Simple Definition of a Trial Balance

A ledger is created when many entries are made in different accounts. A trial balance is the presentation of all the ledger balances on a particular date in a single worksheet. It can be understood by the following:

- System of Dual Entry – The recording of two consecutive, equal, and opposite entries for one transaction

- Register – An overview of all diaries of an equal disposition.

- Journal – Keeping track of all transactions using the double-entry method of bookkeeping.

Different Benefits of the Trial Balance

- Accuracy in arithmetic

- Summary of all ledgers and balances

- Financial statement preparation prerequisite

Need for Gen Bal Software to Import Trial Balance File

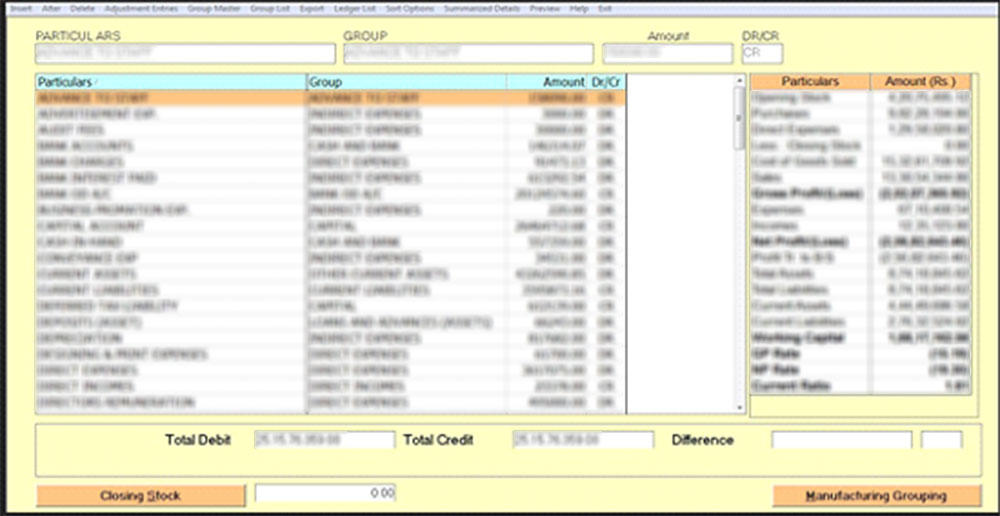

The Gen Balance Sheet Software is a popular choice for Chartered Accountants. By using the software, you can quickly prepare balance sheets by automatically calculating profits and losses. Third-party accounting software such as Busy and Tally can import trial balances directly.

Additionally, users can upload 3CA or 3CB files directly online after filing them within the software. Depreciation can be calculated, and audit forms can be prepared using the software.

In addition to updating tax audit reports, this software offers the option of changing the format of the items in the Account Notes and preparing audit reports of all kinds. Drawing trading accounts in columnar format with quantitative details, formulating ratios, merging trial balances and calculating deferred tax liabilities.

Procedure to Import Trial Balance File Using Gen Bal

Step 1:- First, install Gen Balance Sheet Tax Audit Software on your laptop and pc.

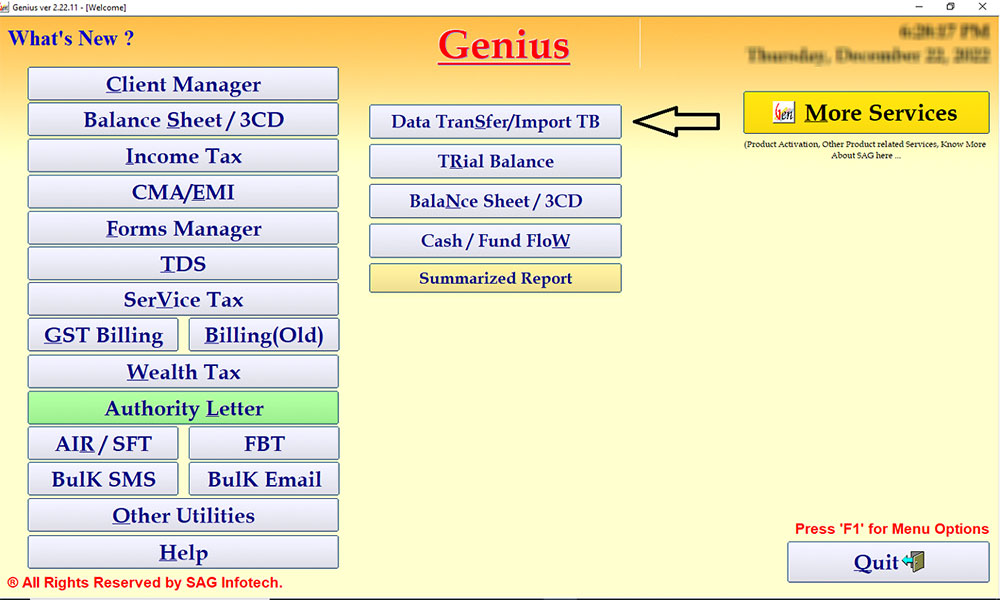

Step 2:- After opening the software, go to Balance Sheet/3CD Option and then click on Data Transfer/Import TB Option.

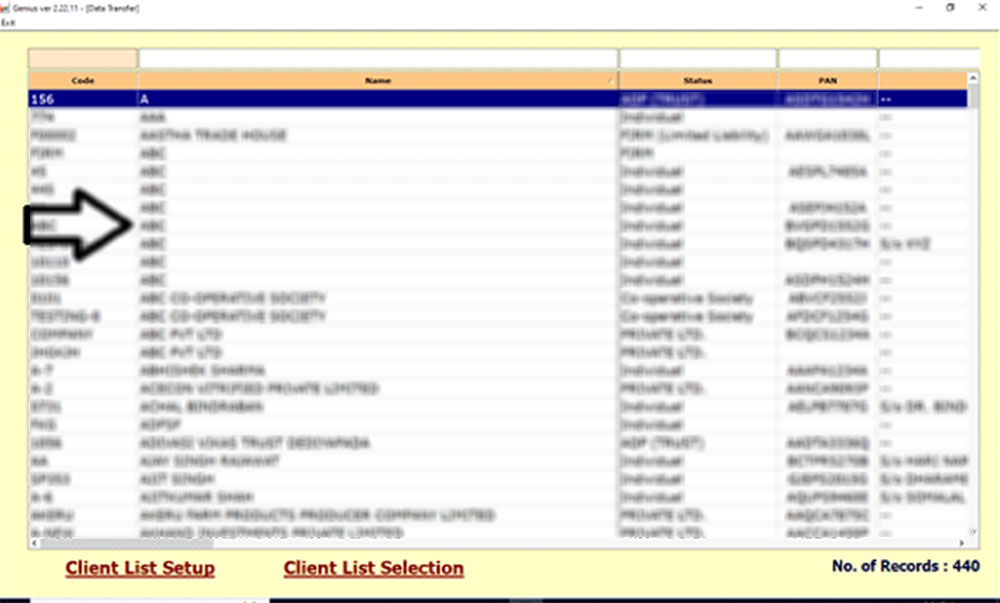

Step 3:- Now select the client for which you want to import the Trial Balance.

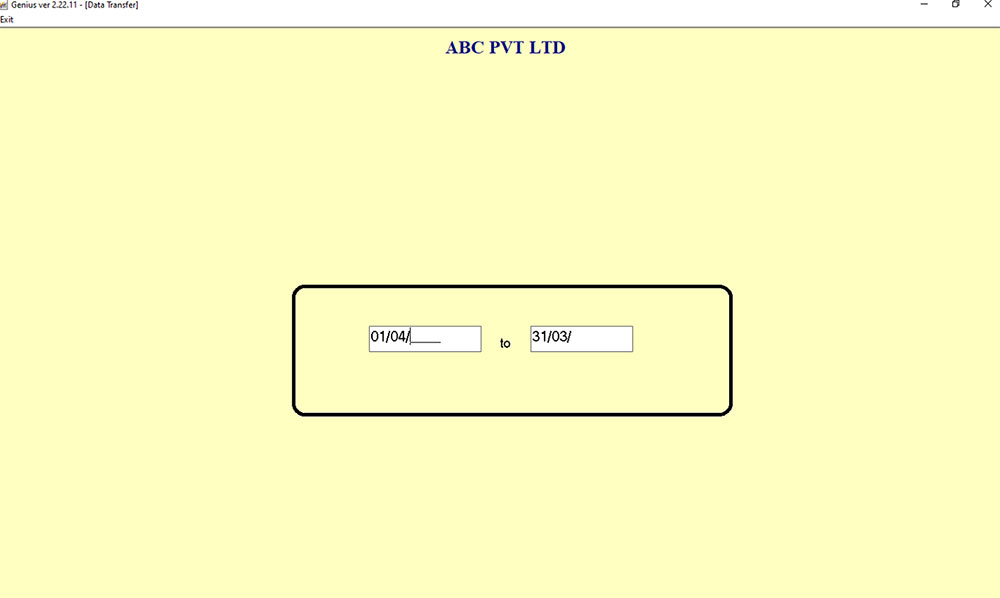

Step 4:- After that, enter the Year for which you want to import the Trial Balance.

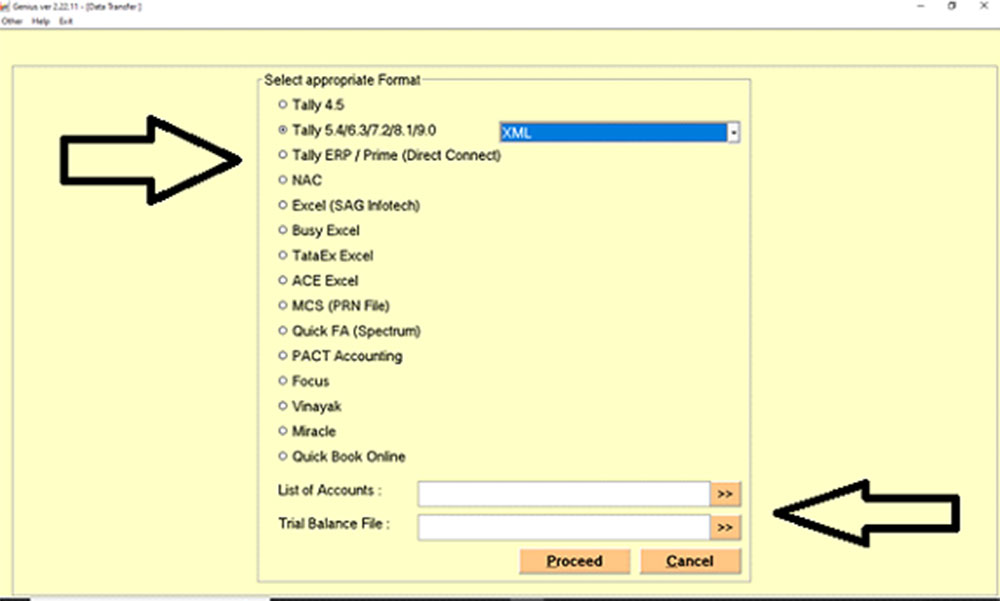

Step 5:- Select the options through which you want to import the Trial Balance, and if you want to import the same through the Tally 9 XML Option, do the same by attaching the List of Accounts and Trial Balance File downloaded from Tally ERP 9.

Step 6:- After this, your Trial Balance will get imported and prepared.

How to export from busy and import in genius

In Genius, go to the Balance Sheet (3CD) section. Click on ‘Help,’ then select ‘Final Account and Data Transfer.’ There, you’ll find instructions on how to export data from Busy and import it into Genius.