As we know, the time for e-filing ITR is running, so every taxpayer must remember the income tax return filing due dates to avoid penalties under the Income Tax Act of 1961. In this post, you can check out all the due dates compulsory for FY 2025-26 (AY 2026-27).

The practising CA, CS and tax professionals can also view advance tax and revised and updated ITR due dates.

What is the Income Tax?

Two types of tax levied on entities are direct tax and indirect tax. Income tax is a direct tax that is directly attributable to the income of the assessee. Income which is generated from the various heads of income, viz. Salary, House Property, Business, Capital Gain and Income from other sources. The assessee has to pay income tax if his total Income after allowing Chapter VI-A Deduction is more than the taxable income limit.

Due Dates of ITR for Different Categories of Taxpayers for FY 2025-26 (AY 2026-27)

| Category of Taxpayer | Due Date (Original Return) |

|---|---|

| Company (whether tax audit applicable or not applicable) | 31st October 2026 |

| Other than a company to which the tax audit is applicable | 31st October 2026 |

| Partner of the firm to whom the tax audit is applicable | 31st October 2026 |

| Assessee includes the partner’s firm or the spouse of such partner, who is needed to be provided report under section 172 | 30th November 2026 |

| Assessees who are not required to get his Accounts Audit | 31st July 2026 |

| Revised Return/ Belated Return | 31st December 2026 |

| Updated Return (ITR-U) | Upto 31st March 2031 |

Filing Income Tax Return Due Dates for FY 2025-26 (AY 2026-27)

There is a different category of taxpayer, viz. Individual, HUF, Firm, LLP, Company, Trust and AOP/BOI. Due Date is different according to audit or non-audit cases of such categories as defined in section 263 of the Income Tax Act, 2025.

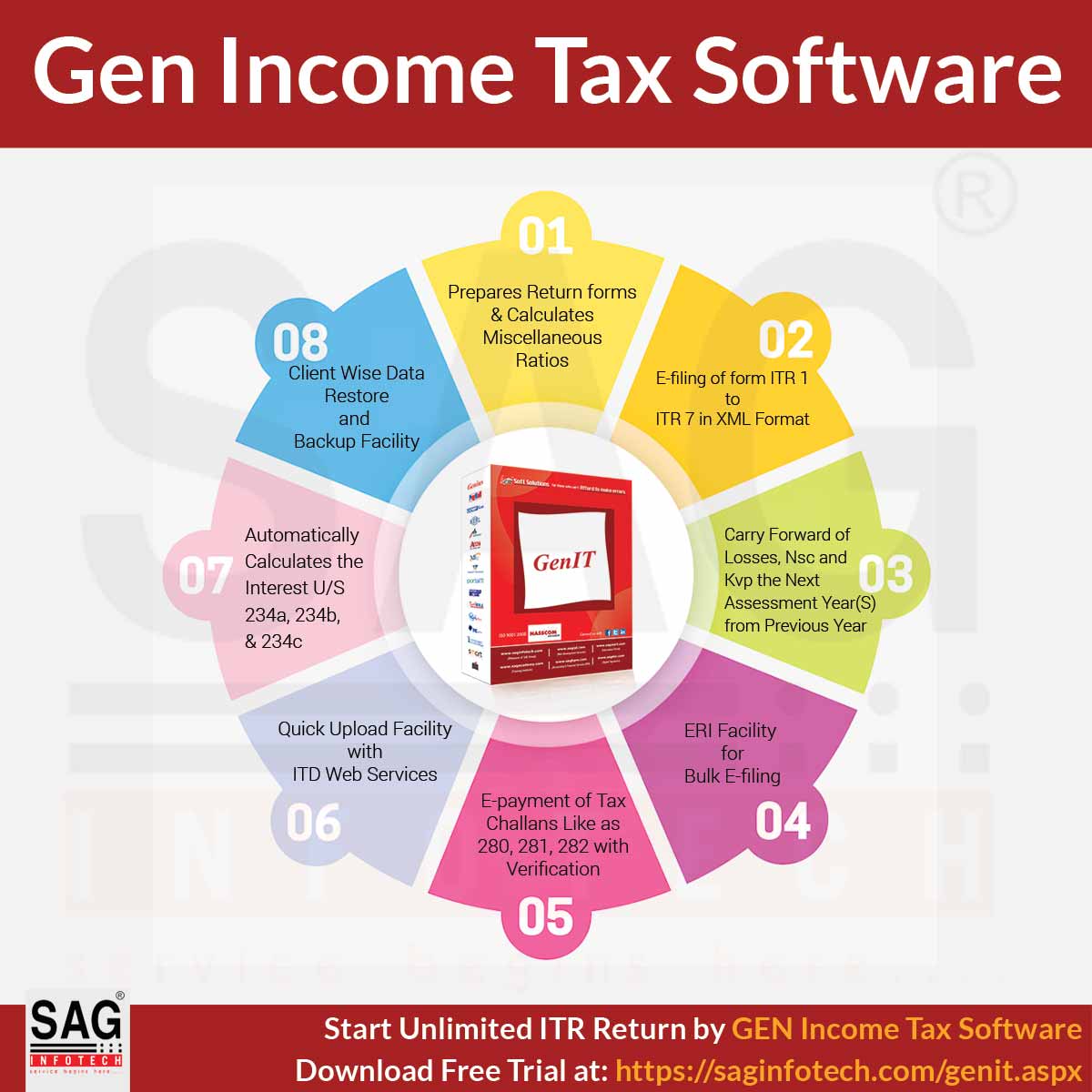

Free Download Gen IT Software for e-Filing Returns

Due Date of Income Tax Return Filing for AY 2026-27 (Non-Audit Cases)

- The common due date for filing the Income Tax Return by Assesse whose Books of Account are not required to be audited is 31st July 2026.

Filing Income Tax Return Due Date for AY 2026-27 (Audit Cases)

- The general due date for filing the Income Tax Return for the audit cases is 31st October 2026.

Due Dates for Tax Audit Report (3CA-3CD/3CB-3CD)

- The due date for filing the Tax Audit Report for all categories of assessees whose accounts are required to be audited is the date one month before the due date for furnishing the return of income under sub-section (1) of section 263, i.e., September 30, 2026.

Revised & Belated ITR Due Dates for AY 2026-27

- The due date for filing a revised and belated income tax return for AY 2026-27 is nine months from the end of the relevant tax year or before the completion of the assessment, whichever is earlier, i.e. 31st Dec 2026.

File Tax Returns for AY 2026-27 Before 31st December with INR 5,000 Penalty

The income tax department notified the taxpayers of the late filing of tax returns for A.Y. 2026-27, along with a penalty of INR 5000. However, if the taxpayer’s total income does not exceed Rs 5 lakh, then the maximum penalty levied for delay will not exceed Rs 1000.

Due Date of Income Tax Return Filing for AY 2026-27

(Assessee who are required to furnish a report under sec 92E)

- The due date for filing the Income Tax Return by an assessee who is required to furnish a report under sec 92E is 30th November 2026.

- The due date for furnishing a Report from an Accountant by persons entering into an international transaction or specified domestic transaction under section 92E of the Act for the Previous Year 2025-26, is at least one month before the due date of filing of return u/s 263(1)

What Would Happen If You Missed the ITR Filing Deadline?

Missing the deadline for filing Income Tax Returns (ITR) for the FY 2025-26 and AY 2026-27 can have some harmful effects. Take a look at what happens if you miss the ITR deadline:

- Potential for Scrutiny: Recognise that if you file your taxes later, it might grab the attention of the I-T department and expand the possibilities of them bringing a closer look at your income tax return. This could suggest they request more records, and it might take longer for you to get your tax refund on time.

- Interest on Unpaid Tax: If you are filing an ITR later and pay taxes, you have to pay additional money in interest on the amount that you owe from the deadline until you pay it.

- Loss of Carry Forward Benefits: Sometimes, you might be able to utilise any financial failures or tax deductions from previous years to reduce the tax amount you owe in the future. But if you have missed the ITR filing deadline, you might not be able to take any benefit.

It is essential to submit your ITR before the due date to avoid difficulties. Filing tax returns on time allows you to make the process much easier, stops you from facing penalties and extra costs, and provides you with all the tax benefits you are entitled to.

Advance Income Taxes Filing Due Dates FY 2025-26

If the tax liability is more than Rs 10,000 in a financial year, then advance tax needs to be paid by the assessee.

| Due Date | Compliance Nature | Tax Paid |

|---|---|---|

| 15th June 2025 | First Instalment | 15% |

| 15th September 2025 | Second Instalment | 45% |

| 15th December 2025 | Third Instalment | 75% |

| 15th March 2026 | Fourth Instalment | 100% |

The assessee who is covered under section 58 (i.e. Presumptive Income) is also required to pay the advance tax on or before the 15th of March of the previous year. However, any tax paid till 31st March will be treated as Advance Tax.

Most Important FAQs on the ITR Filing Deadline for AY 2026-27

Q.1 – What is the last date for filing an income tax return (ITR) for non-audit cases?

The due date for filing income tax returns for AY 2026-27 (FY 2025-26) is 31st July 2026

Q.2 – Could I E-file My Return after the due date?

Yes, you can file your late income tax return (ITR) upto 31st of December of that assessment year (AY) after paying extra fees and interest.

Q.3 – What is the due date to E-file income tax return (ITR) for Cos?

The deadline for filing the ITR of domestic companies for the financial year (FY) 2025-26 is 31st October 2026. For all companies, it is essential to e-file their Income Tax Returns (ITR) by a specific date every year.

Q.4 – Is It Possible to File a Revised ITR?

Yes, you can make the particular modification in your ITR after submitting it. It would be best if you changed it on or before 31st of December.

Q.5 – What happens if a person files their ITR after the due date?

If you have missed the particular deadline for filing your income tax return, then you have to pay some additional fees as per section 428 of the Income Tax Act, 2025.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

What is the due date for non-working partners return firm under audit?

As the partner is non-working, the due date will be 31/08/2018.

I am the director f private limited company. my Pvt ltd company is under tax audit and company audit both. what is the due date of my Income tax Return filing as a Director of Auditable Company?

31st August

Hello sir,

I am iyyanar, Partnership firm. What is the due date of filing our Income tax return for a.y: 2018-19?

Hi sir

I am the partner of Partnership firm. What is the due date of filing my Income tax return for a.y: 2018-19?

If partnership firm is unaudited then due date will be 31/07/2018 otherwise 30/09/2018.

Any hope for extension

No such update yet.

SIR

HOW TO FILL ITR AFTER DUE DATE (2017-18), PLEASE SUGGEST ME.

As the due date for AY 2017-18 is over now, you cannot file ITR for the concerned period.

sir mere koi job nhi h aur mujhe income sirf FD aur saving bank a/c se hote h jo ki sirf 120000 h aur bank n mere FD per 4000 TDS kata tha to maine assesment year 2017-18 m ek sir se itr bharwaya tha unhone itr 4 form bhara tha aur 1000 rs payment li thi. Sir. mai is saal assesment year 2018-19 ka return khud bharna chahta hu aur ITR 1 k thru sirf salary for other sources k thru aur mere koi job nhi h to kya m bhar sakta hu ITR 1 ya mujhe unhe k pass jana hoga.

If you fill ITR on your own by giving all the details then you can do it otherwise take consultancy

YOU TUBE PE VIDEO DEKHJE BHARDO SALARY ME KUCHH NAAHI HOTA

I need to pay tax on short-term capital gains (around Rs. 3000) for FY 2017-18. What is due date (31st March)? Is there any interest for late payment, how much? If possible please quote the relevant Section of Income Tax Act; because I have searched on IT website could not find this information.

You need to check your advance tax liability as per section 208 based on your total income. If advance tax provisions are not applicable in your case, no interest will be levied if payment made till the due date of ITR i.e. 31.07.2018.

SIR CAN I FILE LAST YEAR’S HENCE ASSESSMENT YEAR 2017-18(PERIOD 01/04/2016 TO 31/03/2017) ITR NOW. AND IF YES PL EXPLAIN UNDER WHICH SECTION IT COULD BE FILLED.

As the due date for AY 2017-18 is over, you did not file the return for the concerned FY.

IF THERE IS REFUND, THEN YOU CAN FILE YOUR ITR WITH APPLICATION AS PER CIRCULAR 9/2015 DT 9/06/2015 WITH PRINCIPAL CIT.

Sir,

My trading turnover is 1.5 cr (losses 3.5 lakh)but my total income(salary) is less than 2.5 lakh for the year 17-18 I don’t have any other incomes but have Personal loans and credit card outstanding, Do I need an audit? if require before when I shall submit my returns. I am totally confused.

Thanks

raju

As t/o is more than 1 cr. , so tax audit is mandatory, no matter there is profit or loss. Due date for filing return for entities covered under audit is 30/09/2018.

Sir,

I have started a shop in the month of July-2017. When do I have to file my first IT returns.

I am a government servant, one of my instalment of Rs.13,340/- has been deducted from my monthly salary, one similar instalment is yet to pay which I told that, I will pay it by cash. When do I pay and what is the due date to pay?

Liability to deduct tax lies with the person who pays the amount of income.

Before 31st july

You can file the return on or before 31/07/2018

Sir,

by mistake, I filed my ITR for AY 2016-17 instead of actually filing for AY 2017-18, kindly advice me on how to rectify this issue.

If you have wrongly filed ITR for AY 2016-17 and you have given wrong figures then you can file revised return for AY 2016-17. Then you can file separate ITR for AY 2017-18.

Sir,

I know the last date for filing tax audit report was 7 Nov 2017 for AY 2017-18. But Can I file late tax audit report now in March 2018 for AY 2017-18 with the penalty?

If yes- how much penalty I have to pay and is it possible u/s 139(4)

The penalty for late furnishing of the audit report is .5% of turnover subject to the maximum of Rs.150000. you may file return U/s 234A, B and C as applicable.

HI Saurabh,

I lost my job 2 years back and until then my taxes were paid by my company and I had filed returns for them without fail. BUt From last 2 years as I have no job and income, I did not pay any tax, but now I am getting emails and msgs from IT department saying that I need to file returns for the last years. Is it compulsory to file returns as I did not pay any tax from last 2 years bcoz of no income and also earlier my company used to pay tax on behalf of me. What must I do now?

As per provision of sec.139 of IT act, individuals require to file the return if their total income exceeds basic exemption limit. So, in this case, you need to contact the department.

Thanks a lot for your reply..U said that individuals require to file a return if their income exceeds basic exemption limit where I don’t have any income now. But nominal transactions are happening and they did not exceed 2.5 Lakh. So what must I do? Is it still compulsory to file a return though it did not exceed the limit? I am in dilemma. I shall be very grateful if u can clear this one thing. Thanks a lot.

As your income doesn’t exceed the limit , so you not need to file the return.

Thanks a lot for ur advice and valuable time spent to reply me. Thank u.

One final query…U said no need to file returns if my income is within the given limit. But I am getting emails and msgs to file returns though I did not pay taxes from last 2 years as I have no job, then will I be served notices later by IT department if I don’t file returns. Thanks.

As we said that you are not eligible but you are receiving notices so in this case, you need to contact the department.

Ok …I contacted the department and they said no need to file returns and those emails and msgs are sent for awareness. Thanks a lot for ur replies.

Sir, last date to file individual 44ab

For A.Y. 2017-18, the due date for submitting 3cb-3cd was 07/11/2017.

Sir AY-2017-18 return filing due date extend?

07th Nov 2017 was the last date for audit cases.

Dear sir any postpone the date of income tax filing.

Income tax due date for company assesses and assesses covered under audit has been extended to 7th nov 2017.

I’ve got For AY 2016-17, the end date to file ITR u/s 139(1) is over. Could you just tell the procedure for “Now return u/s 139(4) can be filed”? Thanks in Advance.

You can file the return for AY 2016-17 upto 31 march 2018 under section 139(4).

Is there is any possibility of extending the due date apart from 31st October 2017 for filing the tax audit report for the financial year 2016-17

No update from the department till now regarding extending the due date.

can ITR-1 e-filling can be done now for fy 2016-17, ay 2017-18. Is there any last date as such? Kindly guide me.

The due date for filing ITR’s was 5th Aug 2017 for A.Y. 2017-18. Now you can file a belated return u/s 139(4).

I have filed my return on June 20th, 2017, still, it was showing under process only, waiting for the refund. Could you please let me know any idea when I will receive my Refund amount?

Contact department for assistance.

Is there any chance of further extension of the tax audit due date. at least nov 2017?

No notification till now as such.

Is there any possibility of further extension of the tax audit due date?

No such notification is issued by department yet.

I forgot to file the IT for the financial year 2016-17. Is there any way to file it now? Please advise if there’s any.

yes, you can file the return for F.Y. 2016-17 u/s 139(4).

I have incorporated Pvt. Ltd. Co. in February 2017. The co. did not conduct any operations in Feb, March 2017, two months after incorporation of the pvt. Ltd. Co. Do I have to file ITR, audit and ROC for FY 2016-2017?

I also read at Bankbazaar.com/Tax/section-139-late-filing-it-return.html as given below:

Quote

“If a co. was not operational during the FY, will it still be required to file IT returns?

Ans. – A firm or a company that did not conduct any business or operations during the course of the relevant FY has an option to decide whether it should file its ITR or not”

Unquote

Can this be interpreted that I need not file ITR, Audit and ROC for FY 2016-17 by Sept. 30, 2017? Would it mean, I have to file ITR return, audit and ROC for 2+12 months by sept. 30, 2018?

As per Sec 2(41) of Companies act, 2013, “financial year”, in relation to any company or body corporate, where it has been incorporated on or after the 1st day of January of a year, the period ending on the 31st day of March of the following year, in respect whereof financial statement of the company or body corporate is made up. i.e. as per companies act you can go for audit and ROC filing in next year of incorporation for the full period after incorporation.

But there is no such relaxation under Income Tax Act, as per sec 139, every company need to file ITR. So better to go for ITR and ROC filing in same year of incorporation. For more clarification, you can consult to a practising CA.

Thanks for your reply and clarification. That means I need to file ITR by 30 sept. 2017. However I can file ROC and audit report in Sept. 2018 for 14 months. Trust my understanding is correct.

Sir,

Just for understanding, what is considered as company being operational, is it when it starts generating revenue or when any transaction for the co. (say only expenditure for the company).

Also, assuming that I need to file ITR, though co. was not operational (as it did not generate revenue) and I do not file by sept 30, 2017 but file say by sept. 30, 2018 alongwith ROC and audit, what will be the penalty for filing late ITR?

Will be grateful for your explanation.

As such under act, it is not clarified that which company needs to be considered operational or which one not. In act, it is mentioned that every company registered during FY needs to file ITR. Non-filing of return on time will attract interest on tax u/s 234(A), 234(B), 234(C) and a penalty upto Rs.5000 u/s 271F.

I had incorporated Pvt. Ltd. Co. in Feb. 2017. In the month of Feb and March there are only expenses. Do I need to file ITR, ROC as well as statutory audit? If yes what will be last date for each of these?

Mai apna income tax return from date 01.04.2017 se 31.03.2018 tak ka return nahi bhar paya, plz help me and tell me ye kab tak jama kar sakte hai or last date kya hai taki Mai Bina interest ka tax jama kar saku.plz last date bataye.

Advance tax is payable if the tax liability after TDS is more than Rs. 10000/-. Last date to pay advance tax was 15th March 2018. After that, interest would be applicable.

I have paid the TAX for wrong ASSESSMENT year how should I refund it. I filed the return already in AY 2016-17 but I wrongly filled and paid additional tax for assessment AY 2016-17. How should i refund the amount. Please suggest.

Your excess tax deposited will be reflected in Form 26AS for the AY 2016-17. You can claim refund by filing the rectification return since your return should have been already processed at CPC.

I am unable to submit IT-Returns today i.e., 1st Aug 2017 and getting the below message. Please help.

For AY 2016-17, the end date to file ITR u/s 139(1) is over

for AY 2016-17, last date to file ITR u/s 139(1) is july 2016. now ITR u/s 139(4) can be filed.

You are filing in the wrong Assessment Year… for FINANCIAL YR 2016-17, the Assessment Year is 2017-18

Dear friends, its really a very good place to attain knowledge as CA Saurabh himself updates this blog. Moreover I want to inform you about the latest update i.e. Due date for filing income tax return for the AY 2017-18 is now extended to 5 th of August by Income Tax Dept. This step is taken in view of the difficulties faced by the tax payers.

My wife has few FDs in bank. Interest from FD is being only source of income to her. interest of 1,20,000 is deposited for her in fy 2017-18. my question is that is she exempted from tax up to a limit of 2.5L. In such case where her only income is interest and income is within 2.5 L. she does not fall under tax limit. isn’t it? do i have to file her return.if i don’t file her return…is it anything wrong?????

if TDS is deducted on any income and you want to claim an income tax refund then it is mandatory to file income tax return regardless of the quantum of income.

hello, i have a query.i am a housewife and my income does not exceed above Rs 250000/- for ay 2017-18.is it compulsory for me to file return.i have couple of FD’s also but the fd interest does not exceed rs 250000/- please let me know.regards

If tds is deducted on any income and you want to claim an income tax refund then it is mandatory to file income tax return.

Hi,

I have some FD interest income for FY 2016-17.

As part of TDS, 10% of income tax has been already deducted by respective bank which is present in 26AS.

Remaining 20% I have paid using Challan 280 .

I want to clarify, whether there will be implication of interest as below, if I file my returns by July 31st 2017.

For default in payment of advance tax (section 234B)

For deferment of advance tax (section 234C)

Thanks in advance.

Even I see the error “For AY 2016-17, the end date to file ITR u/s 139(1) is over”

For AY 2016-17, due date for filing return u/s 139(1) is 31st July 2016. so the error is correct. Now return u/s 139(4) can be filed

Today is 19th July and I am filing my tax returns. I see deadline is 31st July however I am getting the message – “For AY 2016-17, the end date to file ITR u/s 139(1) is over”. I see others have also faced similar issue. Any solution?

Pls update when we file return for refund claim against A Y 17-18.

I’m trying to file an online return myself with ITR 4S. It is giving an error – “For AY 2016-17, the end date to file ITR u/s 139(1) is over”. From your post I assume the end date should be 31st July, and it is only 14th July today.

Has there been a change in the end date? Or, is it because of some other error?

Please help

i have linked my aadhar and pan card also.

Am i missing something ??

I’m trying to file an online return myself with ITR 4S. It is giving an error – “For AY 2016-17, the end date to file ITR u/s 139(1) is over”. From your post I assume the end date should be 31st July, and it is only 12th July today.

Has there been a change in the end date? Or, is it because of some other error?

Please help

Return for the A.Y. 2016-17 cannot be filed u/s 139(1) after 31st July 2016. belated return u/s 139(4) can be filed.

Did you find an answer?

Bro I guess you should file ITR for AY 2017-18 which people are filing nowadays.

what return filled under section assessment year 2016-2017 what section for refund in in come tax return pl confirm

Section 139 for Return filling, Section 234D for Interest on Refund. No section of Refund.

Hi

I am poojitha and completed my CA and actually i filed the returns for the AY 2017-18 on may 29th but till i have not received any status about refund but last year we received with in a week only.can u say how much it will take to get refund this year.

Your return will processed. It will take some time as in June and July many return are filled.

what is the return filling due date for HUF who is partner in firm and firm under tax audit

Due date is 30th September

i have a need of form 16 for home loan transfer,

my company C A is saying that income tax submission date is increse from 15 may to 15 june, after that they will issue me form 16 is it right information???

pl give me information

April 16 and May 16 how can submit return