Tax system in India keeps on reforming for good. The Government and other tax-related departments are constantly working to make the tax system more rigid. One such reform is recently brought in practise by the Tax Department related to ‘Income Tax Refund’. Valid from the prevailing year onward, the one who claims Income Tax Refund has to pre-validate the bank account in which he wishes to receive the refund. Apart from that, the IT Department demands the bank accounts to be linked with the taxpayer’s PAN and if in any case the taxpayer fails to link the PAN, then the refund will not be credited in his account.

Experts say, “a taxpayer who is looking to claim the refunds must link the PAN to his bank account and also pre-validate the bank account on income tax e-filing website”. From now onward e-refund will be issued by the tax department and the refund will be credited to the bank account linked with PAN. Visit your bank branch to register your PAN with your bank account.

A Step-wise Guide to Pre-Validate your bank account:

Step 1: Log in to your account on www.incometaxindiaefiling.gov.in. Your user ID is your PAN number.

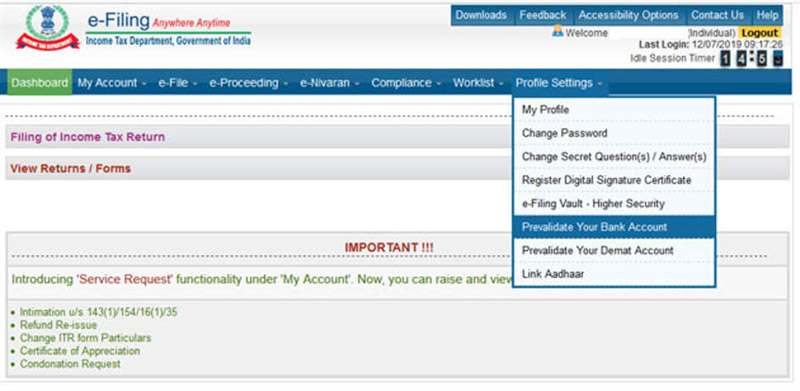

Step 2: On the dashboard, select Profile Setting Tab and from the drop-down select ‘Prevalidate your bank account’ option.

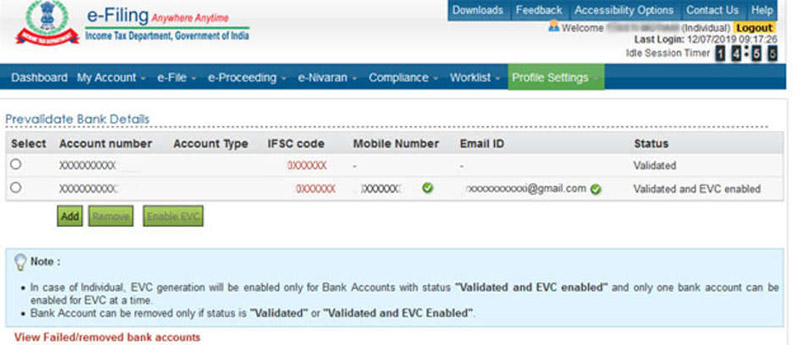

Step 3: The details of Pre-validated bank account (if any) will flash on the screen. If you don’t have a pre-validated account or if you want to pre-validate a new account, click on the ‘Add’ button.

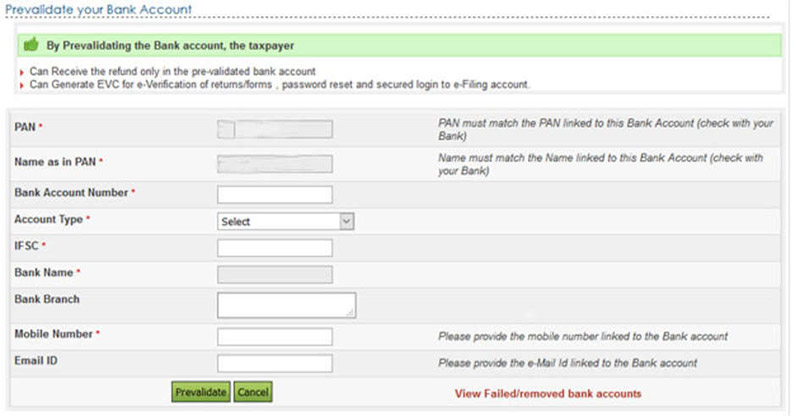

Step 4: You will land on the application form for Pre-validating the bank account. You need to fill the relevant details such as bank account number, account type, bank name, branch name, IFSC, your mobile number and your email id. Take note on the mobile number and email id as they should match with the bank records.

Step 5: As soon as you click the pre-validate button visible in the bottom of the form you will see a message saying “Your request for pre-validating bank account is submitted. Status of your request will be sent to your registered email id and mobile number”.

Quick Tips that might help you while pre-validating your bank account:

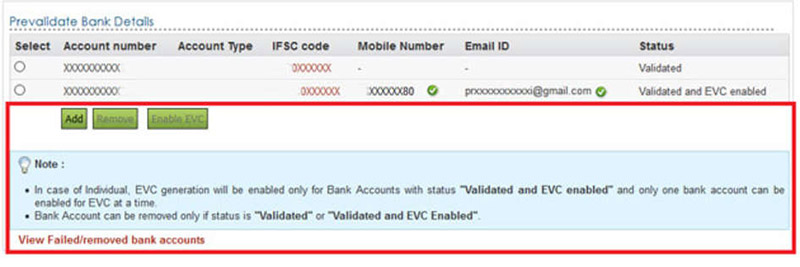

- You can even check the status of your bank account by going back to Pre Validate your bank account under Profile Settings Tab. If your account is pre-validated it will appear on the screen.

- In case if you want to remove a bank account, go to the ‘Pre Validate your bank account’ under Profile Settings Tab, select the account you want to remove then click on the ‘Remove’ tab.

- To see the bank accounts where pre-validation has failed, you can click on ‘View Failed/removed bank accounts’ visible at the bottom of the web page. After clicking, it will display the details of the removed or rejected bank accounts with the reason for removal or rejection.