The Judicial Member Kuldip Singh of Mumbai ITAT Bench has revoked the reopening of the assessment via AO because of the absence of valid reasons along with the tangible materials and removed the incurred other things.

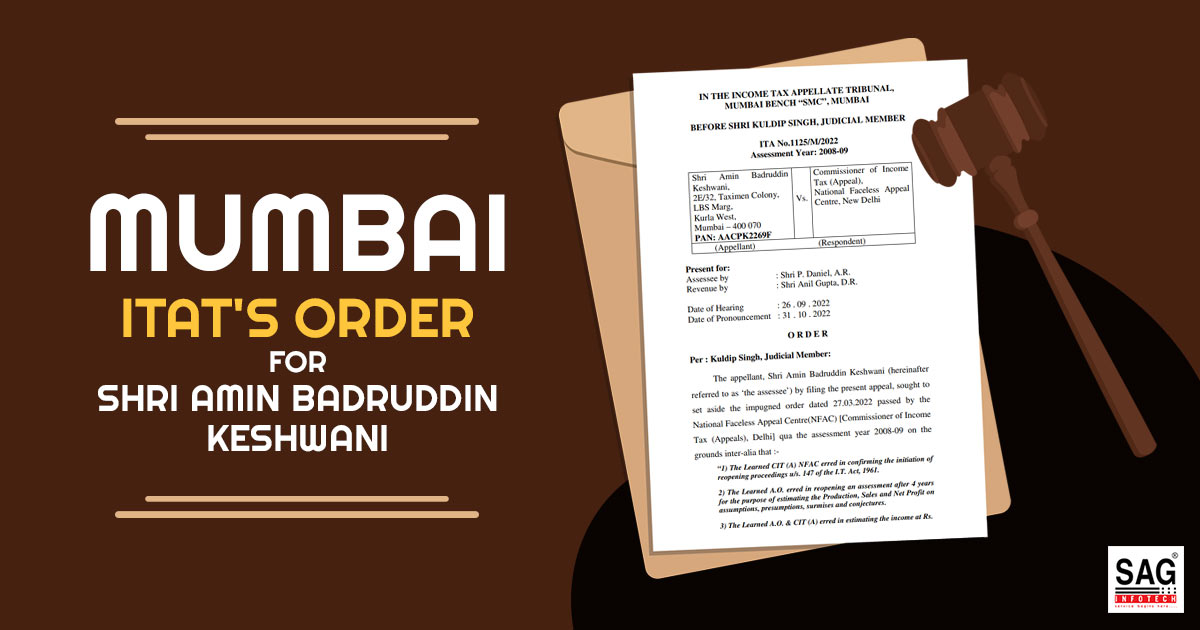

The taxpayer is involved in the manufacturing of steel wool, filed a plea to the ITAT to set aside the impugned order on 27.03.2022 which has been issued via the National Faceless Appeal Centre(NFAC) [Commissioner of Income Tax (Appeals), Delhi] of the A.Y. 2008-09 on various basis.

As per the data furnished via Electricity Authorities through a letter V&S/ENF/874 dated 18.03.2006, initiated the reopening proceedings. The letter specified that the taxpayer has consumed 37.3 units of electricity per hour in his factory from which the steel wool-making machine takes 29.84 units of electricity per hour, 80% of the total consumption of 37.3 units per hour. under Section 142(1) of the Income Tax Act, 1961 a notice was issued to the taxpayer for filing the needed data.

AO denied the views that the taxpayer has raised and proceeded to find out the turnover and the profit ratio on it to the tune of 8.11%. AO has again opened the assessment by calculating the production of the taxpayer at the rate of 2.5 Kg per unit of the consumption of electricity and carried that with the rate of 55 per Kg as stated via taxpayer and calculated the turnover at the rate of Rs.67,26,225 and then approximated the net profit at the rate of 8.11%.

The taxpayer has furnished the petition to CIT(A) however refused, and furnished the petition to the tribunal on that.

For the taxpayer, P. Daniel expresses that “there was no ‘tangible material’ whatsoever with the AO to reopen the assessment, though, framed under section 143(1) of the Act and the letter issued by the electricity department intimating the consumption of electricity units per hour is not a tangible material in any case.”

The single bench of Judicial Member Kuldip Singh sees that “the assessment was framed under section 143(1) of the Act but assessee has a right to challenge the reopening because of “change of opinion” as there was no reason whatsoever with the AO except the letter issued by the electricity department which was not relevant for confirmation of the belief.”

Read Also: All Latest Updates of Mumbai ITAT Bench

The bench saw that “since the AO was not having any valid reason to reopen the assessment nor any intangible material was there, further estimating the income by merely calculating the production of the assessee on the basis of guesswork is not sustainable on merits also.”

It tracked that, “The Assessing Officer (AO) has also not made any comparison with the assessee’s own productions in the earlier years to arrive at the logical conclusion. Even in earlier years for A.Y. 2002-03, 2003-04 and 2005-06 the Ld. CIT(A) himself quashed the reopening which was made on the basis of information received from Maharashtra State Electricity Board that the assessee is involved in the theft of electricity.”

| Case Title | Shri Amin Badruddin Keshwani vs Commissioner of Income Tax |

| Citation | ITA No.1125/M/2022 |

| Date | 31.10.2022 |

| Assessee by | Shri P. Daniel, A.R. |

| Revenue by | Shri Anil Gupta, D.R. |

| ITAT Mumbai | Read Order |