According to the Kerala High Court, once the tax is calculated, the full amount must be paid until an amnesty scheme is implemented.

The bench of Justice Bechu Kurian Thomas mentioned that “the assessee had even acquiesced in the order by paying the first installment, and thereafter he has turned around and now requests acceptance of a portion of the amount in satisfaction of the entire tax assessed. Such a procedure is unheard of in law. Once tax has been assessed, the entire amount has to be paid, unless there are amnesty schemes.”

The applicant in this case is the property owner. The building was made by the taxpayer as per the permit, and after that, the owners were assessed to building tax to the tune of Rs.12,42,800.

Read Also:- Kerala HC Upholds GST Penalty U/S 74, Cites Delay and No Jurisdictional Error

Accepting the order, the first installment of the mentioned order of the assessment was paid by the taxpayer. While the taxpayer has furnished a request letter to the assessing authority to cancel the initiated proceedings against him by accepting a part of the amount computed and preventing any additional proceedings.

The said letter was answered via the assessing authority under the order citing that the assessment order was passed dated 27.01.2023 and that, as there was a failure to file the remaining amount, revenue recovery proceedings have been suggested before.

The order has been contested by the taxpayer/applicant which has passed via the assessing authority, and also asks to levy building tax on his building as per the plinth area of the plan approved via the local authority.

Also Read: Kerala HC: Goods Carriage Vehicles Cannot Be Reclassified as Construction Equipment for One-Time Tax

The bench cited that the Kerala Building Tax Act, 1975, provides for the assessment of building tax. The assessing authority becomes practically functus officio for building tax after an order of assessment is passed.

A person who is dissatisfied with an assessment order can seek relief by filing a statutory appeal or revision as outlined in the Act. If the petitioner does not invoke any statutory remedy, the assessment order will be considered final. Consequently, it is not appropriate to pursue recourse under Article 226 of the Constitution of India, the bench stated.

The bench in the above said has dismissed the petition.

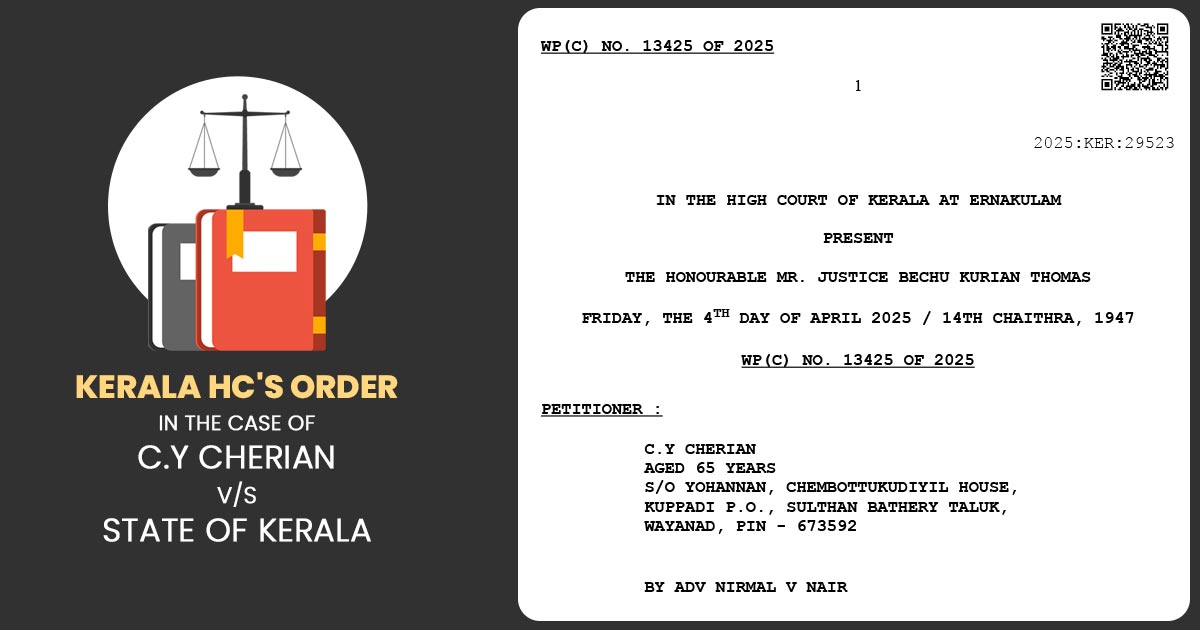

| Case Title | C.Y Cherian V/S State of Kerala |

| Case No. | WP(C) NO. 13425 OF 2025 |

| Date | 04.04.2025 |

| Counsel For Petitioner | Adv. Nirmal V Nair |

| Counsel For Respondent | SMT. Jasmin M.M, Government Pleader, Sri. Jayakumar Namboodiri T V, Standing Counsel |

| Kerala High Court | Read Order |