The article will give you complete information regarding the key amendments that were made in the e-Way Bill (EWB) generation form. All the registered taxpayers or transporters can get an accurate idea about the latest changes in the e-Way Bill generation form so they don’t have to face any problems while generating the same.

Some Key Changes in the e-Way Bill System

- Automatic distance calculation between given PIN codes for the generation of e-Way Bill

- Facility to Identity the Total distance between two PIN codes

- Restriction on multiple e-Way bill generation for a single Invoice/Document

- Facility for e-Way Bill extension in case the consignment is in Transit/Movement

- Report Generation for e-Way bills about to expire

A detailed explanation for all the above-mentioned points is presented below:

Automatic Distance Calculation between given PIN Codes

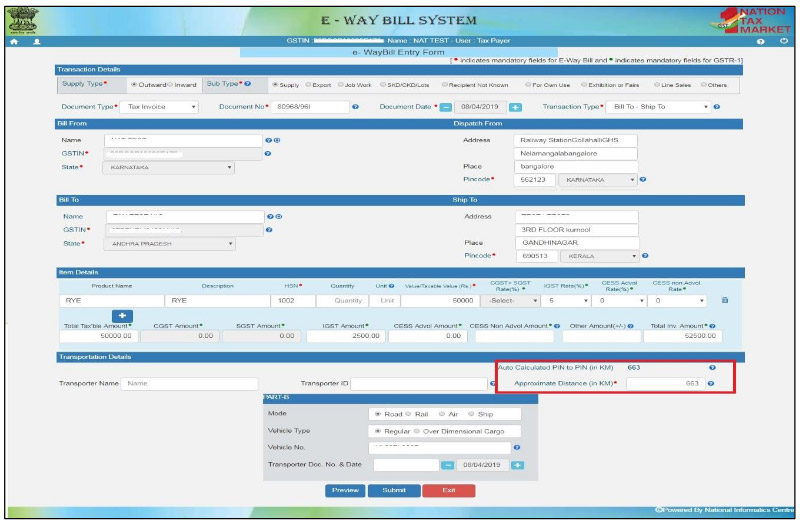

The facility of auto calculation of the distance between the source (supplier address) and destination (recipient address) point based on the pin code has been added to the e-Way bill system. Now, the taxpayers/transporters can quickly get an idea about the motorable distance between two places based on the pin codes (see Image 1). Albeit this, a user can also enter the actual travel distance, but it can’t be more than 10% of the auto-calculated length. For instance, if the system has displayed the distance between Place X and Place Y as 500 km, then a user is allowed to enter the actual distance covered up to 550 km (500 km + 50 km).

Key Points to Remember:

- In cases, where the source and destination Pin Codes are the same, the user will be allowed to enter the actual travel distance up to 100 km (maximum) only.

- The system will give an alert message to the user in case a wrong/invalid PIN CODE is entered. The system will also flag the e-Way fills with wrong pin codes for review by the department.

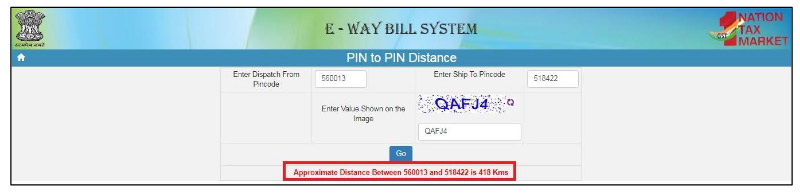

Facility to Identity the Total Distance Between 2 PIN codes

The refreshed e-Way bill system also has the facility to check the distance between two PIN codes for the users. To avail of this facility, the users must visit (http://ewaybillgst.gov.in). Afterwards, hovering the cursor over the ‘Search’ will allow the users to view various options and select “PIN to PIN Distance.”

The users can also see the PIN to PIN distance on the screen where they enter the “Dispatch From” and “Ship to Pin codes” options are given as shown in image 2. The data from varied electronic sources are used to calculate the approximate distance for the given PIN codes. This data has attributes like average travel speed, road class, travel direction, traffic data etc. This data is also picked up from the traffic on state highways, national highways, district highways, main city roads, etc. After receiving such travel data, a proprietary logic is applied for calculating the approximate distance for the given pin codes.

Read Also: Gen GST E Way Bill Software: A Complete E Waybill Solution For Suppliers & Transporters

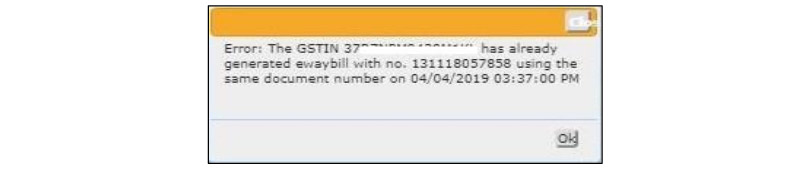

Restriction on Multiple e-Way Bill Generation for a Single Invoice/Document

The Indian government and indirect tax department have recently announced that they will not allow the generation of multiple e-way bills on a single invoice for any party, i.e., consignor, consignee, and transporter. Adhering to this announcement, the updated e-Way Bill system blocks the generation of multiple e-Way bills for a particular invoice.

In simplest terms, if the e-way bill has been generated by a consignee, consignor or transporter for a particular invoice once, then none of these parties can generate another e-Way Bill with the same invoice number. This is also termed as the ‘One Invoice, One E-Way’ Bill policy.

For instance, If the consignor uses a previously used GSTIN number for the generation of another e-Way Bill using the same document number & type, then the e-Way bill system will restrict such action by showing an error message as shown in Image 3.

Facility for e-Way Bill Extension in Case the Consignment is in Transit/Movement

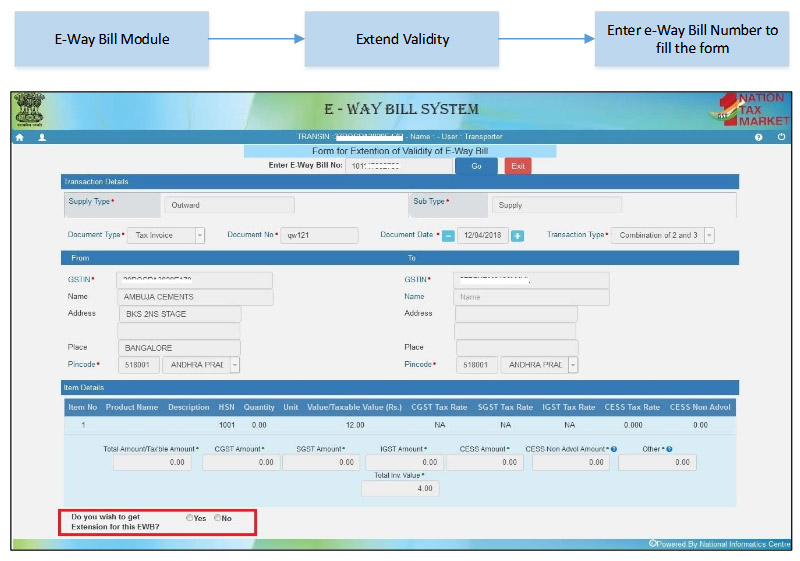

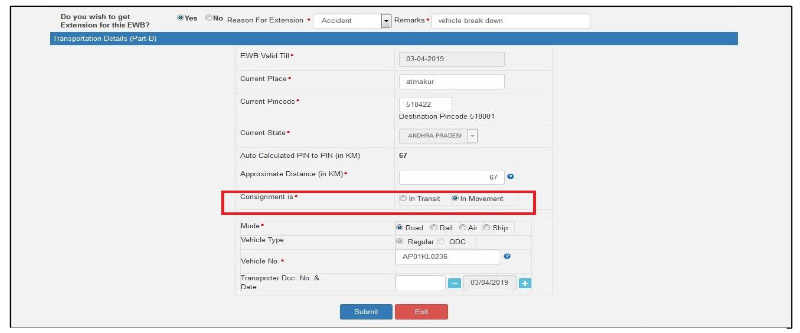

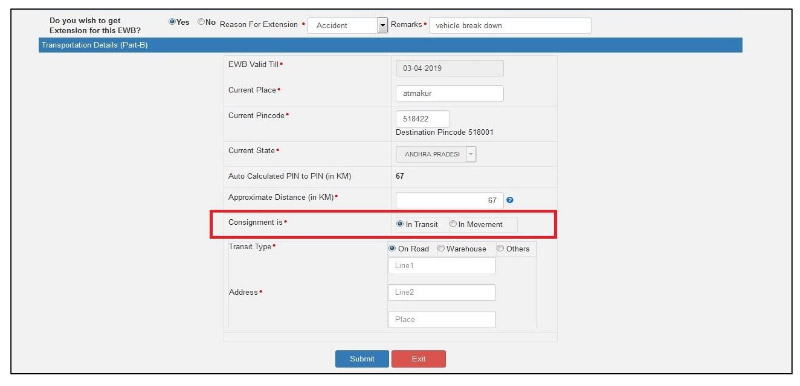

In the past, multiple requests have been made by the transporters to tax authorities for extending the e-Way Bill, if the goods are in Transit/Movement. Responding to such requests, the facility for extension of the e-Way Bill has been added to the refreshed e-Way Bill system. The transporters can visit the (https://ewaybillgst.gov.in/) portal and select the option by navigating through the menu below in Image 4.

Point to Remember

- In order to avail of this facility, it is important that one must visit the extension validity option in the Form and choose “Yes” for extension in the e-Way Bill. (see Image 4). Afterwards, Transportation Details (Part -B) will appear in the form in which the user must select the position of the consignment as In Transit / In Movement.

a. In Movement

After the selection of ‘In Movement,’ the system will suggest the user select the “Mode” and “Vehicle details.”

(b) In Transit

After selecting ‘In Transit,’ the user would be prompted to select the “Transit type” like On Road, Warehouse etc. Afterwards, the Address details of the transit place must also be filled in.

Report Generation for e-Way Bills About to Expire

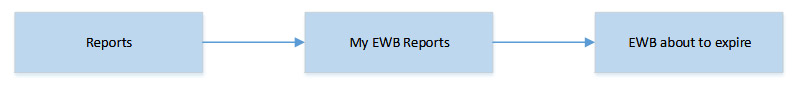

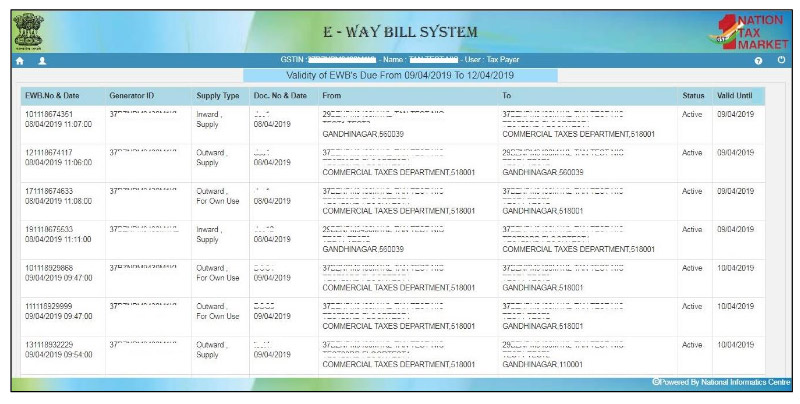

The updated e-Way Bill system now also allows the taxpayers or transporters to see the complete list of e-Way Bills that are about to expire in a time span of 4 days.

Transporters/taxpayers can also track the expiry dates for each of the consignments generated by them. For availing of this facility, the user must visit the (https://ewaybillgst.gov.in/) portal and select the option by navigating through the menu as given below in image 7.

I wish to learn. All.about GST

Can.you.provide me. Notes with PDF

Regards

Somnath Basu

Kolkata westbengal