In the fast-paced environment of GST compliance businesses are mandated a streamlined system for handling their outward supplies efficiently. An effective Inventory Management System (IMS) has been proposed by Gen GST software developed by SAG Infotech which eases the tracking of outward supplies, managing invoices, and ensuring seamless GST compliance.

What is an Outward Supply under GST?

Outward supply is directed to the sale of goods and services via a business. It comprises taxable supplies, exempt supplies, exports, and inter-state or intra-state supplies. To ensure accurate GST filing and compliance with government regulations, it is important to have the proper management of outward supplies.

For businesses under the GST regime Managing outward supplies efficiently is significant. With robust IMS (Inventory Management System) Outward Supply Features Gen GST Software facilitates this process. Such features assist businesses track sales, manage invoices, and ensure compliance with GST regulations seamlessly.

IMS Outward Supply Features in Gen GST Software

- Multi-User & Multi-Location Access:

- Businesses functioning in multiple locations can handle their outward supplies seamlessly.

- Role-based access to ensure data security and prevent unauthorized modifications.

- Advanced Reporting & Data Analytics

- Generate detailed outward supply reports for precise decision-making.

- Examine sales trends and GST liabilities in a structured format.

- Export reports in Excel, PDF, or other formats for effortless record-keeping.

- Easier GST Return Filing

- Directly link outward supply data with GST returns (GSTR-1, GSTR-3B, etc.).

- Prevent mismatches and errors in tax filings with automated reconciliation.

- Faster and error-free return submission with integrated GSTN validation.

What is the reason to opt for the Gen GST Software for Outward Supply Management?

- User-Friendly Interface: Easy handling of the dashboard for quick navigation.

- 100% GST Compliance: Ensures precise tax calculations and filings.

- Cloud & Offline Availability: Access software online or work offline as required.

- Secure & Reliable: Multi-layer security to safeguard your financial data.

- Regular Updates: Stay compliant with the updated GST norms and government amendments.

Steps to Use IMS Outward Supply in Gen GST Software

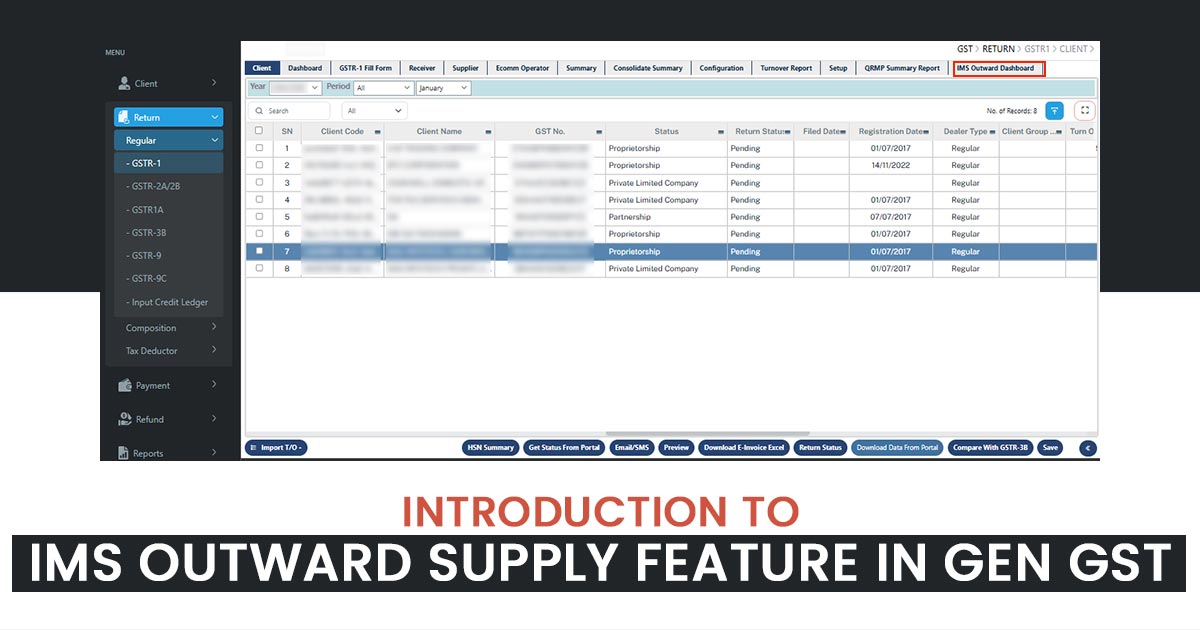

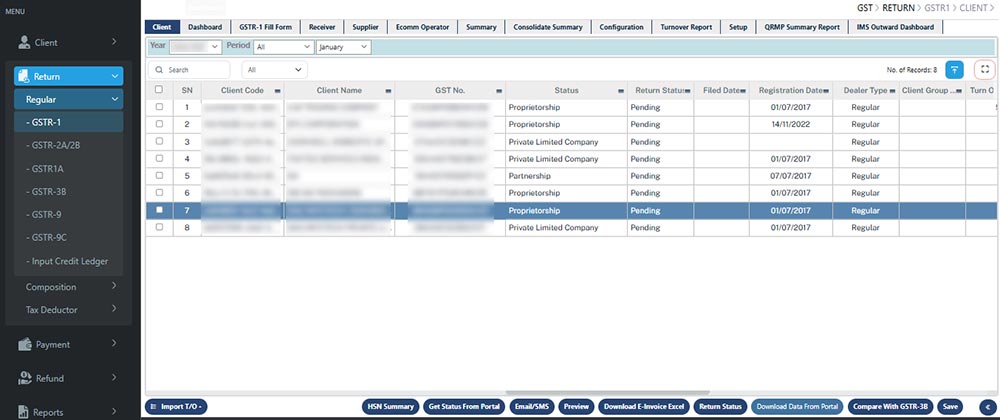

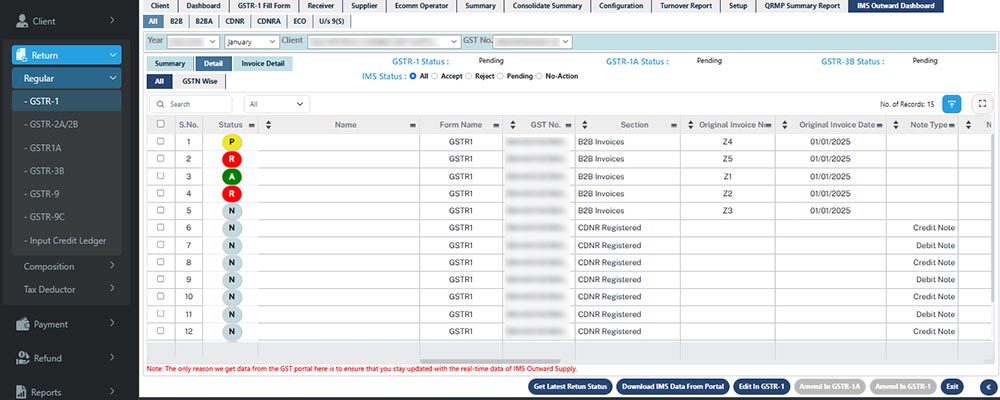

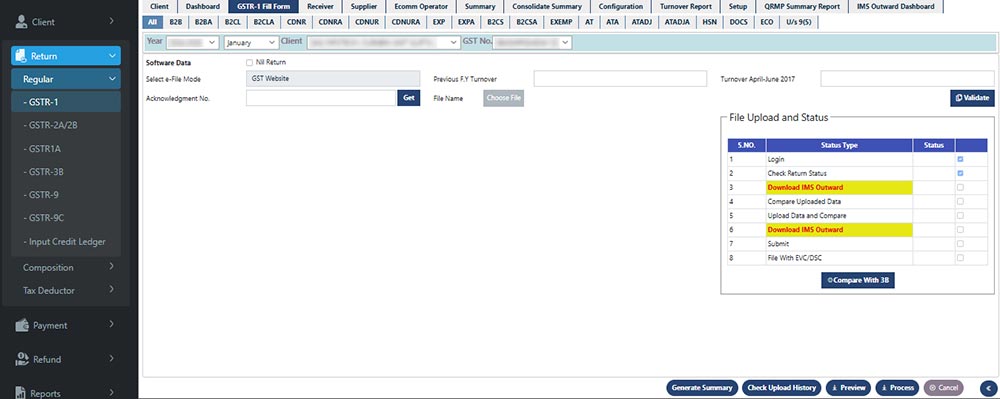

Step 1: To use this, Kindly select client first, Then Goto Return -> Regular -> GSTR-1 -> IMS (Invoice Management System) Outward Dashboard

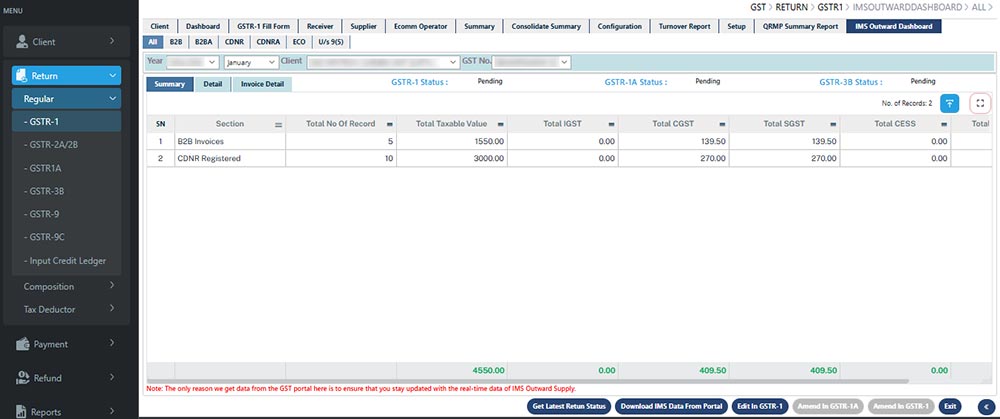

Step 2: Once you click on this dashboard button, the software will automatically download the data from the portal. Here, you can see that the data download process has been completed, and your B2B invoices CDNR data is reflected in this section.

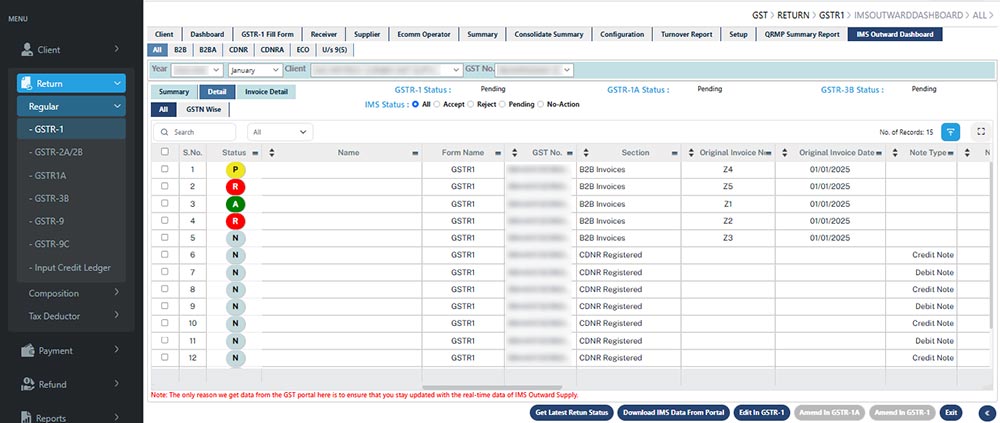

Step 3: There is a details section where you can check all the invoices reflected with their respective status whether the status is accepted, rejected, pending or no action

Step 4: You can view the status of all invoices. If you want to download the latest return status, there is a ‘Get Latest Return Status’ option available, from which you can download the GSTR-1/1A/3B latest return filing status. If you wish to download the latest data from the portal, the option is available in the footer.

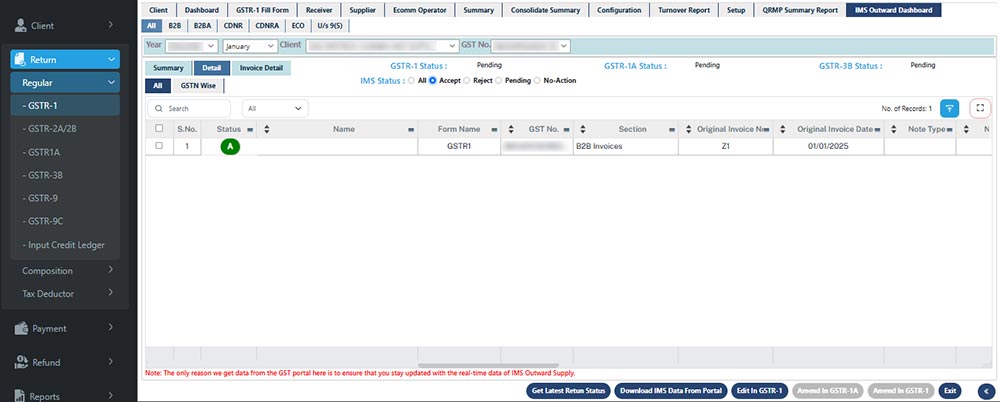

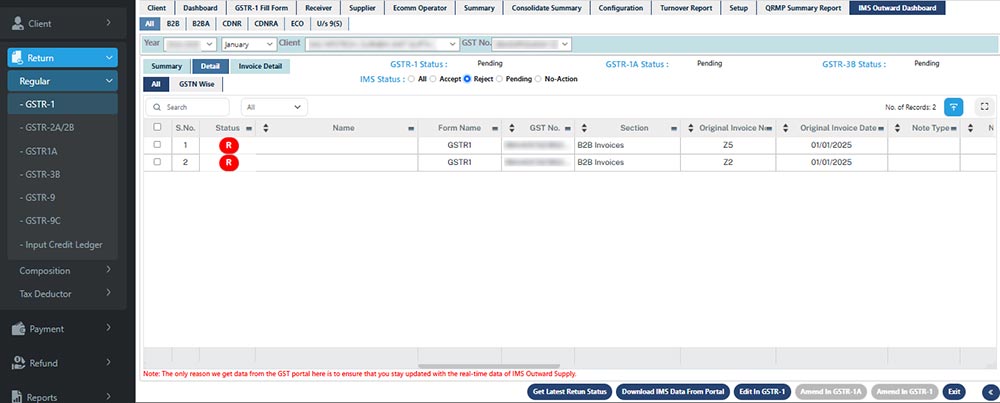

Step 5: If you want to see only the accepted invoices just simply click on accept option. In the rejected section, you can see your rejected invoices

Step 6: If you want to modify rejected or pending invoices based on the details, simply select the ‘Edit’ option in GSTR-1, ‘Amend’ in GSTR-1A, or ‘Amend’ in GSTR-3B. If your GSTR-1 status is pending, click on ‘Edit’ in GSTR-1. If your GSTR-1 status is filed, click on ‘Amend’ in GSTR-1A. If your GSTR-1 and GSTR-1A statuses are filed, or if your GSTR-1 and GSTR-3B statuses are filed, then click on ‘Amend’ in GSTR-1

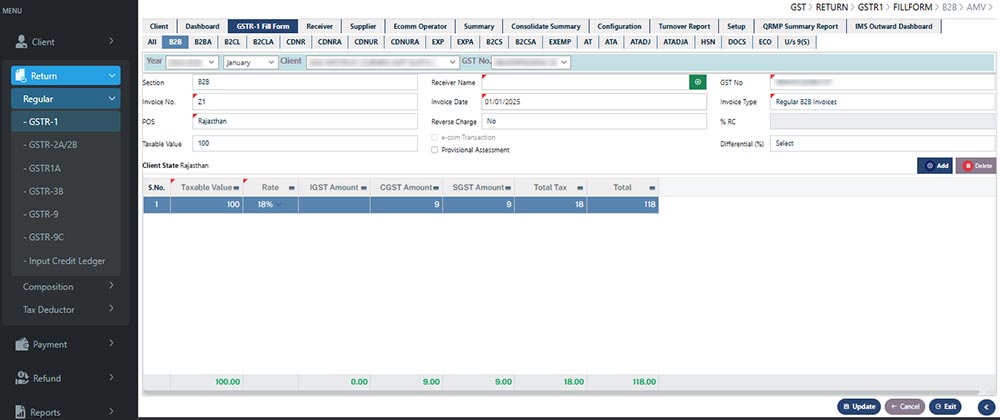

Step 7: Currently, the GSTR-1 status is pending, so you need to click on ‘Edit’ in GSTR-1. Simply click on ‘Edit’ in GSTR-1, and this invoice will be forwarded to the GSTR-1 data. You can then modify this invoice in the GSTR-1 table and upload the updated version to the GSTR portal.

Step 8: In the ‘Return Submit’ option in GSTR-1/1A, there is also an option to download the IMS Outward Supply data both before and after uploading the GSTR-1/1A data. This allows you to check and update the latest IMS Outward Supply data. This way, you can review the IMS Outward Supply status before filing GSTR-1 or GSTR-1A, ensuring that no rejected invoices are included in the GSTR filing.

Businesses with the Gen GST software could handle their outward supplies while ensuring complete GST compliance. Use the same efficient tool to save time, and manual errors and ease your whole invoicing and tax filing process.