It was carried out by ITAT Chennai that the condonation of delay must not be dismissed for the cause that the plea submitted belatedly is not accompanied by the condonation petition. Therefore the order has been set aside and the case remanded back.

Key Facts and Information

The petitioner vides the present plea challenged that Addl/JCIT was mistaken in not condoning the delay and indeed dismissed the plea for non-prosecution. The taxpayer’s grievance is that the Commissioner of Income Tax (Appeals) apart from dismissing the plea in limine and not carried, dismissed the plea for the non-prosecution.

Conclusion

It was carried out that the condonation of delay must not be dismissed summarily for the cause that the late plea submitted is not accompanied via the condonation petition. Under the Income-tax Act, the provisions of the condonation are para material to Rule 3A of Code of Civil Procedure, 1908, and Order 41 categorically cited that there is zero law specified for the rejection of memorandum of plea for the matter where the plea is not accompanied by an application for condoning the delay.

When the appeal’s memorandum is submitted in the appeal without an accompanying application to condone the appeal the outcomes could not be disastrous. The appeal does not get regarded by the court since no valid application is there to condone the delay being cancelled, it must be opted including with the already submitted memorandum of appeal merely when the court can deem it as statutory presented.

Read Also: ITAT Chennai Rejects Appeal for Late Tax Filing Beyond 8 Years

Nothing is incorrect if the courts return the memorandum of the plea as defective and these defects could be fixed via the party-related and present the plea without additional delay.

Hence it carried that dismissal for default by CIT(A) is poor and as per that, we set aside the CIT(A) order.

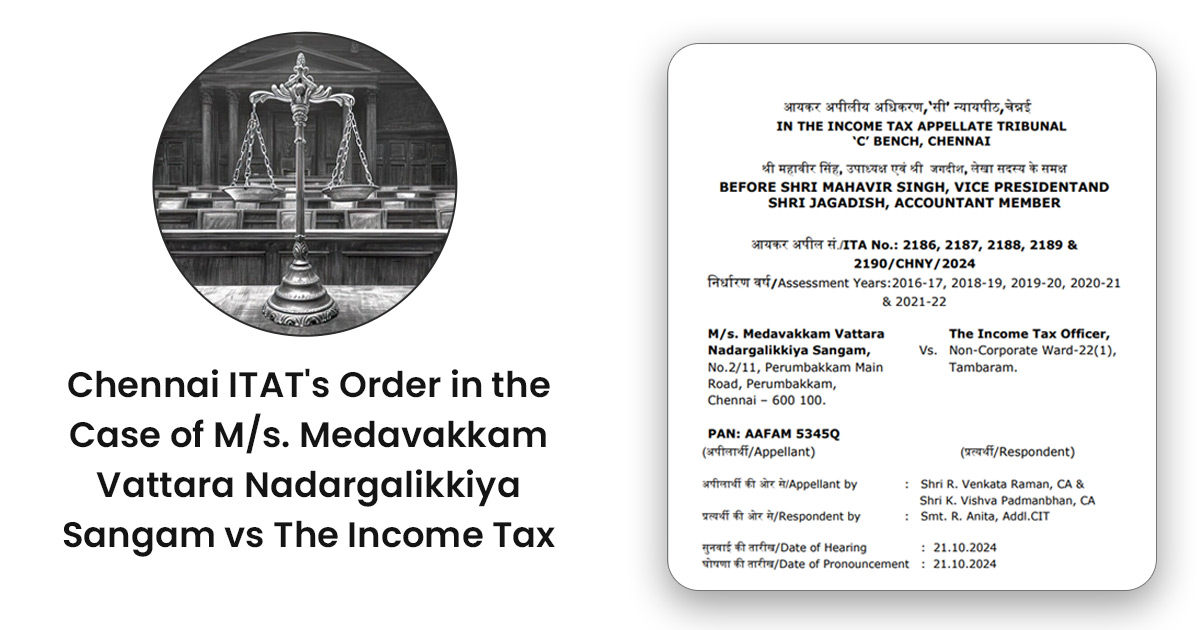

| Case Title | M/s. Medavakkam Vattara Nadargalikkiya Sangam vs The Income Tax Officer |

| Citation | ITA No.: 2186, 2187, 2188, 2189 & 2190/CHNY/2024 |

| Date | 21.10.2024 |

| Appellant by | Shri R. Venkata Raman, Shri K. Vishva Padmanbhan |

| Respondent by | Smt. R. Anita |

| ITAT Chennai | Read Order |