The Income Tax Department has issued e-Forms for filing ITR 2 for the Financial Year 2018-19. ITR 2 is the second most commonly used form of filing income tax returns. This form is mandatory to be filed by anyone who has a capital gain or more than one house property. Whereas those who earn money through business and job are not required to fill this form.

The salary format of ITR 2 is synced to the salary breakup structure given in Form 16. However, now we need to give more information on salary breakup in ITR 2 which is even more than the detailed information given in Form-16.

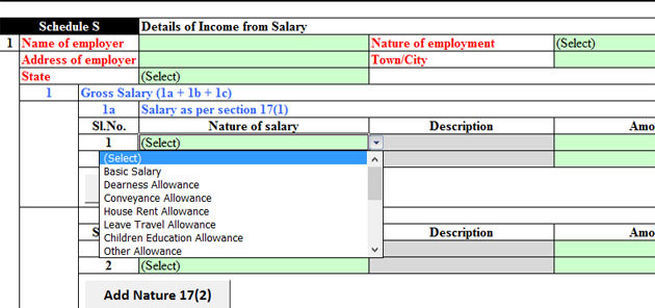

Yet It is not clear whether salary break-up will be available in the new form 16 or not but in case it is not available in the new Form 16, then you will have to perform a lot of calculation by gathering numbers and data from sources like salary slip etc. Information about the Allowances that are available to the salaried people will also be filled separately for which 17 options like Basic Salary, Dear allowance, House Rent Allowance (HRA), Gratuity are given in the Dropdown menu in ITR 2.

“The Formula Schedule is given in Form 16 and ITR Forms has been modified with the intent of syncing them together with each other,” says DGM and charity accountant Naveen Wadhwa of Taxmann.com.

In ITR-2’s Return Filing Utility, now you have to give information about the most common parts of salary like Basic Salary, HRA, LTA, Children Education Allowance etc. As far as Form 16 is concerned, section 17 (1) of Form 16 has been given only one field for the aggregate amount of taxable salary.

In the same way, if the investors under Real Estate Investment Trust (REIT) will be required to represent the income from these sources under the tag “Income From House Property”.