The Kerala High Court in a ruling carried that GST notices sent through WhatsApp are said to be an invalid service mode u/s 169 of the CGST Act, even if used in the COVID-19 period.

A writ petition has been filed by Mathai M.V., a truck owner, contesting the detention and confiscation of his vehicle by the State GST authorities in Ernakulam.

The GST tax evasion has been alleged by the authorities, which was through the consignor, and confiscated Mathai’s truck u/s 130 of the CGST Act, 2017, claiming that notice had been served to the applicant through WhatsApp before confiscation.

The applicant was never engaged in the alleged tax evasion and also does not hold any information for the same, the counsel of the applicant mentioned.

They said that the truck was hired for transportation purposes only and that the confiscation was not legal since no valid notice u/s 130 was served by the procedure u/s 169 of the CGST Act.

Via WhatsApp applicant was notified about the proceedings, and the confiscation was valid as the applicant had been contacted in the procedure, the counsel of the GST department mentioned. The counsel said that the notice via WhatsApp was enough to move with the confiscation as per the situation.

A division bench ruled by Chief Justice Nitin Jamdar and Justice Basant Balaji mentioned that in the times of the Covid-19 pandemic, communication was made via WhatsApp, though it was not an acknowledged regulatory way of serving notice u/s 169 of the CGST Act.

Read Also: Kerala HC: Hearing Opportunity Was Given; Not Availing It Doesn’t Invalidate GST Order

Before confiscating goods or conveyances u/s 130, service of notice is an obligatory need, and the failure to comply with the regulatory procedure of the department directed to confiscation is illegal, the court mentioned.

The confiscation of the petitioner’s truck has been set aside by the Kerala High Court, which was seized via the GST department without issuing a suitable regulatory notice.

The writ of appeal has been authorised by the court. The case was remanded to the department, citing to issue a proper notice to the applicant as mandated u/s 130 of the CGST Act and to pass fresh orders after providing the petitioner an opportunity of hearing.

The court does not analyse the merits of the confiscation itself, and the authorities can move as per the law post serving a valid notice.

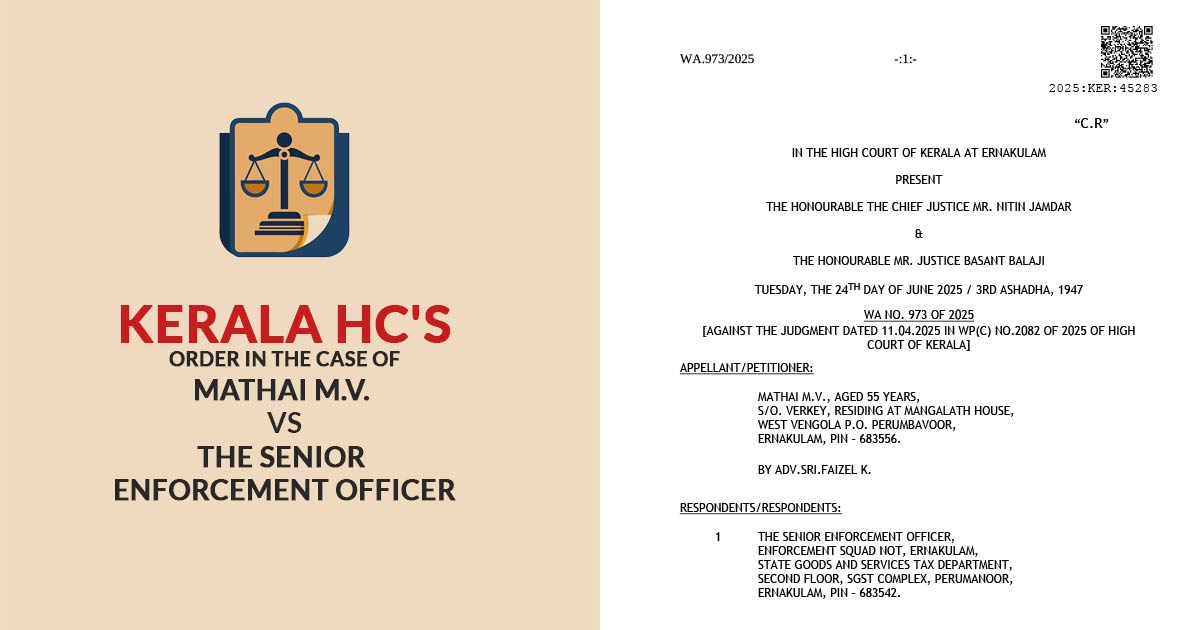

| Case Title | Mathai M.V. vs. The Senior Enforcement Officer |

| Case No. | WA NO. 973 OF 2025 |

| Appellant by | Sri. Faizel K |

| Respondent by | Dr. Thushara James |

| Kerala High Court | Read Order |