The Kolkata Bench of the Income Tax Appellate Tribunal (ITAT), in a ruling, adopted a compassionate approach in condoning a delay of 848 days in filing an appeal, after the appellant’s Income Tax Consultant tragically passed away during the COVID-19 pandemic.

The assessment order for AY 2015-16 has been contested by the applicant, Subodh Adhikary, in which the AO had made distinct additions apart from the issue of the cash deposits that was originally flagged under CASS. AO had expanded the investigation into capital gains, unexplained investments, and property transactions before formally converting the case into a complete scrutiny.

The counsel of the applicant said that the action of the AO breached the CBDT Instruction No. 5/2016, which restricts investigation in limited scrutiny cases unless credible material is available and proper approval is received. He relied on earlier decisions, including Dev Milk Foods Pvt. Ltd. (Delhi ITAT) and Vijay Kumar (Chandigarh ITAT), which had taken an identical view.

The counsel of the department said that the AO has issued notice u/s 142(1) and thereafter converted the matter to complete scrutiny dated December 1, 2017, thereby explaining the additions.

The Division Bench of Shri Rajesh Kumar (Accountant Member) and Shri Pradip Kumar Choubey (Judicial Member) cited that the AO had initiated an investigation into other problems before the conversion order was passed. The Tribunal determined that this action was against the CBDT’s binding instructions and constituted a fishing and roving inquiry. It also observed that the approval for conversion was mechanical and did not have concrete evidence.

The Tribunal had set aside the assessment order, removing all additions which consist of short-term capital gains of Rs 2.26 crore, unexplained investment of ₹2.84 crore, and the cash credit of ₹28 lakh. The appeal was permitted.

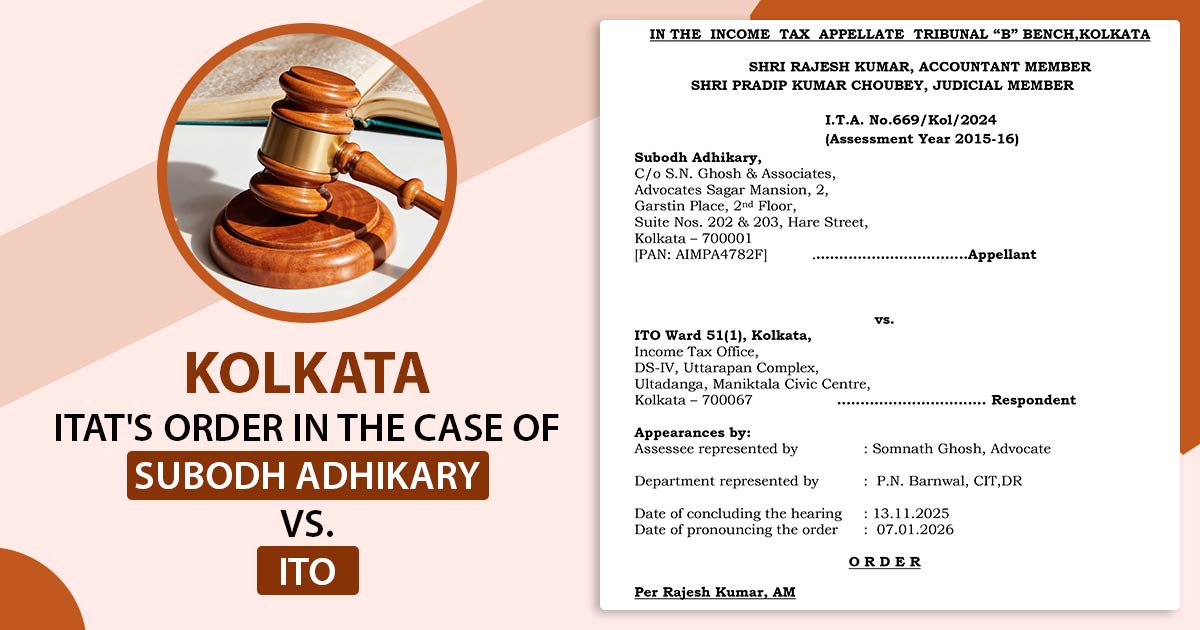

| Case Title | Subodh Adhikary vs ITO |

| Case No. | I.T.A. No.669/Kol/2024 |

| For Petitioner | Somnath Ghosh, Advocate |

| For Respondent | P.N. Barnwal, CIT, DR |

| Kolkata ITAT | Read Order |