Recently, the Income Tax department has extended the final date for employers to disperse Form 16 TDS certificate to its employees till 31st July 2021 for FY 2020-21.

Along with this, the income tax department has also extended the last date to file the TDS return in Form 24Q by one month till 15th July.

The Central Board of Direct Taxes (CBDT) issued in a statement that the reason of extension in deadline is for the reduction in TDS deductors distress for which they have to continuously obliged on the basis of revised format and multiples updates of file validation utility.

Therefore, the last date to furnish TDS statement under Form 24Q for the FY 2020-21 has been stretched from June 30th 2021 to 15th July 2021, whereas the same for issue of TDS certificate has been extended to July 31st 2021, for the employers.

Read Also: Guide to Download/Generate Form 16 via Gen TDS Return Software

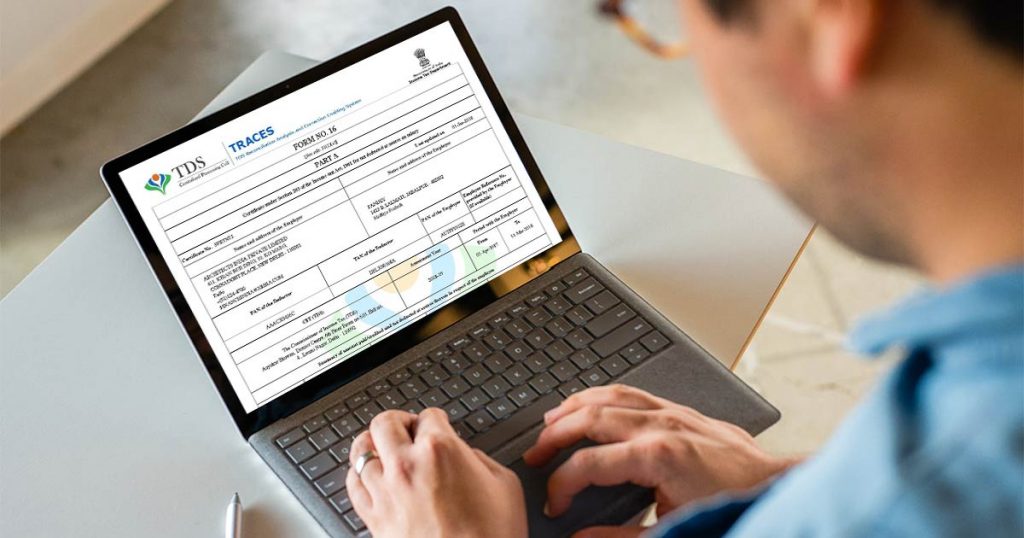

One must note that TDS is deducted at the time of paying salary to an employee by the employer, after which he is required to file the quarterly TDS returns to the income tax department with the help of Form 24Q. The details about salary paid to employees along with TDS deducted on such payment is mentioned under Form 24Q.

“CBDT is wholeheartedly working to reduce the stress among the taxpayers by easing the compliance process for them,” said Neha Malhotra, Executive Director- Nangia Advisors (Andersen Global).

All The Assessees can File their ITR by 30th September 2021 for FY 2020-21.