As the adjournment request of the applicant was disregarded and no chance was provided, the Madras High Court quashed the Goods and Services Tax (GST) demand order.

The applicant, Sri Nallamal Steels received SCNs on 05.02.2024 regarding diverse financial years, except for 2021-2022, with a due date for reply by 07.02.2024. Even after the applicant’s plea for an adjournment, without consideration, the impugned orders were issued.

The applicant’s counsel stressed that the response on 08.02.2024 asked for an adjournment as of the illness of the authorized representative. The same plea was overlooked and the orders were passed on the same day. For the FY 2021-22 in which an Show Cause Notice on 18.12.2023 was issued, the reply of the applicant on 21.12.2023 was disregarded.

The adjournment request was made for the FY 2021-2022 and not for other years, Mr. V. Prashanth Kiran, Government Advocate, marked.

The High Court remarked that, for FY 2018-2019, 2019-2020, and 2020-2021, where show cause notices were issued dated 05.02.2024, and orders were passed dated 08.02.2024, it is apparent that a chance was not furnished to the applicant, significantly regarding the adjournment request on 08.02.2024.

Read More: Notice and Tax Demand Order Given at Same Time: Madras HC Directs to Start Case Proceeding By Law

Likewise, for the FY 2021-2022, where the reply of the applicant before the show cause notice on 18.12.2023 was disregarded, the order cannot be kept.

A Single bench of Justice Senthilkumar Ramamoorthy for the aforesaid reasons has set aside the impugned order and the case was remanded for reconsideration. The applicant is authorized 2 weeks to respond to the respective show cause notices.

The respondent on receipt is asked to submit an opportunity before the applicant along with a personal hearing and furnish a fresh order within 3 months. Consequently, the writ petition was disposed of.

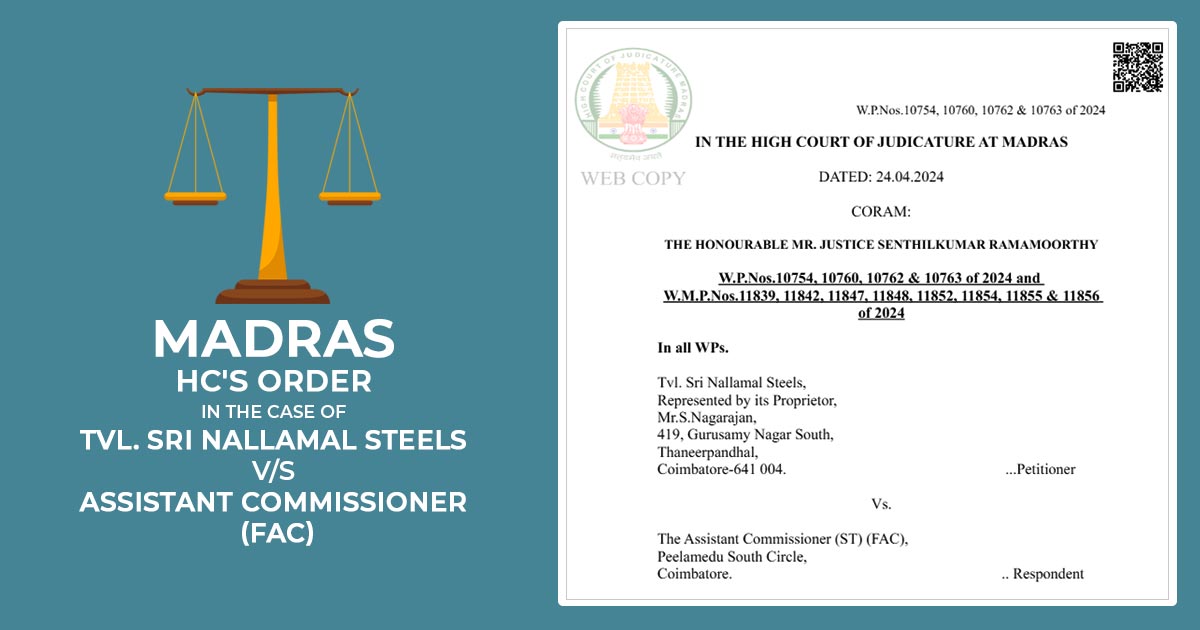

| Case Title | Tvl. Sri Nallamal Steels V/S Assistant Commissioner (ST) (FAC) |

| Case No.:- | W.P.Nos.10754, 10760, 10762 & 10763 of 2024 |

| Date | 24.04.2024 |

| Counsel For Petitioner | Mr.R.Anish Kumar |

| Counsel For Respondent | Mr.V.Prashanth Kiran, Govt. Adv. (T) |

| Madras High Court | Read Order |