The Madras High Court in a ruling ordered reconsideration of the GST ( Goods and Services Tax ) liability confirmed on proceeding on the assumption that the sales turnover shall be 110% of the purchase turnover.

The taxpayer K V M Textiles, claimed that they were not informed of the proceedings, as the show cause notice and other communications were just accessible via the “view additional notices and orders” tab on the GST portal, and not via any other mode of communication.

The taxpayer contested the GST order before the High Court on the foundation that insufficient chance for the taxpayer to challenge the tax demand on its merits.

The counsel of the taxpayer furnished that due to a personal emergency particularly the accident of the applicant’s son, the applicant was not able to handle the business for the important duration.

Also, the counsel of the applicant argued that the GST dispute has emerged from a difference between the purchase turnover and sales turnover. The taxpayer is prepared to show that the outward supply turnover shown in their returns is precise. The taxpayer as per the remand request admitted to remit 10% of the disputed tax demand.

In answer, Mrs. K. Vasanthamala, the Government Advocate, claimed that due process was followed. This contained sending an intimation, a show cause notice dated November 19, 2023, and proposing a personal hearing.

It was observed via the bench of Justice Senthilkumar Ramamooorthy that the impugned GST order, however, was established on an assumption that the sales turnover must be 110% of the purchase turnover.

Provided that the taxpayer was not heard before the confirmation of the tax proposal the court considered a remand critical to maintain the principles of natural justice.

The order was set aside by the court thereafter as per the condition that the applicant remit 10% of the disputed tax demand within 15 days of obtaining a copy of the order of the court.

In this duration, the taxpayer has been allowed to respond to the SCN. the GST council asked to provide a new order post obtaining the payment and response of the taxpayer.

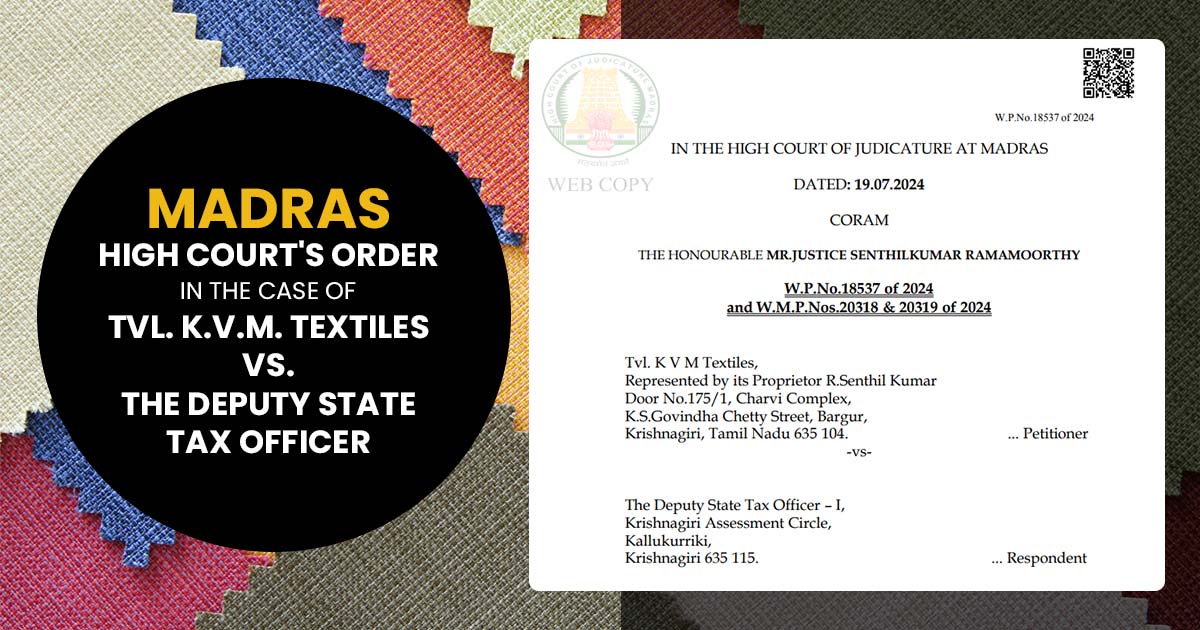

| Case Title | Tvl. K V M Textiles Vs. The Deputy State Tax Officer |

| Citation | W. P.N o.18537 of 2024 W.M.P.Nos.20318 & 20319 of 2024 |

| Date | 19.07.2024 |

| For Petitioner | Ms.Rukmani Venugopalan |

| For Respondent | Mrs.K.Vasanthamala, GA (T) |

| Madras High Court | Read Order |