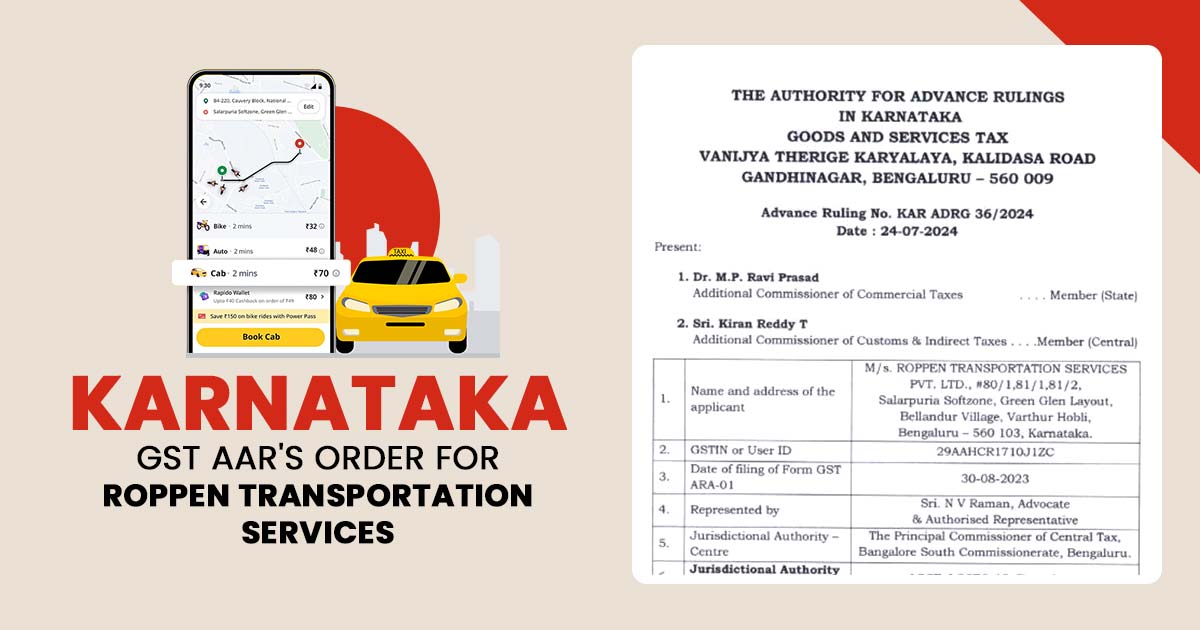

In a setback for Rapido, the Karnataka Authority for Advance Rulings (AAR) has carried that the ride-hailing unicorn is accountable for paying goods and service tax for its cab services.

The ARR order cited, “The applicant (Rapido’s parent company Roppen Transportation) is liable to pay GST on the supply of services provided by the independent four-wheeler cab service provider (person who has subscribed to the applicant’s Rapido) to his passengers on the applicant’s app platform, being an e-commerce operator, in terms of Section 9 (5) of the CGST Act 2017,”

As part of the hearing, Rapido furnished that it levies its drivers a subscription rather than a commission without making any revenue on the fare.

Read Also: Uber and Others Seek Clarification from the Govt on GST Applicability to Its Business

It is to be learned that the retrospective ruling shall open Rapido to the earlier tax dues on its cab services.

This comes at a time when Rapido became a unicorn after receiving $120 million in funding from its existing investor WestBridge Capital, in a post-money valuation of just over $1 billion.

The company in December entered the cab booking services class with the launch of Rapido Cabs. After that, the Swiggy-backed company mentioned that it had a fleet of nearly 1 lakh cabs on its platform and the service is in operation at present in Delhi NCR, Hyderabad, and Bengaluru.

Also, the Karnataka AAR mentioned the ambiguity of the GST applicability on the fare companies that function through the subscription model with their drivers and service providers.

Karnataka ARR Opposite to the same judgment, ruled in favour of Namma Yatri which proposed a subscription-based model before its driver-partners, permitting it to not pay GST.

The AAR based its decision in the Juspay Technologies the company behind the Namma Yatri mobility platform case on the dictionary definition of the word “through.” It concluded that simply connecting service providers with customers through a digital platform does not qualify as a supply of service and is therefore not subject to tax.

Earlier an opposite ruling in the case of Opta Cabs Pvt Ltd has been issued by the same Karnataka authority. Also in a recent decision concerning Balat Enterprises Pvt Ltd, the Tamil Nadu Advance Ruling Authority, ruled that the company which furnishes a platform for small business owners to connect with customers is obligated to release the tax u/s 9(5) of the CGST law for set services.

These ride-hailing platforms made a 5% GST on the fare for rides they streamlined through the commission model.

Under the subscription model, ride-hailing platforms charge a daily or weekly fee to driver partners for access to benefits such as increased visibility to customers.

This development occurs as Ola and Uber also introduce subscription-based models for three-wheeler booking services.

Earlier this month, platforms such as Uber sought clarity from the finance ministry regarding their liability to incur indirect taxes.

Important: Tamil Nadu AAR: ITC is Not Allowable for Rotary Car Parking Systems Under GST

This year, the Karnataka transport department set standard fares for all taxis operating in the state, including those using meters. With the new rules, app-based cab companies are not allowed to impose surge pricing on customers during busy hours.

These app-based taxi services have also come under scrutiny by other state governments, such as those in Delhi and Maharashtra, for various reasons.