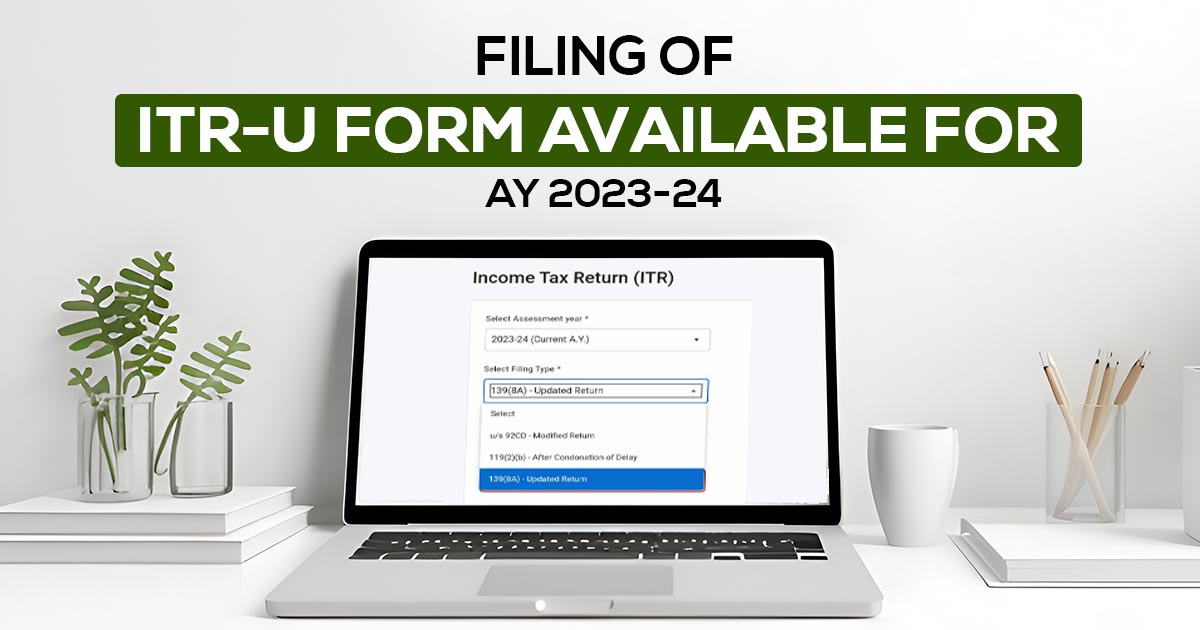

The Central Board of Direct Taxes (CBDT) has recently updated the Income Tax Portal, enabling the electronic submission of amended Income Tax Returns (ITRs) for the Assessment Year (AY) 2023-24 or Financial Year (FY) 2022-23.

Taxpayers are now given the option to submit revised Income Tax Returns (ITRs) for the ongoing assessment year under Section 139(8A). According to Section 139(5) of the Income Tax Act, 1961, individuals have the opportunity to modify returns that were earlier filed by Section 139(1) or Section 139(4) of the Income Tax Act. This requirement enables the inclusion of any excluded entries or the rectification of mistakes in the original return.

It’s crucial to keep in mind that certain limitations apply to the filing of updated returns. Assessees cannot revise returns that result in a net loss, generate a higher refund against the original return, or minimize tax accountability.

The process of submitting updated returns not only supports taxpayers in correcting errors but also demonstrates unforced compliance with tax laws, thereby mitigating possible legal concerns associated with tax evasion.

However, taxpayers should be mindful that filing an updated return may lead to additional income tax accountabilities, as it may disclose previously undisclosed income that was not reported in the initial return.

Even after this potential burden, the benefits include avoiding litigation concerning tax evasion and boosting voluntary compliance with tax laws. Stay informed and compliant by keeping up with the recent modifications on the Income Tax Portal for a seamless and precise filing experience.