To increase the spending on the festive season the ministry of finance prolonged the advantages of LTC cash voucher scheme on Thursday to the government employees other than central. “In order to provide the benefits to other employees (i.e. non-central government employees)… it has been decided to provide a similar income-tax exemption for the payment of cash equivalent of LTC fare to the non-central Government employees also,”

Beneath LTA the employer remunerated the family holiday travel cost to any place or the reimbursement to employees travel to their hometown. The remuneration is only given on the employee’s travel cost but to the extent of the cost will then be liable according to the post of the employee. LTC is privileged under the act of income tax specific to the particular states. The privilege is permitted for only two travels for the 4 years block. Presently the block is 2018-21.

In the pandemic times, the travel gets restricted to the employees, they now have the option to exchange the tour with cash equal to the LTC fare granted so far and leave receipt without travelling. Now instead of the tax privilege part if LTC and LTA (Leave Travel Allowance)

For the maximum of Rs 36,000 to an individual, the payment of cash allowance is eligible for LTC fare to an individual for a round trip for the employees other than the non-central government will be granted for the privilege of income tax.

The income tax privilege of the receipt on the LTC fare is given to the employees other than the central government employees will be given only on the fulfilment of the below conditions:

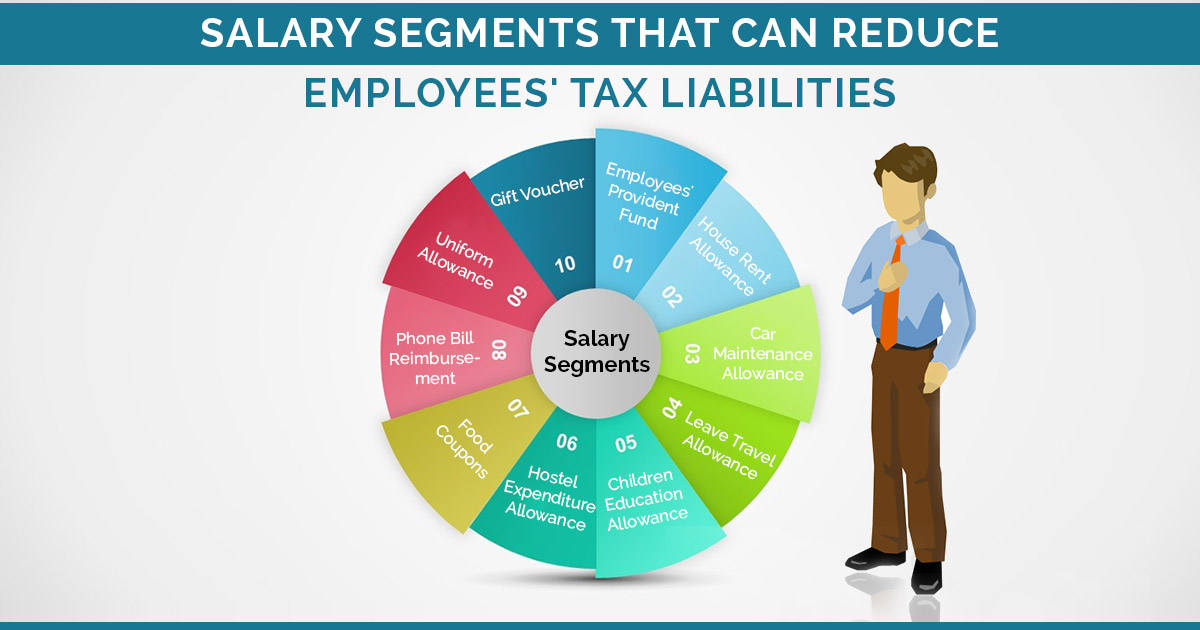

- For the block year 2018-21, the employees have a choice for considered LTC fare instead of suitable LTC Cash Voucher Scheme

- The employees should purchase goods and services whose worth is 3 times LTC and should leave the payment in the draft amount so as to buy the items other than food

- Money should be spent on goods on which 12% GST or more from the GST enrolled vendor digitally. All these buying should be from GST enrolled vendors by digital mode. The employee will have a voucher which states the GST number as well as the amount of GST given. From 12 October 2020 to 31 March 2021 individuals can buy all purchases

- An employee who delivers less than 3 times of the considered LTC fare on the expenditure between the specified time will not be regarded to receive the full amount of considered LTC fare along with the privilege on income tax as well as the amount gets diminished

Under the tax administration new or modified the person who used the choice to pay the tax will not be liable to the policy.

Example:

- Deemed LTC Fare : ₹20,000 x 4 = ₹80,000

- Amount to be spent : ₹80,000 x 3 = ₹2,40,000

An individual will be liable to have LTC fare and a similar income tax privilege if the employee spends Rs 2,40,000 or more on the particular expenditure. If the amount spent by the employee is Rs 1,80,000 then the person is liable to have 75% which is Rs 60,000 of considered LTC fare along with tax privilege to that. The employee needs to return Rs 20,000 if he had Rs 80,000 from the employer because he has only 75% privilege of the amount.