The Karnataka High Court refused to pass an ex parte order staying the guideline issued on September 9 via the Union of India mandating the declaration of revised retail sale price (MRP), on unsold stock manufactured/packed/imported, which would come into force from September 22, in addition to the existing retail sale price (MRP).

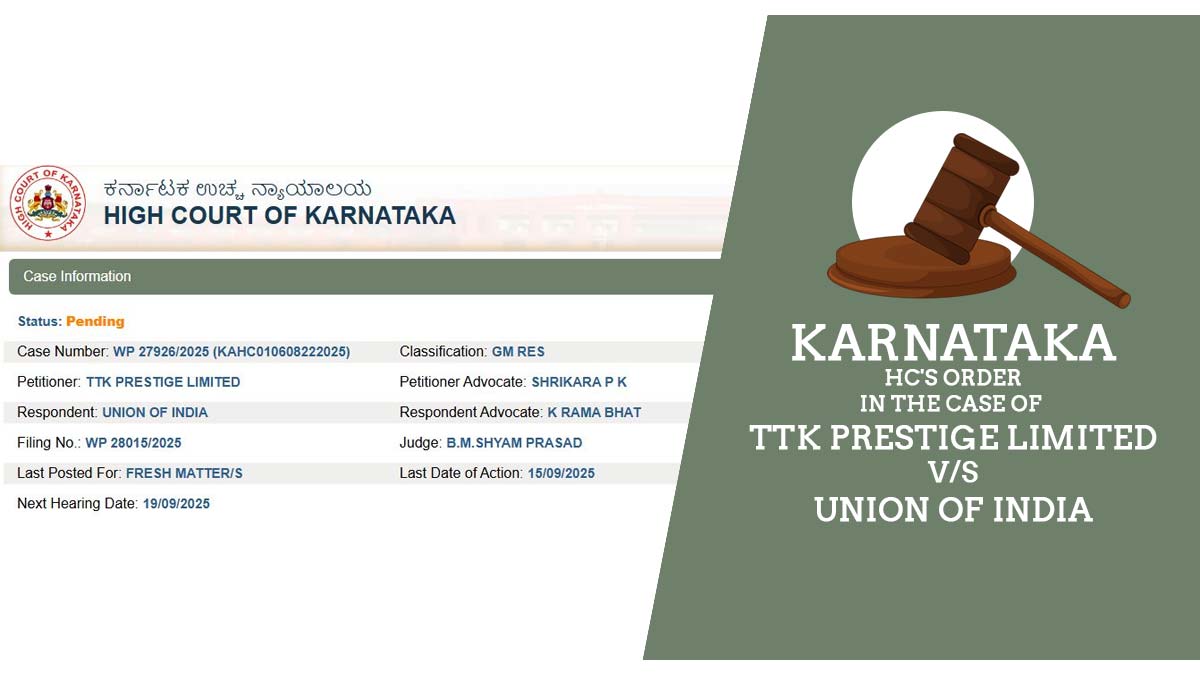

On the petition filed by Kitchen and Home Products Company, TTK Prestige Limited, the ex parte interim order has been denied by Justice B M Shyam Prasad. The company seeks to quash the guidelines by approaching the court.

In the order of the court, it said that, “Petitioner is pleading certain circumstances for immediate orders. The counsel is permitted to serve copies of the petition on the chambers of Aravind Kamath, Additional Solicitor General. He is called upon to accept notice for R1, R2. The office is directed to relist this matter on September 19.”

The appeal was to quash the guidelines because it mandates the applicant to declare the revised retail sale price (MRP), via stamping method or putting sticker or online printing on the unsold stock manufactured/packed/imported before revision of GST upto 31.12.2025 or till such date the stock is exhausted, whichever is earlier, after lessening the reduced amount of tax due to modification in GST (implemented with effect from 22.09.2025) in addition to the existing retail sale price (MRP). Via an interim order, it had strived to stay the impugned guideline or relax it insofar as the applicant company is concerned.

For the applicant Advocate Shrikara P K claimed that with more than 26 lakh products and 3,000 units across India, the Central government is citing that we need to affix varied market price stickers on every product. It is a logistical issue for us, and beyond that, the cost will be more for us.

Read Also: MRP (Max Retail Price) Rules Under GST Act in India

Also, he cited that, “Rule says we cannot charge anything more than MRP minus the payable tax. We now have to affix stickers on products worth about Rs 185 crore, across 3,000 units in India. About 26 lakh odd products, more than 650 persons are to be employed only for this purpose. Everything has to be done before September 22, because products cannot be sold. This is the first practical problem we are facing because of which we are forced to come to court.”

Requesting an interim order of stay of the guideline or relaxation insofar as the applicant company was concerned, he said that “We do not know how many products are being sold in how many shops. If some products are sold if they say that it amounts to violations, I will be prosecuted. Practically, it is not possible, milord. We do not know how many products can be sold.”

An ex parte interim order has not been granted by the court. The bench expressed that, “It is not a reason to grant an ex parte order.” As per this claim, all product stickers must be affixed. The court specified that “You have your software which checks every sale, etc. You have your dealers/vendors.”