The patient work and perfect strategy have reaped goodies for the GST Council as, after continuous downfall in the Revenue collection, January 2019 has come up with Good news for the Council. Despite the tax deduction implementation on 17 items and six services, the council managed a heavy GST revenue collection of Rs 1 lakh crore.

It has been for the second time when the Collection has crossed Rs 1 lakh Crore mark. As compared to that of December’s Rs 94,726 crore, there is a splendid hike in the collections apart from all the tax reductions. This greatly reveals the perfect planning and implementation of the strategy which is adorable!

The information regarding the current collection has been given by the Finance Minister through a tweet.

“This increase has been achieved despite various Tax Relief measures implemented by the GST Council to lower the tax burden on the consumers.” said the finance ministry.

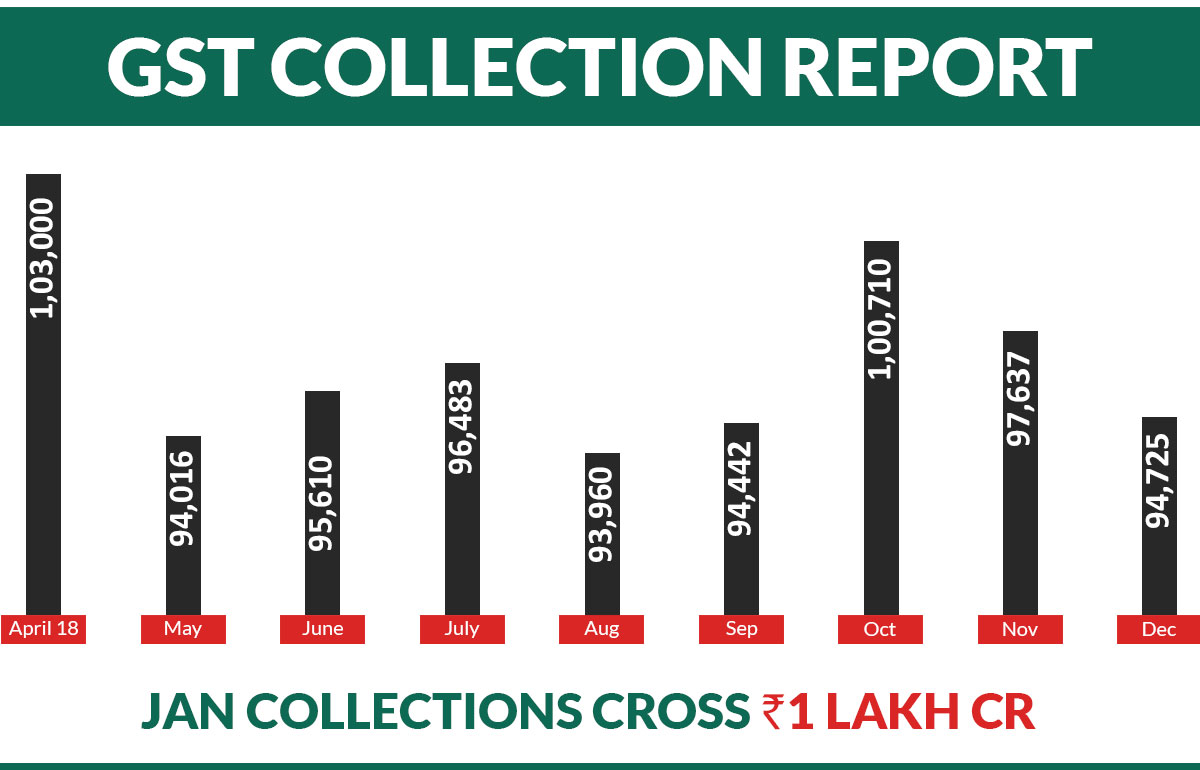

The sudden jump in GST revenue collection is a significant improvement. Looking at the previous year data we find that it is the second time when the collection has crossed Rs 1 lakh crore mark in this fiscal. Collections were like Rs 1.03 lakh crore in April, Rs 94,016 crore in May, Rs 95,610 crore in June, Rs 96,483 crore in July, Rs 93,960 crore in August, Rs 94,442 crore in September, Rs 1,00,710 crore in October and Rs 97,637 crore in November. So, the above-mentioned data reveals the continuous downfall in GST revenue as collected throughout last year.

Looking at the tax burden on the consumers, the tax has been reduced on various commodities and some services. The final figures and the detailed description of the collection will be made public on February 2, said the Ministry in a statement.

Read Also: GST Council All Meeting Updates: All You Need to Know

Now, the Government has fixed a monthly target of Rs 1 lakh crore for the complete financial year 2019.

Earlier on 22nd December, the GST Council had decided to cut the tax on 17 items and six services viz. computer monitors, TV screens, lithium-ion power banks, retreaded tyres, wheelchairs, etc. This step by Government has come in time and has left a good impression on the Consumer section.