Income Tax Appellate Tribunal (ITAT), Bangalore in a case where the appeal of the taxpayer was permitted by considering the Medical Certificate as adequate evidence for condonation of taxpayer’s filing delay of the audit report.

The appellant Home of Peoples Empowerment Foundation has submitted an appeal against the impugned order of the income tax officer. The problem with the ITAT was that if the CIT(A) was true in law in dismissing the taxpayer’s appeal without condoning the delay of 205 days.

Read Also: Delhi HC: Two Judgment Orders Against One SCN Cannot Be Accepted for the Same Period

Advocate Arun Bhatt the counsel of the taxpayer has said that the delay has arrived because of the illness of the trustee who was asked for 2 to 3 months rest by the doctors. In discarding the submissions of the taxpayer’s condonation of delay, CIT(A) was incorrect.

The counsel of the taxpayer has furnished a medical certificate and indeed the advantage of sections 11 and 12 were refused to the taxpayer. The ITAT bench Accountant Member Waseem Ahmed and Judicial Member Prakash Chand Yadav marked that given the medical certificate document, CIT(A) must have condoned the delay of 205 days.

Benefits under sections 11 & 12 were refused by the assessee as the assessee failed to annex Form No.10B. U/s 119(2)(b) of the Income Tax Act the taxpayer has submitted a petition to the Central Board of Direct Taxes (CBDT) asking for the condonation of delay in submitting Form No.10B.

The CBDT has condoned the delay in filing Form No. 10B and asked the Jurisdictional Assessing Officer (JAO) to regard the taxpayer’s claim. The board asked the Assessing Officer to analyze the taxpayer’s claim under the norms of CBDT. Therefore the plea of the taxpayer was permitted.

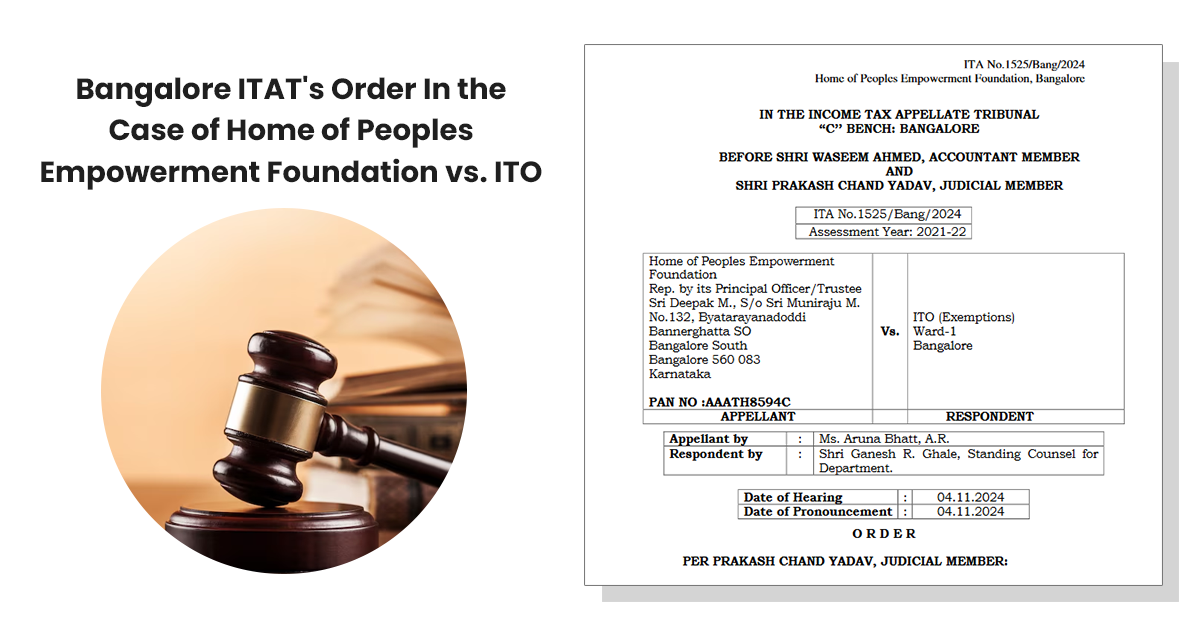

| Case Title | Home of Peoples Empowerment Foundation vs. ITO |

| Citation | ITA No.1525/Bang/2024 |

| Date | 04.11.2024 |

| Appellant by | Ms. Aruna Bhatt |

| Respondent by | Shri Ganesh R. Ghale |

| ITAT Bangalore | Read Order |