The bench of the Income Tax Appellate Tribunal, Chennai, held that any reassessment notice issued by a Jurisdictional Assessing Officer (AO) after the introduction of the faceless regime is not valid in law.

The Tribunal, emphasising the binding nature of the CBDT’s e-Assessment of Income Scheme, 2022, held that the issuance of notices u/s 148 of the Income Tax Act, 1961, should comply with the faceless procedure, and any deviation from it renders the reassessment proceedings void.

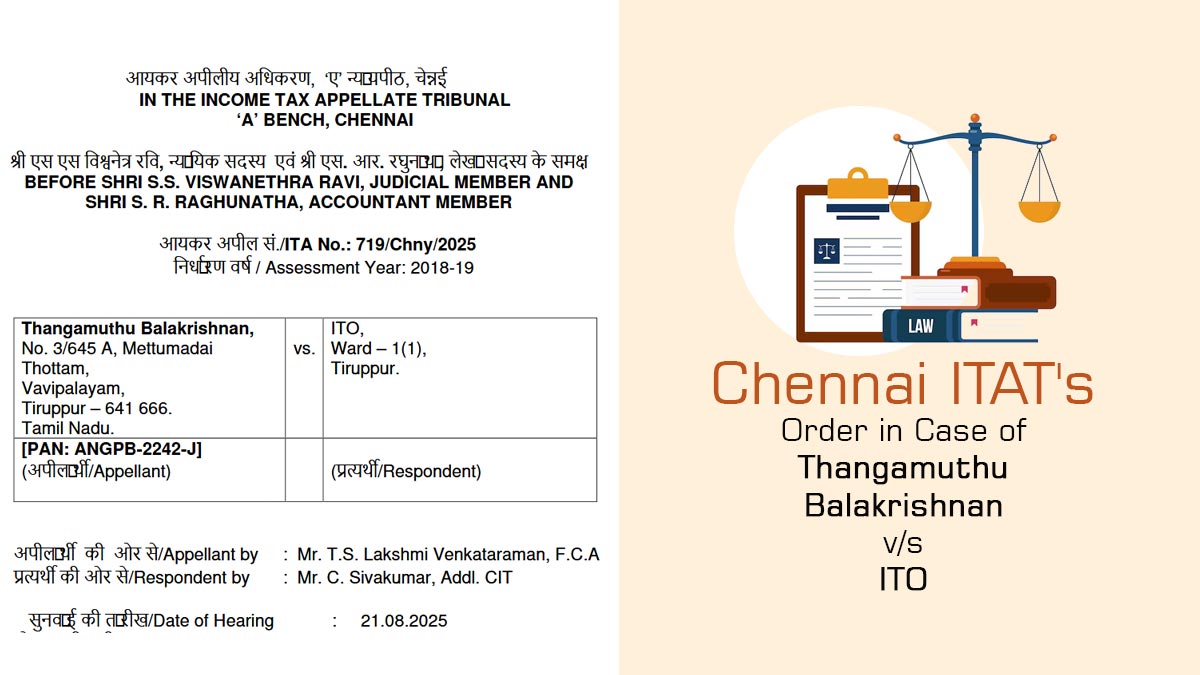

Thangamuthu Balakrishnan, an individual engaged in the business of manufacturing and exporting garments, submitted the appeal against the order of the Commissioner of Income Tax (Appeals), [CIT(A)], Delhi, dated 16 January 2025, for the Assessment Year (A.Y.) 2018-19.

The case was reopened following a specific order issued by the tax authorities on March 31, 2022. This order allowed the local tax officer to look into the matter again. As a result, the National Faceless Assessment Centre reviewed the case and found some discrepancies. They added two significant amounts: one of ₹8,28,250, which was deemed as business income, and another of ₹87,71,500, categorised as unexplained funds. This was done under a particular section of the Income Tax Act that deals with unaccounted money.

The taxpayer was dissatisfied with the order and filed a plea to the CIT(A), which was dismissed, leading to the present appeal before the Tribunal.

The appellant’s representative T.S. Lakshmi Venkataraman, contested the jurisdiction of the reopening proceedings, claimed that the notice issued u/s 148 by the Jurisdictional Assessing Officer was void ab initio since, after the Central Board of Direct Taxes (CBDT) Notification dated 29 March 2022, all such notices needs to be issued by the NFAC in accordance with the e-Assessment of Income Scheme, 2022.

On the judgment of the Madras High Court in TVS Credit Services Ltd. v. DCIT (2025), reliance was placed on which held that reassessment notices issued via the JAO post-notification were not valid. Therefore, the appellant requested that the reassessment order be quashed as being without jurisdiction.

A revenue representative named C. Sivakumar argued that sending a notice through the local tax officer instead of the National Faceless Assessment Centre (NFAC) didn’t affect the legality of reopening a case. He stated that it didn’t matter who issued the notice, the local officer or the NFAC, when it came to deciding if the reassessment was valid. Because of this reasoning, he suggested that the appeal should be dismissed.

The Bench, Judicial Member S.S. Viswanethra Ravi and Accountant Member S.R. Raghunatha, said that the CBDT Notification dated 29 March 2022 obligated that reassessment proceedings, along with notices under Sections 148A(d) and 148, should be undergone via the faceless procedure.

The tribunal ruled that as the impugned notice and order were issued by the AO, both dated 31 March 2022, they were contrary to the regulatory scheme and therefore not valid.

As per the Bench, the appeal was permitted in the taxpayer’s favour.

Subsequently, ITAT quashed the impugned notice issued u/s 148 and the resultant assessment order.

| Case Title | Thangamuthu Balakrishnan vs ITO |

| Case No. | ITA No.: 719/Chny/2025 |

| Appellant by | Mr. T.S. Lakshmi Venkataraman, F.C.A |

| For Respondent | Mr. C. Sivakumar, Addl. CIT |

| Chennai ITAT | Read Order |