Easy to Understand Balance Sheet

Balance sheets are financial statements that show liabilities, assets, etc. at a particular point in time. Investors evaluate a company’s capital structure and compute returns based on the balance sheet.

As a financial statement, a balance sheet shows what a company owns and owes, as well as the amount shareholders have invested. A balance sheet can be used to calculate financial ratios or conduct fundamental analysis.

Purpose of a Balance Sheet

A balance sheet provides investors, executives, analysts, and regulators with an overview of the company’s financial health. Financial statements such as this are generally used alongside income statements and cash flow statements.

A balance sheet provides a quick overview of a company’s assets and liabilities. In addition to showing the company’s net worth and cash balances, It can also indicate whether the company is highly indebted compared with its competitors.

How is a Balance Sheet Prepared?

Balance sheets may be prepared by different parties depending on the particular company. An owner or company bookkeeper may prepare the balance sheet for a small privately held business. An external accountant might review them after they are prepared within mid-sized private firms.

Companies that are publicly traded must hire public accountants for external audits, and their books must also be maintained to a largely higher standard. It is mandatory for these companies to prepare and file their balance sheets and other financial statements in accordance with Generally Accepted Accounting Principles (GAAP) with the Securities and Exchange Commission (SEC).

Why Genius Tax Software is So Popular Among Tax Professionals?

For tax professionals, SAG Infotech’s Genius is the most well-known return software in India. A complete income tax and TDS filing package are provided by the software for chartered accountants and people who are working in the accounting field. The software has several important features, including unlimited filings of income tax returns, AIR/SFT, TDS, Balance Sheets, Profit and Loss Statements, and a fully updated taxation process.

Different Features of Genius Software

- Software Allows You to Upload Quick ITR

- Quickly Generating XML and JSON Files

- Options for E-Paying Challans

- TDS Return Filing Facility

- Data Import Options for AIS, TIS, and 26AS

- Interest Calculation & I-T Computation

- New PAN Card Correction and Application

Step-by-Step Guide to Prepare Balance Sheet Using Genius Tax Software

Step 1:- First, install the Genius Tax Return Filing Software on your Desktop and PC.

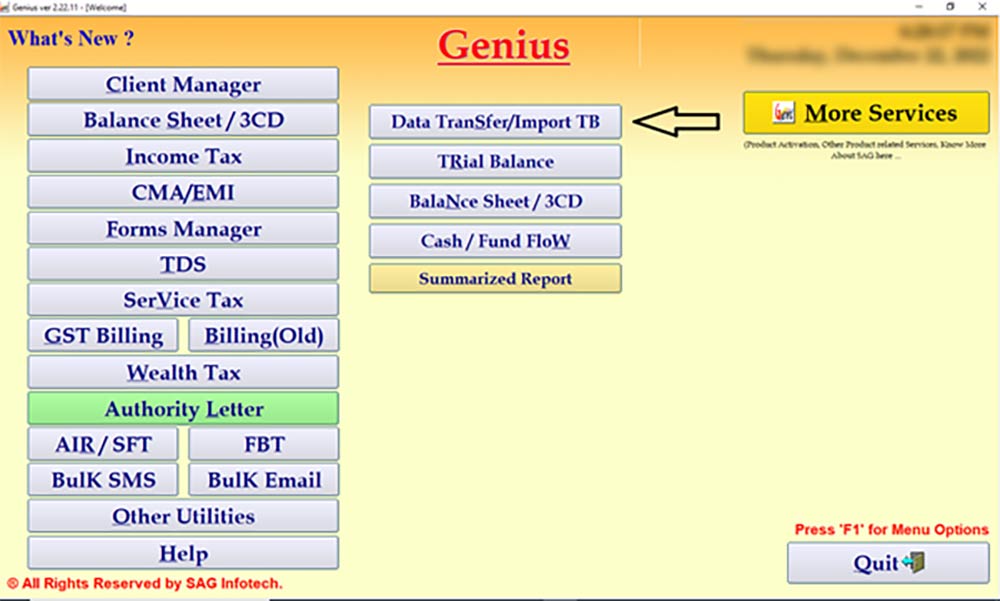

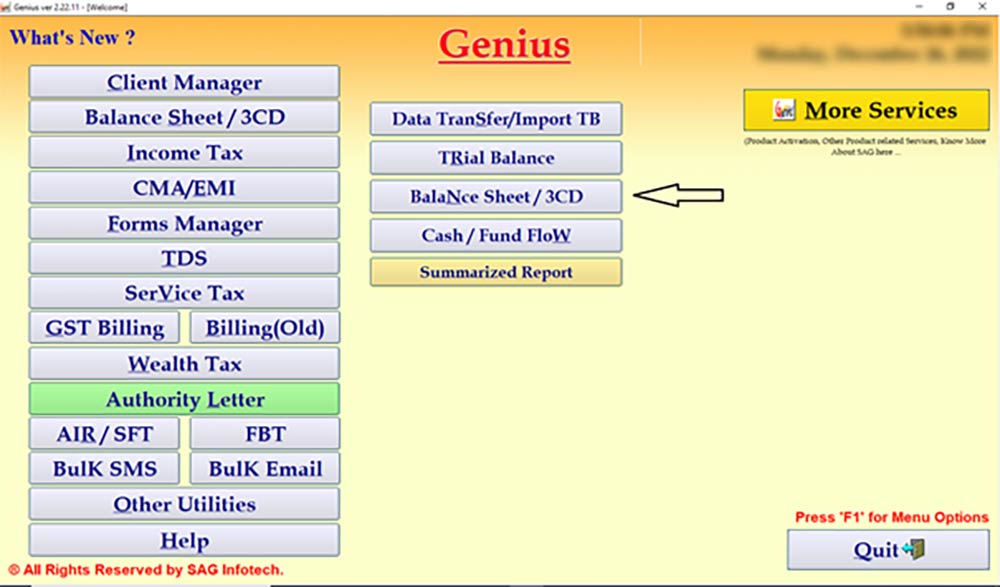

Step 2:- Run the software Go to the ‘Balance Sheet/3CD’ option and then click on the ‘Data Transfer/Import TB’ option.

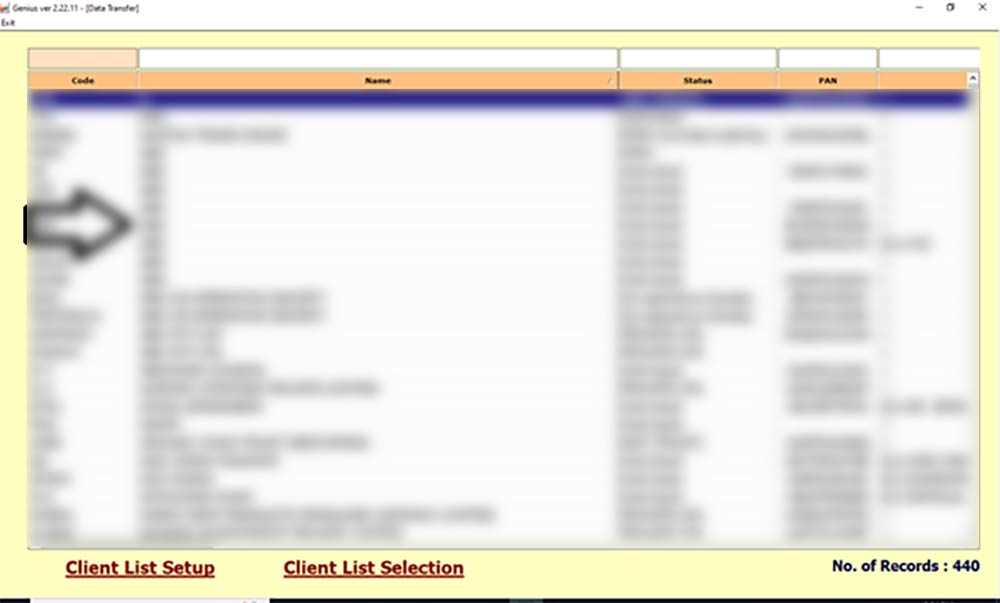

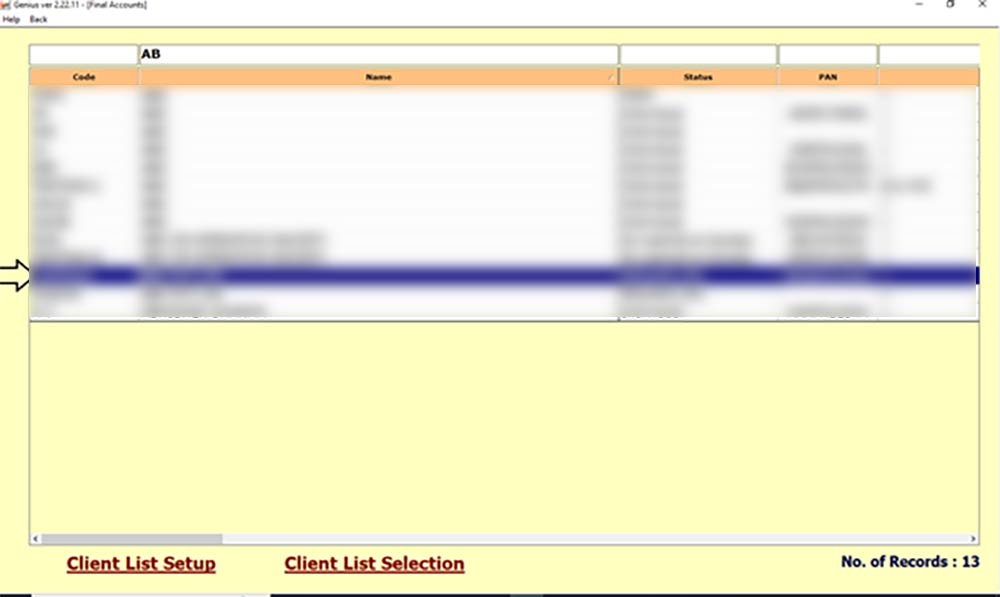

Step 3:- Select the client for which you want to import the Trial Balance.

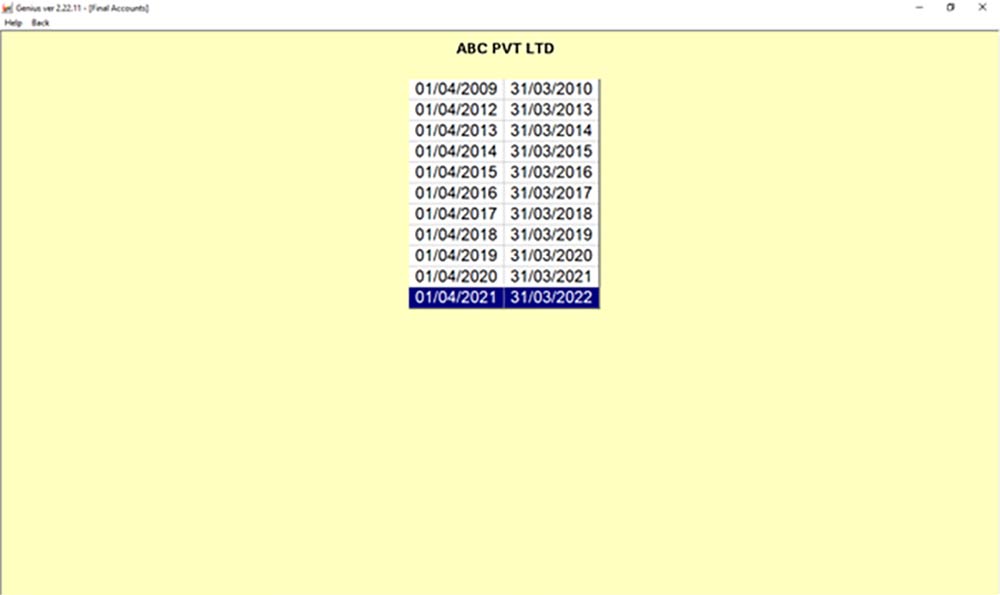

Step 4:- Enter the year for which you want to import the Trial Balance.

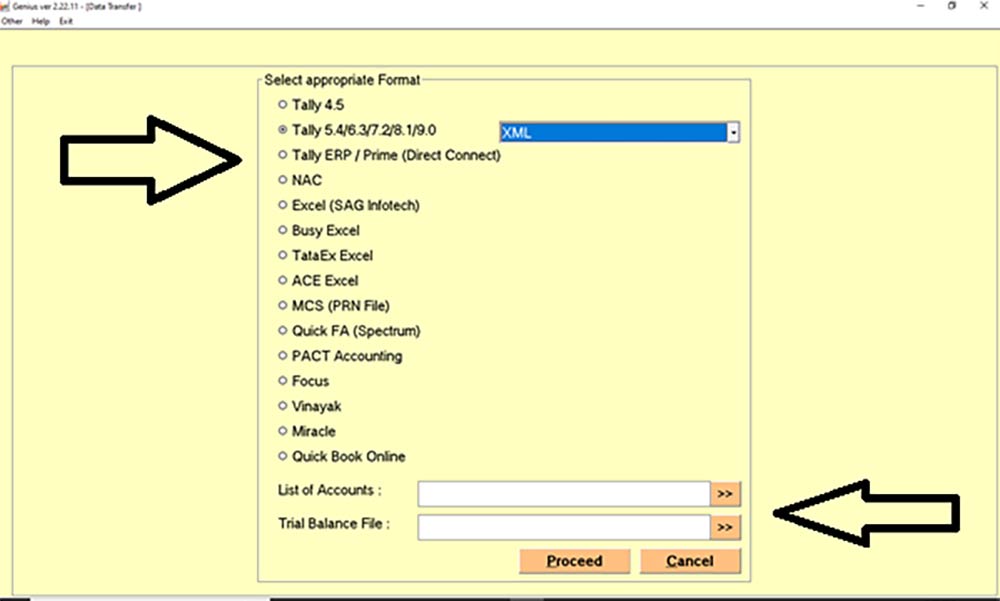

Step 5:- Select the options through which you want to import the Trial Balance and if you want to import the same through the Tally 9 XML Option can do the same by attaching a List of Accounts and Trial Balance File downloaded from Tally ERP 9.

Step 6:- After this Trial Balance will be imported and prepared.

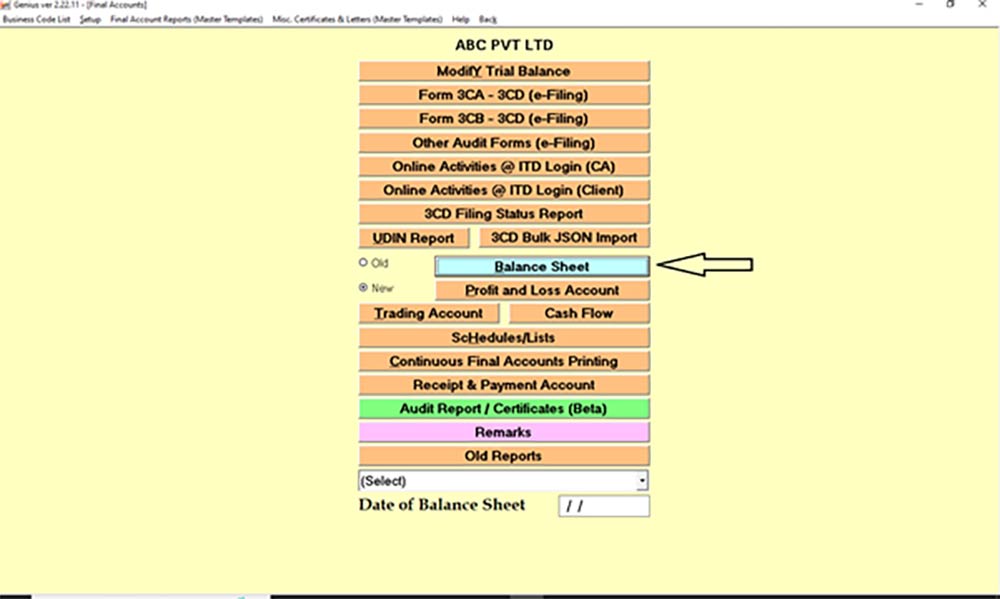

Step 7:- After Importing the Trial Balance Go to ‘Income Tax’ and then ‘Balance Sheet/3CD’.

Step 8:- Select the Client for which you want to prepare the Balance Sheet.

Step 9:- Select the Year for which you want to prepare the Balance Sheet.

Step 10:- Click on the Balance Sheet Tab.

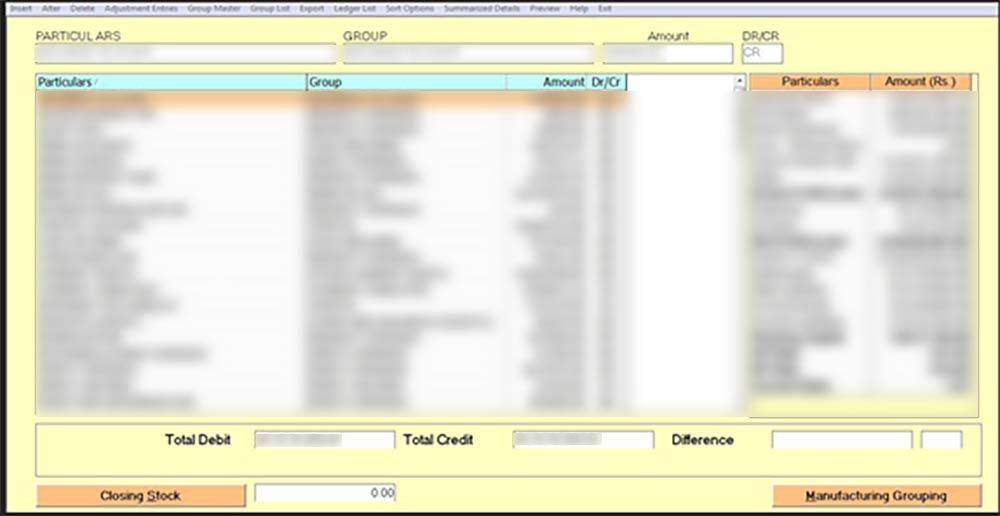

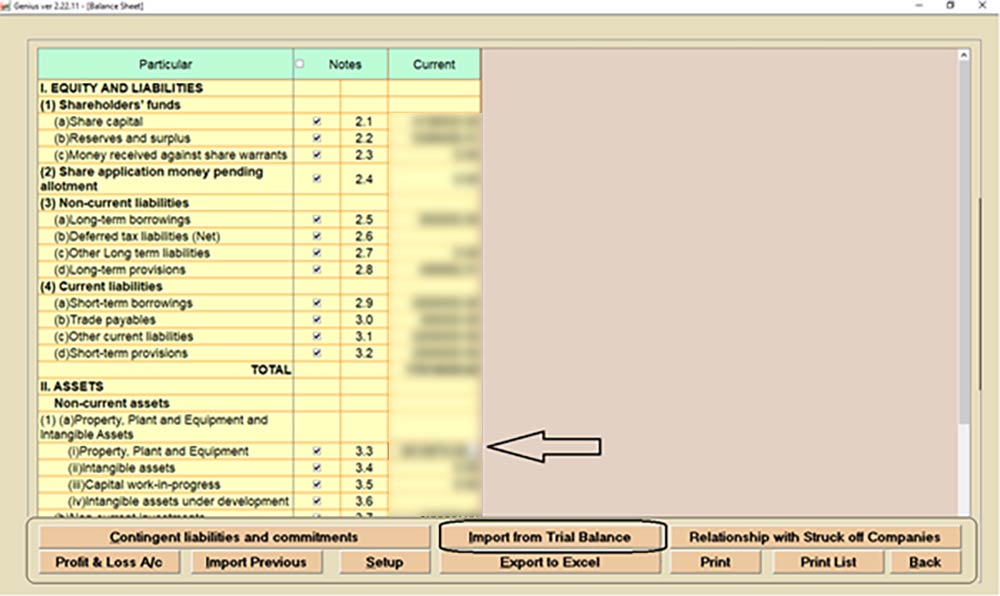

Step 11:- If you want to prepare it manually then you can do so by going through three dots but if you want to import the figures through Trial Balance can do it from Import from Trial Balance.

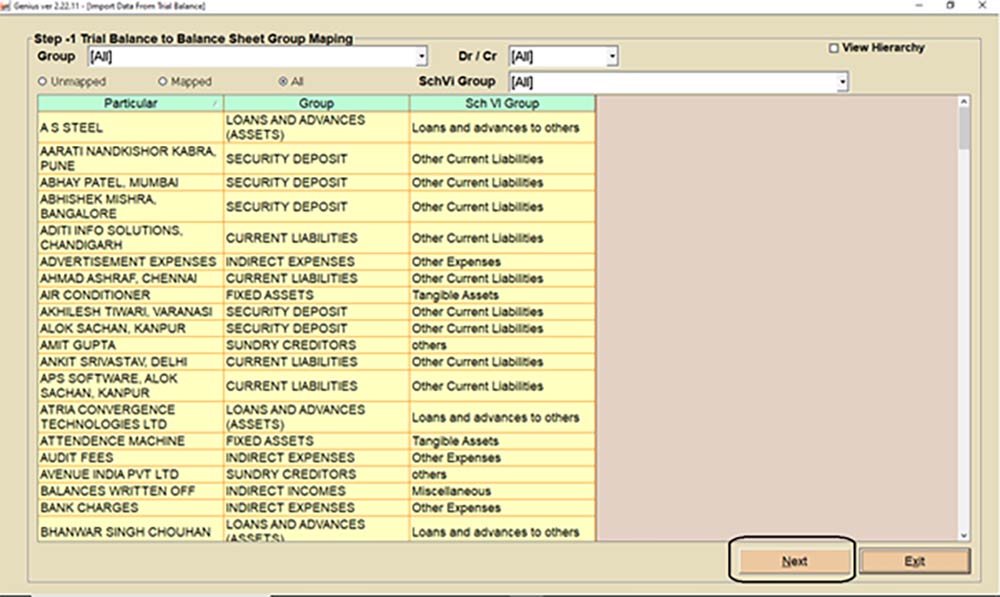

Step 12:- Click on the Next Button

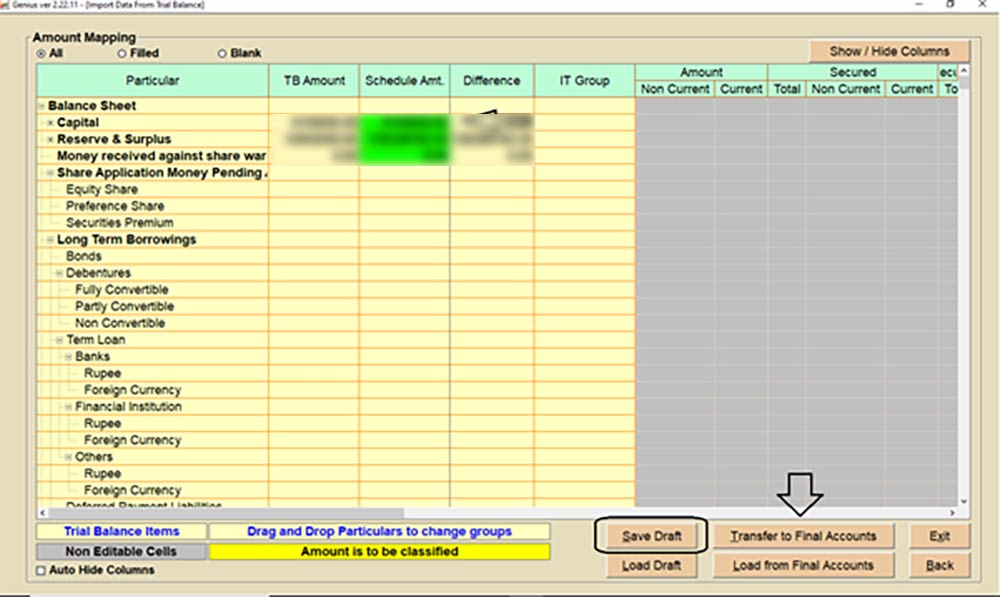

Step 13:- In the Green tabs you have to fill in the Schedules and in the Yellow fields you have to bifurcate the amount. After that Save the Draft and Transfer it to the Final Accounts.

Step 14:- After that the Balance Sheet will get prepared.

short term borrowing ke amount change karna hai long term borrowing kesha change kare

Can we prepared consolidated balance sheet and pnl ,if any opting then let me know