The Delhi Bench of the ITAT decided that a taxpayer could not claim a tax deduction for buying a house because the property was registered in their mother’s name

An individual taxpayer, Ashok Kumar, has faced scrutiny for the AY 2015-16. An income tax return (ITR) has been furnished by the taxpayer specifying an income of Rs 2,70,000.

A property of Rs 1,23,00,000 has been sold by the taxpayer dated 5.02.2015, which consequence in a long-term capital gain of Rs 78,57,794 post-indexing the acquisition cost.

The residential property was purchased on 30.06.2015 by the taxpayer from his capital gain in the name of his mother, Smt. Promila Rani Yadav to claim deduction u/s 54F of the IT Act.

The deduction was not permitted by the assessing officer, quoting that section 54F mandates the new asset to be purchased in the name of the taxpayer. The taxpayer, dissatisfied with the order of the AO, has furnished a plea to the Commissioner of Income Tax (Appeals) [CIT(A)].

The order of AO has been kept by the CIT(A) and dismissed the claim of deduction u/s 54F of the Income Tax Act. The taxpayer, dissatisfied with the order of CIT(A), has furnished a plea to the ITAT. The revenue’s counsel defended the order of CIT(A).

On the ruling of the Jurisdictional High Court in the case of Kamal Kant Kamboj vs ITO, the revenue counsel relied, which ruled that to claim the deduction u/s 54B, the new asset would need to be purchased in the name of the taxpayer but not in the name of a family member.

The Revenue Department’s attorney contended that Section 54F of the Act is identical to Section 54B’s provisions. As a result, the rationale used in the case of Kamal Kant Kamboj should be applied to the current appeal.

Read Also: ITAT Delhi: No Tax Deduction Permits U/S 54 Without Basic Facilities

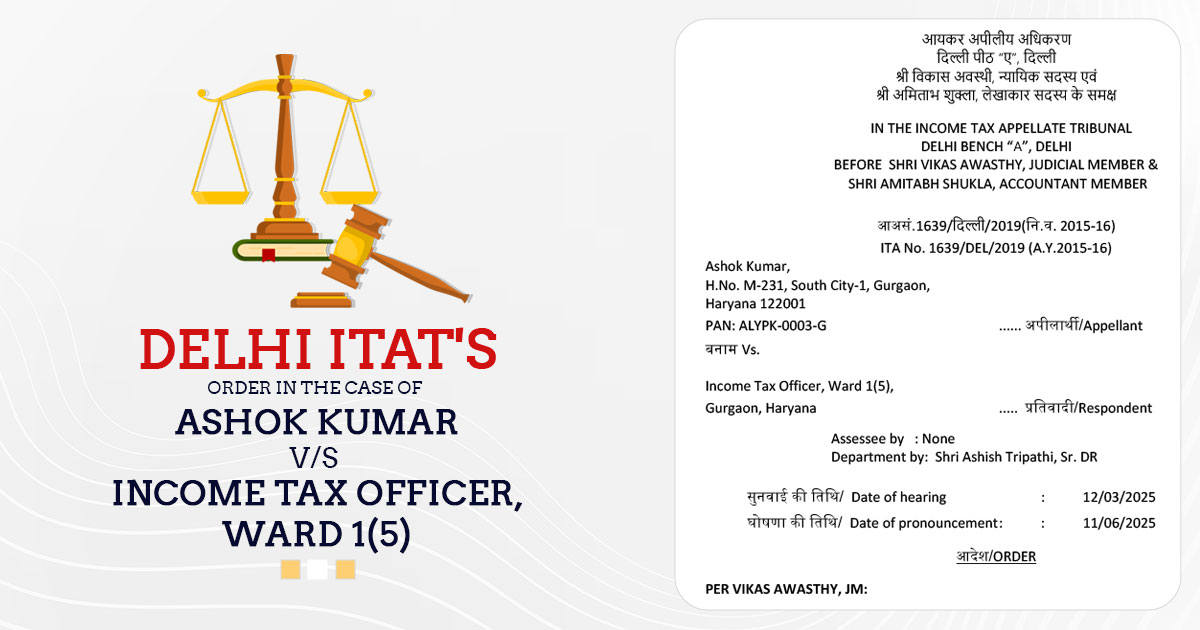

Punjab & Haryana High Court in Jai Narayan vs. ITO and Kamal Kant Kamboj vs. ITO held deductions under Sections 54F and 54B mandates the new asset to be purchased in the name of the taxpayer and not in a family member’s, the two-member bench including Vikas Awasthy (Judicial Member) and Amitabh Shukla (Accountant Member) noted.

The tribunal kept the disallowance of the deduction claim u/s 54F of the Income Tax Act. The order of the Commissioner of Income Tax (Appeals) (CIT(A)) has been affirmed by the tribunal. The appeal of the taxpayer has been dismissed by the tribunal.

| Case Title | Ashok Kumar vs. Income Tax Officer, Ward 1(5) |

| Case No. | ITA No. 1639/DEL/2019 (A.Y.2015-16) |

| For the Appearance | None |

| For the Respondents | Shri Ashish Tripathi |

| Delhi ITAT | Read Order |