Kerala High Court in its ruling carried that the demand for a late fee for belated GSTR 9C is invalid as the Central Goods and Service Tax ( CGST ) notification exempted the same and permitted the refund of the late fee paid. The court, the applicants shall not be authorized to claim a refund of the late fee which has been filed before through them over and exceeding Rs.10,000.

The petitioner Anishia Chandrakanth, is a proprietorship concern dealer under the CGST / SGST Act, 2017 and the Rules made thereunder. The applicant is in the trading of paint, cement, aluminium sheet hardware, and others. The applicant has been filing his proper returns and filing the tax dues thereon.

However, the applicant does not furnish his returns within the said time duration under the law. According to Section 44(1) r/w Rule 80 of the CGST / SGST Act, the annual return Form GSTR-9 ought to be filed before 31st December following the finish of such financial year.

The Government realizing the problems at start of enactment of the GST regime specifically Rule 80 of the GST Rules, 2017, and the prevailing of Covid -19 pandemic, extended the due date for filing the returns for the FY 2017-2018, 2018-2019 and 2019-2020 by the notification No.6/2020-CT on 03.02.2020, 80/2020-CT dated 28.10.2020 and 4/2021-CT dated 28.02.2021 respectively.

An SCN was issued by the applicant on 29.03.2023 to compute the number of days of delay in filing the yearly returns. U/s 47(1) of the CGST / SGST Act, the respondent has asked for a demand of a late fee of Rs 2,93,600 post adjusting the late fee of Rs. 57,600 filed via the applicant.

On 13.04.2023 corrigendum was issued via the respondent expressing that u/s 47(1) referred to in the SCN on 29.03.2023, must be read as Section 47(2) of the GST Act. A reply had been submitted on 25.04.2023 by the applicant stating the detailed complaints to the proposals in the aforesaid notice and asked to drop it via the response on 25.04.2023.

The petitioner, a registered person is accountable for filing the late fee u/s 47(2) solely when he is not able to file the return in FORM GSTR-9 u/s 44 of the CGST / SGST Act. GSTR-9C is only a reconciliation statement that is required to be filed including the annual return and FORM GSTR-9C is not a return as considered u/s 44 of the CGST / SGST Act. Up to the late filing of the GSTR 9 return and not the GSTR-9C reconciliation statement a late fee is levied to tax.

The respondent aggrieved from the objections raised via the applicant and passed the order originally confirming the need for a late fee of Rs. 2,93,600/- (Rs.1,46,800/- under CGST Act and Rs.1,46,800/under the SGST Act) under Section 47(2) of the CGST / SGST Act, for the late return filing specified u/s 44(2) of the CGST / SGST Act for the duration from 2017-2018, 2019-2020. The applicant has filed an amount of Rs. 57,600 for the late fee was appropriated against the demand confirmed.

The applicant counsel has furnished that the Government has issued Notification No.7/2023-CT on 31.03.2023, furnishing for an Amnesty Scheme regarding the non-filers of GSTR-9 returns in practice of the powers granted u/s 128 of the CGST / SGST Act on the guidance of the GST council, in which for non-filers of the returns for the fiscal years 2017-2018 to 2021-2022, time to file the returns in GSTR-9 and 9C was initially furnished upto 30.06.2023.

By the subsequent notification No.25/2023, i.e., 30.06.2023, it was extended up to 17.07.2023. Under the stated Amnesty Scheme, the late fee over Rs.10,000/- to be paid u/s 47 of CGST / SGST Act, regarding the returns for the FY 2017-2018 to 2019-2020 has been exempted.

The annual return for the stated year as early as in the years 2020-2021 and before the beginning of the Amnesty Scheme, i.e., on or before the start of the Amnesty Scheme w.e.f 01.04.2022 has been filed by the applicant.

GSTR-9C is an annual GST Reconciliation statement that reconciles the numbers reported in the GSTR-9 yearly return with the audited financial statements of the assessee.

Earlier Form GSTR-9C applied to registered persons with exceeding Rs. 2 Crores as annual turnover in a certain fiscal year, though, w.e.f date 01.08.2021, now it is applicable for turnover of more than Rs 5 Crores.

The GST portal allows the imposition of late fees for GSTR-9. Annual return GSTR-9 filed without 9C may be deficient drawing a general penalty. To regularise the GSTR9 by filing GSTR9C, a late fee cannot be applied.

Justice Dinesh Kumar Singh noted that when the Government itself exempted the late fee under the aforementioned two notifications Nos.7/2023 on 31.03.2023 and 25/2023 on 17.07.2023 exceeding Rs.10,000, in the matter of non-filers there appears to be no justification in continuing with the notices for non-payment of late fee for late GSTR 9C, that is also filed via the taxpayers before 01.04.2023, the date on which one-time amnesty begins.

The court while permitting the petition stated that the applicants shall not be qualified to avail a refund of the late fee which has been filed before through them over and more than Rs 10,000.

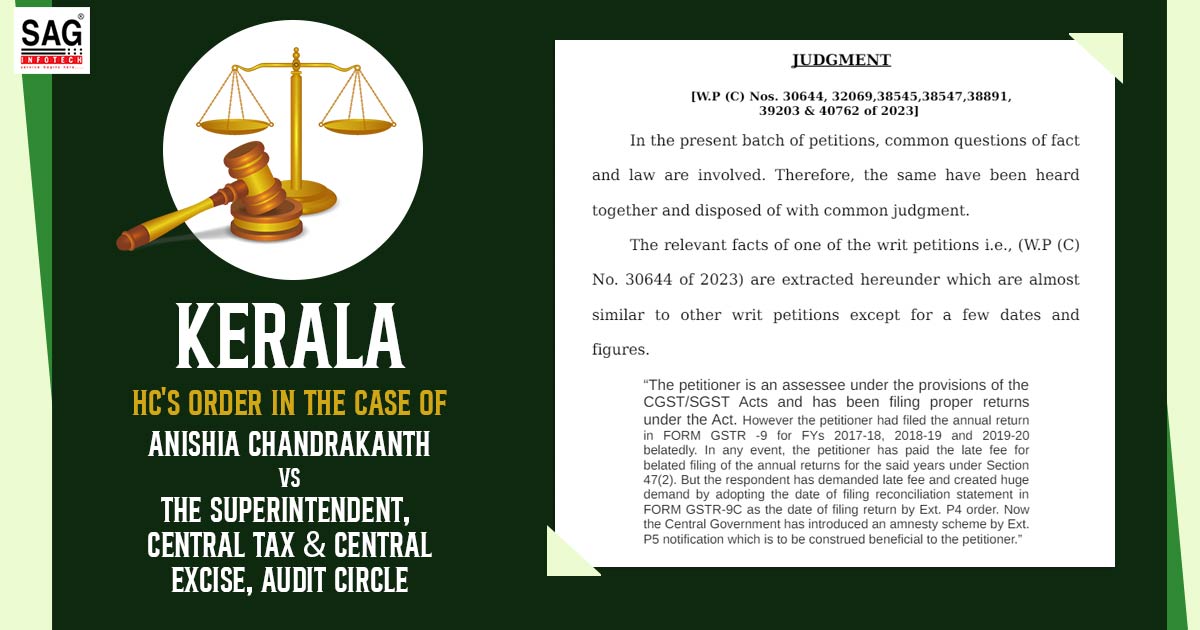

| Case Title | Anishia Chandrakanth vs The Superintendent, Central Tax & Central Excise, Audit Circle |

| Citation | WP(C) NO. 30644 OF 2023 |

| Date | 30.09.2022 |

| Counsel For Appellant | By Advs. Harisankar V. Menon Meera V.menon R.sreejith K.krishna Parvathy Menon |

| Counsel For Respondent | By Adv Sreelal N Warrier;SC |

| Kerela High Court | Read Order |