The Madras High Court in a ruling set aside the GST demand order because of a lack of chance of hearing on a pre-deposit condition as the applicant lost to take part in the proceedings because of the lack of awareness of the notices issued.

A writ petition has been filed by the applicant GLAMOUROSE contesting the orders on the foundation that the applicant was not given a reasonable chance to argue the tax demand on merits. It asserted that show cause notice (SCN) and the additional communications were merely uploaded on the GST portal and not communicated to the applicant via any other mode, the current writ petition was filed.

The counsel of the applicant claimed that provided a chance, the applicant can elaborate on the differences between the GSTR 3B return and the GSTR 1 statement. Also, the applicant cited the willingness to remit 10% of the disputed tax demand as a condition for the remand.

Via issuing a notice in Form ASMT 10 dated July 31, 2023 principles of natural justice were complied with, on September 26, 2023, an SCN and personal hearing notice on the identical date, counsel of the respondent argued.

The bench of Justice Senthilkumar Ramamoorthy marked that the tax proposal, which concentrated on the disparity between the applicant’s GSTR 3B return and GSTR 1 statement, was confirmed because of the non-answering of the applicant to the show cause notice. Due to unawareness, the applicant is not able to take part in the proceedings, the applicant argued.

The court decided to set aside the order and remand the case for reconsideration. The same decision was contingent on the applicant remitting 10% of the disputed tax demand within 2 weeks from the receipt of a copy of the order. The applicant was authorized to submit a response to the SCN within this period.

Read Also: An Informative Guide to GST Portal for Taxpayers and Cos

For the applicant Mr R. Saravanan appeared, and for the respondents Mr V. Prashanth Kiran, Govt. Adv. (T) appeared.

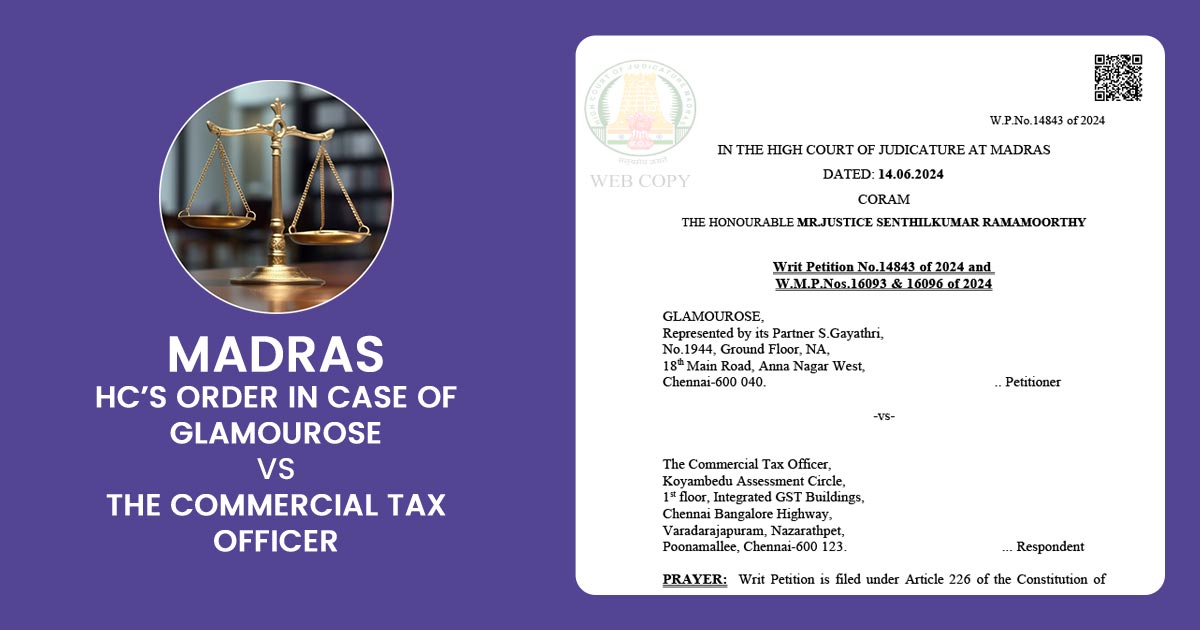

| Case Title | Glamourose Vs. The Commercial Tax Officer |

| Criminal Petition | Writ Petition No.14843 of 2024 and W.M.P.Nos.16093 & 16096 of 2024 |

| Date | 14.06.2024 |

| For Petitioner | Mr.R.Saravanan |

| For Respondent | Mr.V.Prashanth Kiran |

| Madras High Court | Read Order |