GST is a new taxation structure which is almost ready to apply all over the nation but not only a professional but as well as businessmen and small traders are also confused regarding the calculation of GST tax. There are lots of issues that are related to GST so before the discussion related to tax calculation on GST, We must understand the term and how the GST calculator works in the calculation of Tax.

Opting for manual GST calculations in your business operations can be prone to errors. To circumvent such pitfalls, leveraging a GST calculator emerges as a prudent choice, streamlining the calculation process.

This blog post will delve into common pitfalls encountered during GST return submissions and elucidate the role of the GST Calculator in assisting businesses in sidestepping these routine mistakes.

What the Term GST Calculator Signifies?

The GST Calculator presents a user-friendly interface, simplifying the process of determining the GST amount due for a specific month or quarter based on the transaction total. This tool finds widespread utility among various professionals, including wholesalers and manufacturers. Here are its primary features:

- The GST Calculator is a valuable tool for businesses and individuals, enabling them to compute the GST for their transactions.

- Utilizing the GST calculator requires inputting transaction particulars, including the value of goods or services, the relevant GST rate, and any additional costs such as freight or insurance.

- Once all the data is provided, the GST calculator will swiftly and accurately determine the GST amount and the total transaction value.

- This tool serves as a reliable means for precise and expeditious GST computation while minimizing the likelihood of calculation errors. Consequently, it plays a crucial role in preventing penalties and legal complications.

What is the Method to Compute the Tax Via A GST Calculator?

For those seeking simplified GST calculations, numerous online websites offer a convenient solution. These websites provide access to GST calculators that can be utilized on any computer. These calculators are equipped with intelligent formulas designed to compute various aspects of GST, including the GST amount, net price, CGST, SGST/UTGST, and more.

Process for Using the GST Calculator to Compute the GST Online

- Through the GST calculator search for a website.

- As per your requirements, choose either the GST-contained or GST-exclusive option.

- The quantity of the purchased item should be added.

- After that, determine which GST rate is suitable for the products you sell.

- Once you tap calculate, you’ll see the total.

Advantages of Using the GST Calculator

- GST calculator diminishes the possibility of calculation errors.

- It keeps time and resources.

- Computing gross or net product pricing is helpful based on percentage GST rates.

- A GST calculator simplifies the computation of Integrated Goods and Services Tax (IGST).

- Businesses can prevent any tax penalty with a GST calculator.

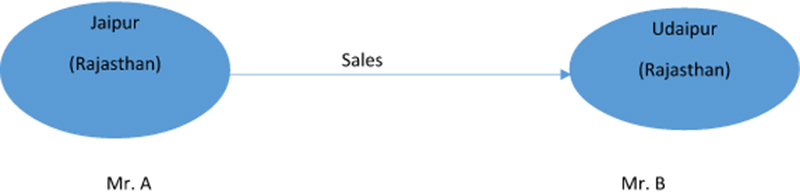

Central Goods and Service Tax (CGST): In the case of intra-state transactions, a portion of the tax rate or tax amount will go to the central government directly.

States Goods and Service Tax (SGST): In the case of intra-state transactions, a portion of the tax rate and tax amount will go to the state government directly.

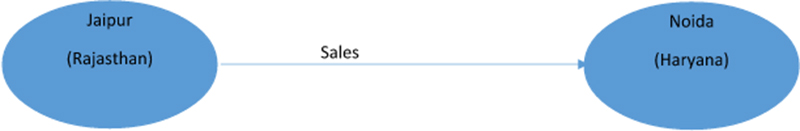

Integrated Goods and Services Tax (IGST): In the case of interstate transactions, the tax amount will go to the Central government and after that, the appropriate tax amount will be transferred by the Central Government to the State government.

Now, Let’s See How to Calculate Tax in the Preview of GST:

In Case of Intrastate Transaction:

- Taxable Sales Value 1000/-

- Tax Rate@ 5% 50/-

- Total Sales 1050/-

Bifurcation of Tax Amount is:

- SGST 25/-

- CGST 25/-

In the Case of Interstate Transactions:

- Taxable Sales Value 1000/-

- Tax Rate@5% 50/-

- Total Sales 1050/-

Bifurcation of Tax amount is:

- IGST 50/-

Now a new question is generated how to make a set-off after the payment of the tax?

The news is spread all over GST India that it will decrease the tax liability and inflation will be decreased once the GST becomes applicable. But the question is, how this will be possible? So here is the answer to this question:

Following taxes will be set off with the same or with different tax input credits:

| CGST | CGST and IGST |

| SGST | SGST and IGST |

| IGST | IGST , CGST and SGST |

Common Errors at the Time of GST Return Filing

- Inaccurate reporting of sales and purchases may result in tax calculation errors.

- Precision is imperative when claiming input tax credits, as incorrect claims can lead to severe repercussions.

- Failure to uphold proper tax invoices and documentation can trigger compliance complications.

- Overlooking GST return deadlines can incur penalties and interest charges.

- Neglecting data reconciliation and discrepancy resolution may invite penalties.

- Choosing an incorrect GST category can complicate the return filing process.

- Mixing up zero-rated and nil-rated supplies can introduce errors in export-related transactions.

What Are the Key Points to Prevent the Common Mistakes?

- Maintain proper records for rectifying the sales and purchases.

- Verify if the ITC claims match with the data of the supplier for the precise filing.

- File the GST returns within time and file the taxes so as to prevent penalties.

- Validate the preciseness of the tax invoices and the needed documents.

- Cross-verify the GSTR-2A against the purchase records so as to settle any issues.

- Consult with experts or professionals to ensure GST compliance.

- Conduct routine audits to find and correct problems prior to submitting returns

- Utilise technology to streamline the filing of GST returns and minimize errors.

- For complicated GST provisions, approach the GST helpdesk

I was registered as a service provider in gst, if i apply a pan card for customer on UTi official portal and uti charged rs. 110/- ,uti returned me rs. 10/-as my commission, I am collect rs. 200/- from customer. What is my GST Tax ? What is procedure?

Does Service, meaning Maintenance of Toilets built in Swacch Bharat attract GST? If so how much?

The GST rates have been fixed for each item in the HSN code and SAC lists.How are the CGST and SGST rates derived from these rates?Is it 50% of the GST rates for CGST and SGST ? Pease let me know where I can more information on these CGST/SGST rates.

Read Here: http://blog.saginfotech.com/meaning-of-sgst-igst-cgst

HI,

I am based in New Delhi and in service industry. My turnover is below threshold limit. My clienteles are from all over India. I render my services for them In Delhi but bill to them to their states. Also I have few international clients.

Now do I need to have GST as turnover is low ?

thanks,

Registration is compulsory if you are providing Inter State services.

My doubt is: How to divide the GST between CGST and IGST or CGST and SGST. What is ratio?

Is it compulsory to divide the GST that means whether all the products are subject to CGST? Is there any body have answer to my doubt?

Hi shiksha tiwari

This is lavan kumar,V I Done M.B.A (finance) From Kakatiya Univercity I have 5years exp in Sr.Accounts Executive and I want GST material briefly can you provide the GST notes.

Download GST Helpline mobile app for more details: https://play.google.com/store/apps/details?id=com.gsthelpline&hl=en

HI,

Now the calculator works fine.

Kindly inform the relevant section / rule of the CGST Act 2017 for the equal share of GST rate in the case of intra state transactions.

Regards,

Nagarajan v

Hi,

Your GST calculator on Mobile application is not showing the correct result for intra state transactions.

Have you updated the same ?

Regards,

Nagarajan v

Accounts Manager

We update it.

Yes Sir,

I have updated the same.

Kindly clarify the basis on which the GST rate is equally shared by the Central and State Govt in the case of intra state transactions.

Regards,

Nagarajan v

We updated it.

Dear,

confusion under GST law – where to consider additional heads…..

1) TAX percentage depends on commodity type – understood.

2) TAX percentage on additional heads where base to calculate is the total of taxable value of commodity. i.e. Additional heads are like – freight, surcharge, insurance, p&f, …..

there is no explanation on sr. no. 2 – silent. this stops us to make business process for purchase, sales.

your help is requested and awaiting your positive reply.

even you can send “DOMESTIC PURCHASE” template with some figures filled in as example for intra-state & inter-state purchases which includes commodity items and additional items.

Thanks & Regards,

Vijay G Prabhu

+91 9909997748

As per the current understanding tax rate on the freight and surcharges, insurance etc. will be the maximum rate of tax which is mention in invoice.

Hi Shikha

I am ADV. Ravi Shankar Dubey. I want to know about the full proforma about GST regarding Uttar Pradesh. Can you provide me. i am new lawyer to deal in taxation. thank you

Hi Shikha,

I am looking for clarification on the below scenario.however not getting proper response on this.

Could you please help!

Incase of customers bill to and ship to is in different state.how GST calculation happens.

A (UP) sold goods to Customer B(Gujarat) but deliveried to Location which is in Bihar.

So could you please explain how B will record this transaction for GST Purpose.

Thanks

arun

B will record the transaction as purchase from UP (A) on which he has to pay IGST charged by A & entitled to get ITC credit & the same is sold (assumed , if Bihar is not place of business of B) to customer at Bihar on which B has to pay IGST

Somnath Ray

Kolkata

what is the different between Non Taxable Turnover, Exempted Turnover and Zero rated turnover as per Model GST Law.

A Mumbai (Maharashtra) based registered trader doing his business with in the state by applying VAT on local Sales and CST on interstate sales transaction.

After implementation of GST..

Can he do his business across the country with single GSTIN registration with Maharashtra state or he required to take registration with each states where he want to sold the goods from Maharashtra state. please clarify.

If you register in Maharashtra then only one GSTIN is required.