The High Court of Jammu & Kashmir and Ladakh, in a ruling, has stated that tax authorities need to acknowledge the late responses to the SCNs before passing the final orders under the GST Act, outlining the norms of natural justice, and set aside the Goods and Services Tax (GST) demand made.

Zakir Hussain, who works as a contractor and is registered for tax purposes, has filed a formal complaint against a decision made by the State Taxes Officer in Kishtwar. This decision involved a demand for a tax payment of Rs. 15,44,922 for the financial year 2020-2021.

The applicant claimed that the demand notice breached the norms of natural justice as his response to the show cause notices (SCN) on 25.11.2024 had not been regarded. Under Section 73(1) of the State Goods and Services Tax Act, 2017, the SCN issued had needed the applicant to pay Rs. 15,06,304/- or submit clarifications by 30.12.2024. On 20.01.2025, the applicant filed his response, after the deadline but before the final order was passed u/s 73(9) of the SGST Act.

The response had not been considered by the State Taxes Officer based on the fact that it was furnished after the specified time, and proceeded to pass the order on 26.02.2025, demanding Rs 15,44,922.

The applicant’s counsel said that non-consideration of his response breaches the norms of natural justice. The issue before the court was whether the proper officer is liable to acknowledge a response filed after the said time but before the final order is passed.

Opposite to that, the revenue claimed that the response was needed to be submitted in time and hence cannot be acknowledged.

The Division Bench of Justices Sanjeev Kumar and Sanjay Parihar examined section 73 of the SGST Act and said that the time period for filing the response to a SCN issued u/s 73(1) has not been statutorily defined. While the proper officer might set a reasonable period, if a response is received before the final order u/s 73(9) is passed, it becomes incumbent upon the officer to consider such a response.

The court said that the language of section 73(9) is clear and mandatory, using the word shall to specify that the proper officer needs to acknowledge the representations, if any, made by the person leviable to tax. For the justice, equity, and fair play, the court said that the reply obtained post-specified time but before the final order needs to be acknowledged.

In this case, there was no dispute that the reply was obtained before the final order was passed. Hence, the proper officer must not refuse to regard the response and pass the order as if no representation had been filed.

The petition was permitted by the bench. It set aside the impugned order on 26.02.2025. A fresh order needs to be passed by the State Taxes Officer, Circle Kishtwar, post acknowledging the response of the applicant and furnishing a chance for oral hearing. The tax, if any, recovered under the quashed order shall be subject to the fresh order to be passed.

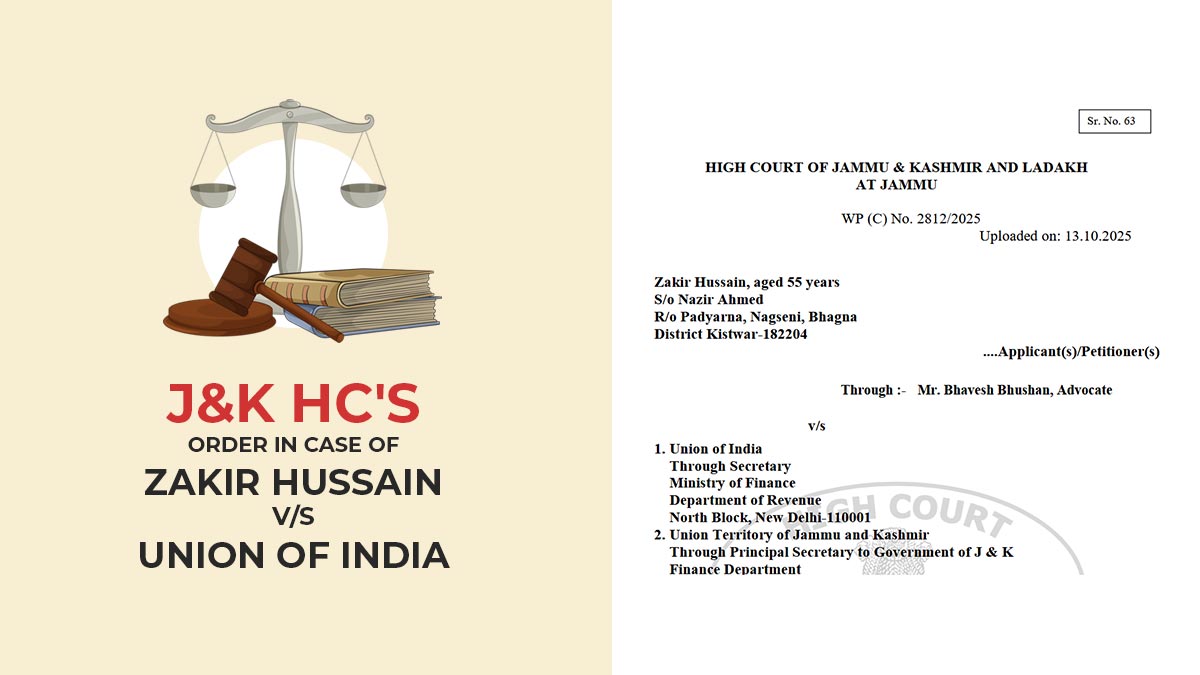

| Case Title | Zakir Hussain vs Union of India |

| Case No. | WP (C) No. 2812/2025 |

| For Petitioner | Mr. Bhavesh Bhushan, Advocate |

| J&K High Court | Read Order |