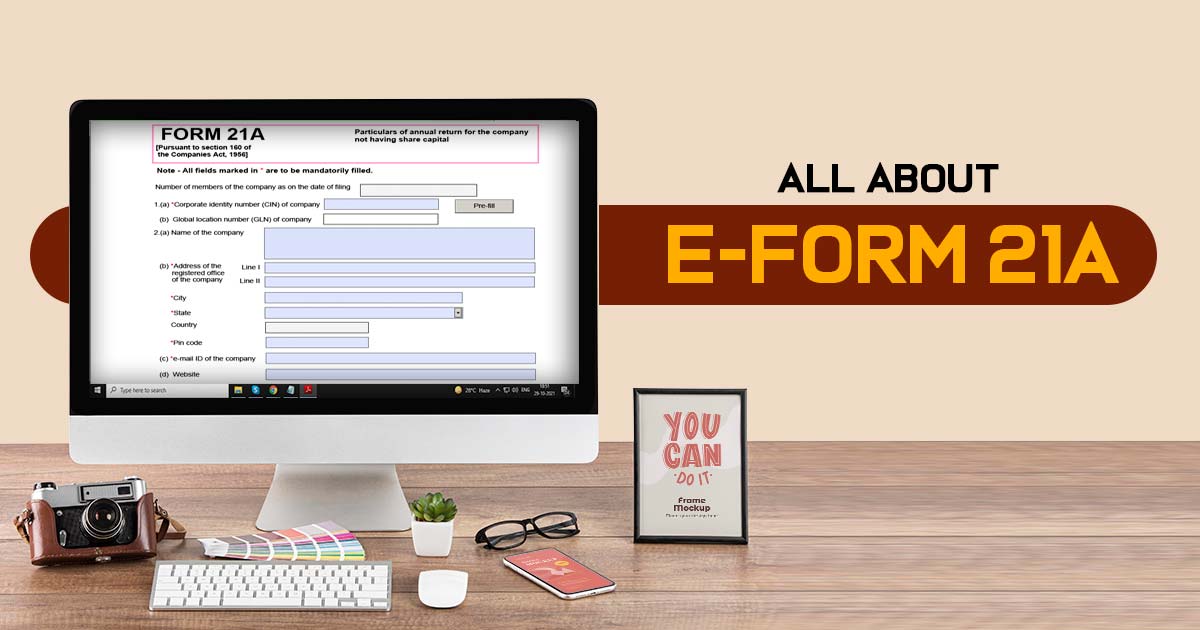

MCA Form 21A Filing Process

Step 1:

- Enter the Corporate Identity Number (CIN) of the organisation.

Step 2:

- Click the “Pre-fill” button.

- The name and the number of the members of the organisation shall be automatically shown by the system.

- The registered address of the company shall be prefilled based on the CIN entered in the form.

- The email ID of the company shall automatically be shown by the system.

Step 3:

- Mention the Financial year-end date to which the annual general meeting (AGM) relates.

- Enter the AGM date or AGM dues, or AGM extension date correctly. The same will get analysed within the other Annual filing forms and could impact their furnishing.

Step 4:

- Since the beginning of the company, the people who are engaged in it enter them in the form of numbers.

- Insert the number of people who have come to an end to be members of the organisation since its start. This must be lower with respect to the number of people who become members of the company as when the company started.

- Enter the number of members as on the AGM date or the latest due date. It must be relevant to the number of people who become members as to when the company started, less the number of people who have blocked the members since the company started.

- Insert the number of members present at the AGM or the due date without including the employees and the past employees; it must not be bigger than the sum of the members as per the date of AGM or the latest date, and must not be more than 50 towards the case of a private firm.

Step 5:

- Details of director(s), Managing Director, manager and secretary as on the date of AGM or the latest due date thereof:

- Details are to be entered in case the date of AGM is on or after 1st July’2007, & Provide Director identification number (DIN) in case of director, Managing Director and Income-tax permanent account number (Income-tax PAN) in case of manager, secretary. Number of director(s), Managing Director, manager and secretary.

- If the date of AGM is not entered by the user, then the latest due date of AGM shall be considered.

- There shall be 5 blocks in the web form, and if any number from 6 to 20 is entered, then the subsequent blocks shall be regenerated and displayed based on the number entered.

- The following validation is applicable only in case the date of AGM is equal to or greater than 01.04.2008 (In case the date of AGM is not entered, then the latest due date of AGM shall be considered):

- In case of a private company (other than a Producer Company), the value entered should be greater than or equal to 2.

- In case of a public company (other than a Producer Company), it should be greater than or equal to 3.

- In the case of Producer Company (part IXA), the value entered should be greater than or equal to 5.

Step 6:

- Enter Details of director(s), Managing Director, manager and secretary who ceased to be associated with the company since the date of the last AGM.

- Details are to be entered only in case the date of AGM is on or after 1st July’2007 & provide DIN in case of the director, Managing Director, and Income-tax PAN in case of the manager, secretary

- The block of fields from “DIN or Income-tax PAN” to “Date of cessation” shall be displayed depending upon the number entered in this field but only in case the date of AGM as entered in field number 4(a) i.e. “If yes, date of AGM (DD/MM/YYYY” is on or after 01.07.2007 (In case date of AGM is not entered, then latest due date of AGM shall be considered).

- There shall be 4 blocks in the web form. If any number from 5 to 8 is entered, then the block shall be regenerated and displayed depending upon the number entered. If the number entered by the user is greater than 8, then the block shall be regenerated 8 times only.

- Date of appointment and Date of cessation. The entered date shall be less than or equal to both the system date and the date of AGM as entered in field 4b (In case the date of AGM is not entered, then the latest due date of AGM shall be considered). Date of cessation (DD/MM/YYYY)

- The entered date shall be less than or equal to both the system date and the date of AGM as entered in field 4b (In case the date of AGM is not entered, then the latest due date of AGM shall be considered).

- The entered date shall be greater than or equal to the date of appointment as entered above

Step 7: Attachments

- The annexure containing particulars of the total amount of indebtedness as on the day of the aforesaid AGM.

- The information of the previous and the current members under the format provided below is not needed if the firm holds the license under section 25 of the Companies Act and is privileged from practising the word limit as the last word of its name. As described under the mentioned format.

- Additional details can be furnished as an optional attachment to the e-form.

Step 8: Verification

- Insert the serial number and date of the board resolution empowering the signatory to sign and furnish to the eForm

Step 9: Digital Signature

The web form shall be signed by the Managing Director, or a director or manager or secretary of the company.

Designation:

- Choose the designation of the individual digitally signing the eForm.

- Insert the DIN towards the case that the individual digitally signing the eForm is a director or managing director.

- Insert the income-tax PAN towards the case when the individual signs the eForm as a Manager.

- Insert the membership number or income-tax PAN towards the case when the individual digitally signs the eForm as a secretary.

Step 10: Certification

- The e-form must be accredited through the CA who practices a whole-time or cost accountant as a whole-time practice or company secretary as a whole-time practice via digitally signing the e-form.

- Choose the related class in the profession and of he or she is connected to.

- Towards the concern that the professional is a CA under whole-time practice or a cost accountant under whole-time practice, insert the membership number. For the concern that a practising professional is a company secretary under whole-time practice, insert the certificate of practice number.

Step 11:

- Select the “submit” button & the details filled in the webform will be automatically saved, and the system verifies the webform. In case any errors are detected, the user will be taken back to the web form, and all the relevant error messages shall be displayed. In case no errors are detected by the system, the submission will be successful.