The Income Tax Appellate Tribunal (ITAT), the Bench of Mumbai judged that TDS should not be deducted on the rent if the accommodation services were considered on a random basis. The taxpayer Dadiba kali Pundole Esplanade House has the business auction fine promoting, publishing, documenting, executing, decorative arts, and selling arts.

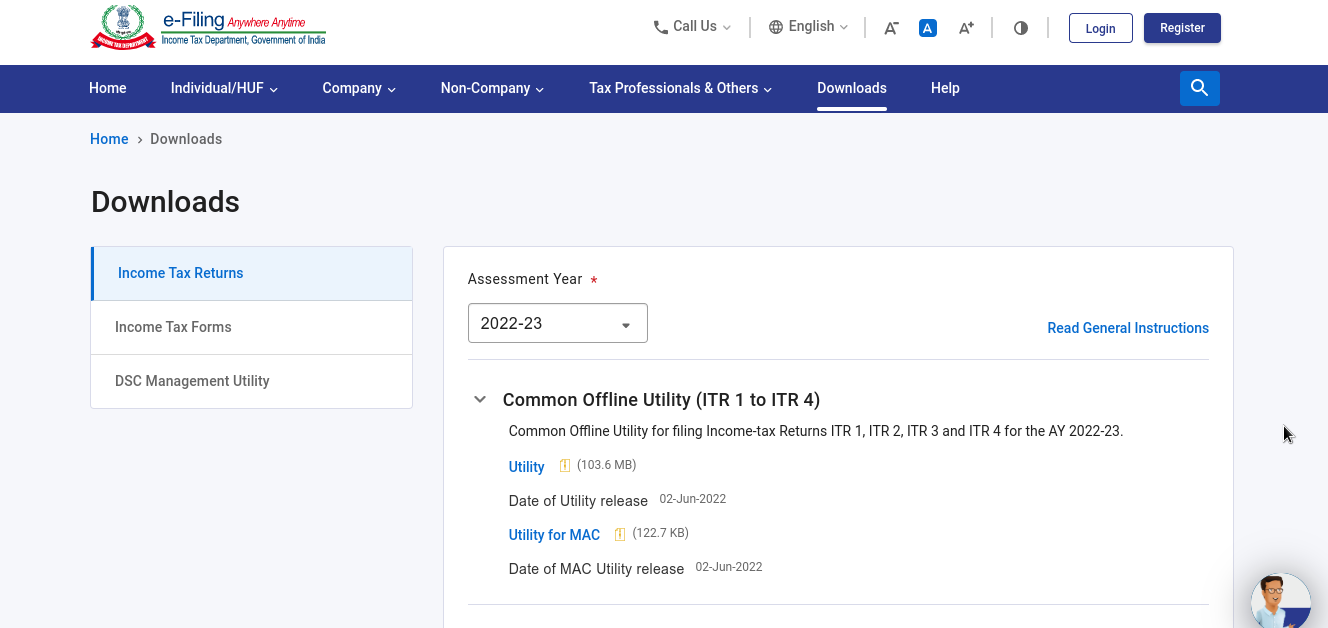

Under section 143(1) the taxpayer files its return

Accordingly, a show cause was given to the assessee as to why the same should not be disallowed under section 40(a)(ia) of the Act for non-deduction of Tax Deducted at Source.

The assessee also declares that there is no payment made more than Rs 1,80,000. The assessee also declares to Circular No.5 dated July 30, 2020, in which he stated that the procurement relevant to a tax deduction for the source concerning the changes created under Finance act 1995.

Other than a single person TDS is also applied to the payments done by other persons. Which he said in his circular. The TDS under section 194-I

AO disallowed and added the same under section 40(a)(ia) of the Act for non-deduction of TDS. CIT(A) states the addition by holding that the assessee has given accommodation charges for the hotel accommodation which is on a regular basis from the club without deduction of TDS at the source.

“We are quite convinced with the arguments of the learned Counsel that this accommodation is occasional/ casual as no specific accommodation is earmarked and the same is made available to the assessee on the availability basis,”