Traders have been given notices by the Goods and Services Tax Department for issuing incorrect or fake invoices. These notices are based on data from the Mera Bill Mera Adhikar Scheme.

The Central Board of Indirect Taxes and Customs (CIBIC) started this scheme to encourage the habit of creating bills and invoices during buying and selling transactions. To spread awareness about this, a campaign supporting the scheme is ongoing. The GST Network, along with its partner e-connect Solutions Pvt. Ltd., is creating a technology platform.

Officers are visiting different businesses and stores, buying items to check the invoices given. If any invoice is found to be fake or wrong, the officers can generate and send notices.

What Does the Violation of Section 122(1)(i) of the CGST Act, 2017 Involve?

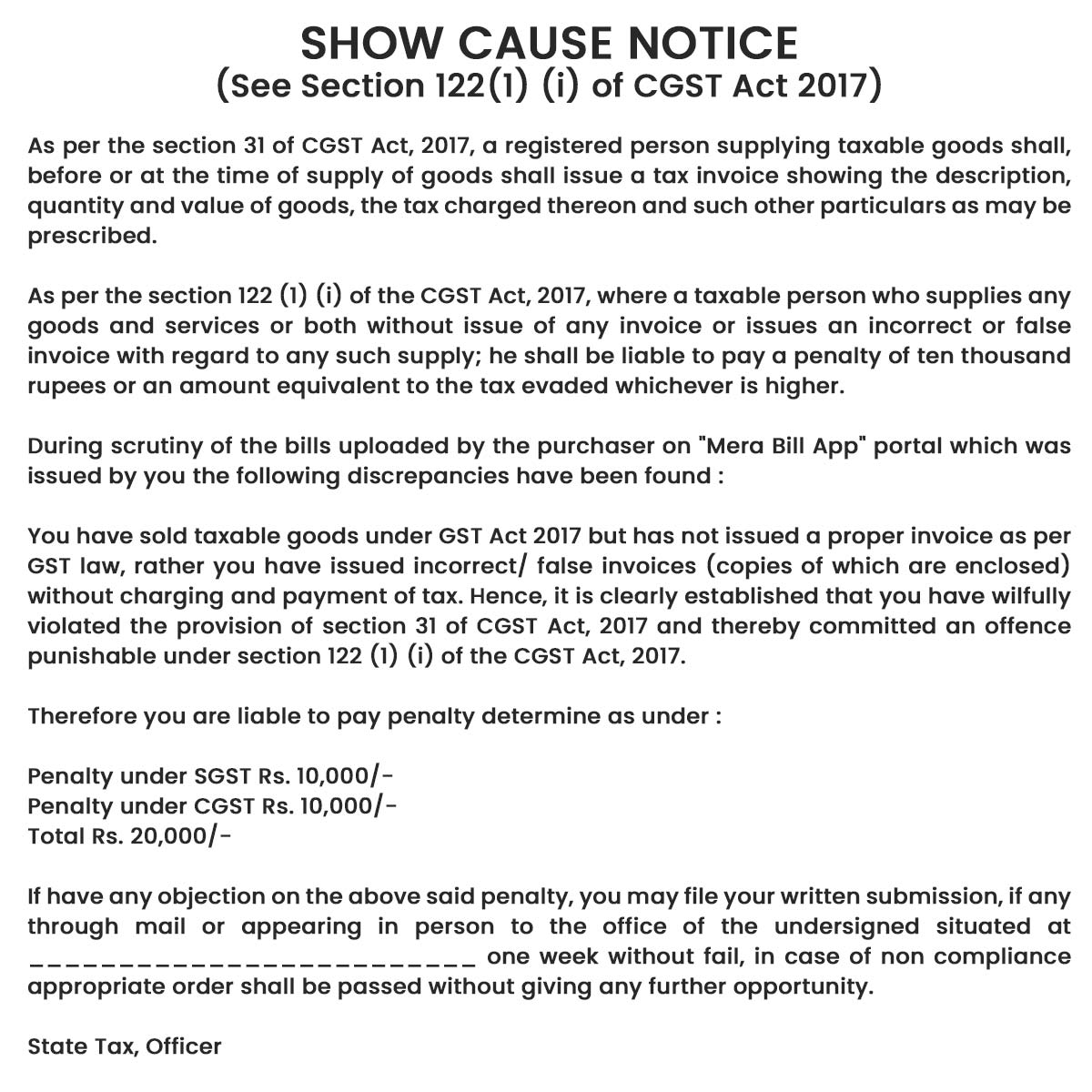

The Show Cause Notice under this section 122(1)(i) of the CGST Act, 2017, claims that you, as a registered business, have broken Section 31.

What are the Allegations?

The allegations include issuing improper tax invoices in violation of GST laws. Specifically, you have issued incorrect or fake GST invoices without properly calculating or paying the necessary taxes.

What are the Details of the Violation?

A review of invoices on the “Mera Bill App” portal found errors in the invoices you issued.

What is the Penalty?

The notices state a penalty of Rs. 10,000 for both SGST and CGST, totalling Rs. 20,000.

What Action is Required?

- You need to respond to this notice, explaining why you didn’t comply and why you issued the wrong invoices.

- You need to provide clarification or proof to support your actions, which can help avoid or reduce the penalties.

Below is the GST show cause notice sent by the department to traders