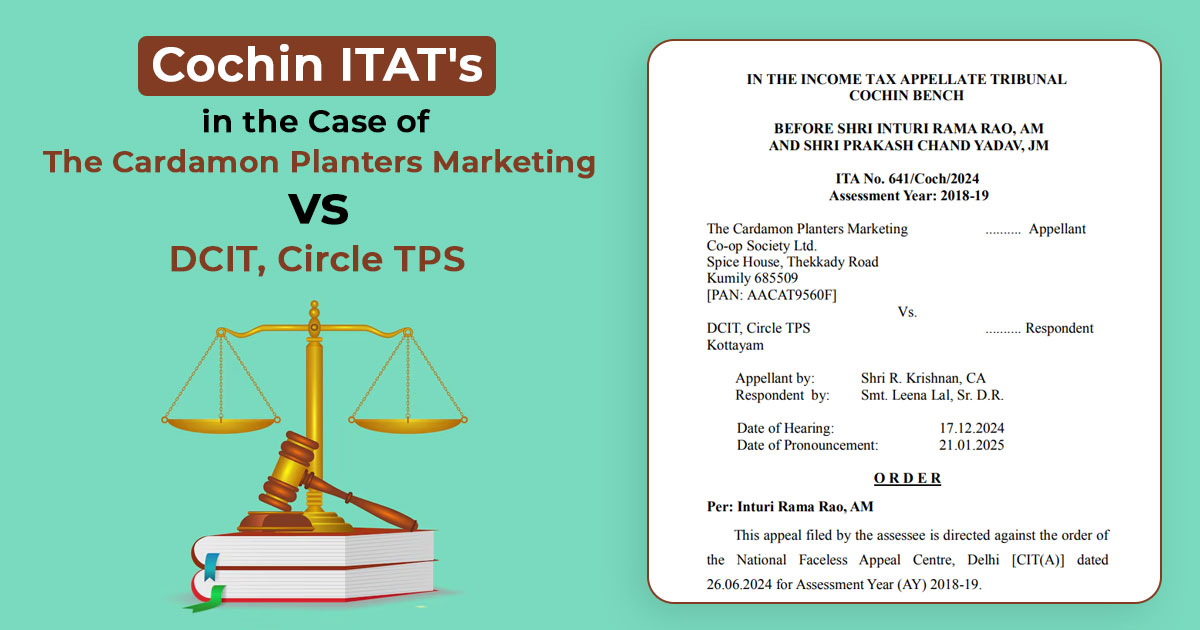

The Cochin Bench of the Income Tax Appellate Tribunal (ITAT) restored the case, remarking that the Commissioner of Income Tax (Appeals) [CIT(A)] failed to decide the immunity application concerning the penalty on its merits.

The taxpayer, The Cardamon Planters Marketing Co-op Society Ltd., filed an income tax return for the Assessment Year (AY) 2018-19 dated October 18, 2018, declaring a total income of Rs. 1,20,22,050. The Assessing Officer (AO) completed the assessment determining a revised income of Rs. 1,82,70,297 by disallowing a portion of the deduction claimed u/s 80P of the Act.

Penalty proceedings are been initiated by the AO u/s 270A of the Income Tax Act. An application has been submitted by the taxpayer for the grant of the immunity u/s 270A(6) of the Income Tax Act. The immunity has been rejected by the AO as of the late filing of Form 28. AO imposed a penalty of Rs 10,81,197.

The taxpayer dissatisfied with the penalty order has approached the Commissioner of Income Tax (appeals)[CIT(A)]. The appeal has been dismissed by the CIT(A) and verified the penalty without dealing with the problem of immunity asked by the taxpayer.

Read Also: All About Penalty Under Section 286 & 271GB of I-T Act

The taxpayer is dissatisfied with the order and submitted a plea to ITAT. The tribunal heard the parties and analyzed the materials on record.

The two-member bench comprising Shri Inturi Rama Rao (Accountant Member) and Shri Prakash Chand Yadav (Judicial Member), noted that the taxpayer asked for immunity from penalty as per the provisions of section 270A of the Income Tax Act.

It was noted by the tribunal that both the AO and the CIT(A) failed to address the immunity application on its merits. It was ruled by the Tribunal that justice shall be provided if the case were remanded to the Assessing Officer (AO) for a fresh examination of the claim of the taxpayer for immunity.

It was ruled by the tribunal that all the claims sought before it stayed open for reconsideration before the AO.

CIT(A)’s order has been set aside by the tribunal and restored the matter to the AO for the fresh decision of the taxpayer’s immunity application. Hence the taxpayer’s appeal was partly permitted.

| Case Title | The Cardamon Planters Marketing vs. DCIT, Circle TPS |

| Citation | ITA No. 641/Coch/2024 Assessment Year: 2018-19 |

| Date | 21.01.2025 |

| Appellant by | Shri R. Krishnan |

| Respondent by | Smt. Leena Lal |

| Cochin ITAT | Read More |