A salary structure encompasses various components such as basic pay, various allowances, annual bonus and reimbursements, etc. Various components such as House Rent Allowance, EPF etc curtail the tax liability of an employee and hence elevate his savings.

Some of the components are fully taxable, some are fully tax-exempt and some are partially taxable. Fully and partially tax-exempt components play an important role in maximising what you are earning while fully taxable is no less important when it comes to concluding a salary structure.

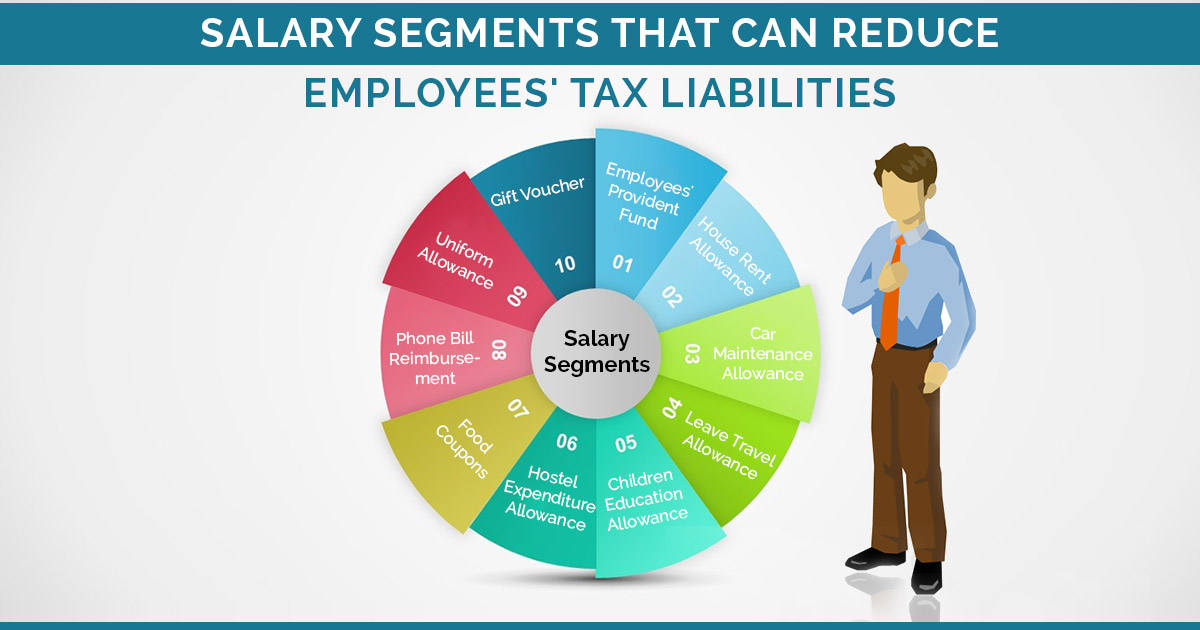

So, to help you out with an optimum salary structure, we are presenting those ten components that minimise your tax liability to a great extent while maximising your pay envelope.

Fill Form for ITR & TDS Compliance Software

Employees’ Provident Fund (EPF)

According to the Employees’ Provident Fund Act, 12 per cent of an employee’s basic salary plus dearness allowance has to be contributed to EPF and the employer also has to invest an equal amount of sum for it.

Section 80C of the Income Tax Act provides tax exemption up to Rs 1.5 lakh on the total contribution withdrawn from the employee’s account. The interest gained on EPF is also tax-exempt, subject to some definitive conditions.

House Rent Allowance (HRA)

House Rent Allowance (HRA) – An allowance which is provided to the employees to assist them in meeting the rent expenditure for the premises or house in which he inhabitants.

HRA is a part of the salary and it must be a part of it because then the only deduction can be claimed over it.

Tax exemption can be claimed for HRA, subject to some definitive limits, conditions and terms.

Tax exemption limit will be the lowest among the following:

- Amount of HRA received;

- Rent paid over 10%( salary + dearness allowance);

- 50%(salary + dearness allowance) when the house is located in metro cities – Mumbai, Kolkata, Delhi or Chennai; and 40% (salary + dearness allowance) when the house is located in non-metro cities.

Note: The tax exemption can be availed only for the period for which the rented house is inhabited by the employer.

Car Maintenance Allowance

Car maintenance allowance is given to employees as a reimbursement of expenses incurred on the car which is partially used for official purposes and partially for personal purposes. However, the limit of tax exemption on this allowance depends on the ownership of the car i.e. whether the car is owned by the employee or by the employer.

When the car is owned by the employee:

- A tax exemption of INR 2,700/ month for the car with an engine capacity of up to 1,600cc

or

- Rs 3,300/ month for a car with an engine capacity higher than 1,600cc is allowed on the reimbursement done by the employer for the car maintenance expenses, fuel expenditure and driver’s salary.

When the car is owned/leased by the employer.

- The allowance of INR 2,700/ month for a car with an engine capacity up to 1,600 cc or Rs 3,300/ month for a car with an engine capacity higher than 1,600cc is taxable and the tax has to be paid by the employee who is using this car w.r.t the aggregate of maintenance & fuel expenses, the actual lease rent and the driver’s salary which is borne by the employer.

Leave Travel Allowance (LTA)

Leave Travel Allowance (LTA) – An allowance which is provided to the employees by the employer as a contribution to meeting the travel expenditures incurred on trekking or touring with the family to anywhere in India. An employee can avail of this allowance by presenting his travel bills or tickets to his employer.

A few noteworthy points in this regard:

- This benefit can be availed for two journeys completed in a slab of four calendar years.

- The current slab of the four-calendar year started in 2022 and will continue till 2025.

- Tax exemption can be availed only for an amount which is equal to the cost of travelling if we take the shortest distance to reach the destination, whether by air, rail or an acknowledged public transport system.

- Family wrt LTA’ includes spouse & children and parents, siblings who are completely or mainly dependent on the employee.

- Tax exemption on LTA is subject to some definitive conditions and terms.

Children Education Allowance

Rs 100 per month or Rs 1,200 per year is provided as an education allowance for the education of a child to an employee by an employer. This allowance is allowed to be treated as a deduction from the taxable income of the employee.

Read Also: Section-Based Income Tax Saving Tips For Salaried Person

- The deduction can be availed only for 2 children of the employee.

- In addition to it, an employee can claim deductions for tuition fees paid for his children u/s 80C of the I.T. Act.

Hostel Expenditure Allowance

INR 300/ month i.e. 3600/ annum is provided as a hostel expenditure allowance by an employer to an employee to help employees meet the hostel expenditure of a child. This allowance is allowed to be treated as a deduction from the taxable income of the employee. This deduction is permitted to be availed for a maximum of 2 children.

Food Coupons Under Food Allowance

Food coupons come under food allowance which is given by the employer to the employee. Food allowance can be given as a provision of food during working hours or as prepaid food vouchers or coupons.

Let’s understand it with an example. Prepaid food vouchers which are non-transferable are tax-exempt to the limit of INR 50 / meal.

Then, the tax exemption for a month has 22 working days will be calculated as:

- 50 x 22 x 2 (two meals per day) = 2,200.

- For a year, it will be:

- 2,200 x 12 = 26,400

So, an employee can avail of an annual deduction of INR 26,400.

Phone Bill Reimbursement

Phone bill reimbursement is inclusive of telephone bill as well as mobile phone bill compensation. This prerequisite includes expenses of telephone having a broadband Internet connection and is given to some specific employees only.

- Telephone and Mobile Expenses borne by the employer on behalf of the employee are not taxable.

- There is no prescribed limit as stated by law for the deduction, but the expenses should be judicious taking into account – the salary and the grade of the employee.

Uniform Allowance by the Employee

Uniform allowances are provided by the employer to the employee to meet the expenses incurred on the purchase and/or upkeep of an official uniform.

Recommended: Best Ways to Save Big Amount of Income Tax for Assessees in India

The cost which is spent by the taxpayer/employee, to purchase and/or upkeep of uniform worn while executing the duties of employment, is exempt from tax, and so the savings (if any) from the amount reimbursed would be taxable as per the provisions of I.T. norms.

Gift Voucher by Employer

A gift voucher or token or any gift given by the employer to the employee is tax-free as far as the aggregate value of gifts is not more than Rs 5,000 annually.

An ideal salary structure is that which let employees meet everyday expenses without any hassles while leaving enough money for savings and long-term financial goals.

The components of the salary mentioned above enable the employee to save a considerable amount of tax. So, an employee should take into consideration the benefits offered by the employer such as accommodation expenses, Phone bill reimbursement, etc and accordingly structure the salary package.