The Gujarat High Court ruled that levying the Integrated Goods and Services Tax (IGST) on ocean freight under a reverse charge mechanism is unconstitutional. As a result, importers are entitled to a refund of the IGST they voluntarily paid, even if this request is made after the usual limitation period.

The applicant imports bituminous coal from overseas suppliers after paying customs duty and IGST on the goods.

The applicant paid 5% IGST on a reverse charge basis for ocean freight charges related to transportation services, in compliance with Notifications 8/2017 and 10/2017. These services involved shipping goods to the Indian customs clearance facility via watercraft. The transaction was carried out between two parties, both located in non-taxable territories.

Read Also: Easy Guide to RCM (Reverse Charge Mechanism) Under GST

However, the applicant was not the receiver of these services, due to considering the fact that, as per Sr.No.10 of Notification No. 10/2017, the liability to release these taxes was affixed on the importer. Therefore, the applicant in February 2019 paid the IGST amount on goods up to the customs clearing station in India.

On January 23, 2020, this court, in the case of M/s Mohit Minerals Pvt. Ltd. v. Union of India & Ors., reported at 2020 (1) TMI 974, ruled that Notification Nos. 8/2017 and 10/2017 were unconstitutional.

As per the above ruling of this Gujarat High Court confirmed by the Hon’ble Apex Court, the applicant has submitted a refund claim for the period February 2019 on 14.05.2024 for the IGST paid on ocean freight for the month of February 2019 in Form GST RFD-01.

However, the refund application was rejected, expressing that there was a delay in the refund application filing.

Closure

Hon’ble Supreme Court in the case of Union of India and another Vs. Mohit Minerals Private Limited, through the Director, has categorically ruled that when the notification itself is struck down, the respondent authorities cannot be asked to impose the IGST on the amount of ocean freight.

In this position, the main problem that comes under the determination of this court is whether the prayers for a refund of the amount imposed are maintainable and whether this court should ask the respondents to refund it to the applicant.

In the case of Mafatlal Industries and others Vs. Union of India and others reported in 1997 (5) SCC 536 that the Supreme Court has cited three situations where the right to refund may emerge. Firstly, where the regulatory provision under which the tax is imposed itself is contested by the taxpayer, established that it is a breach of certain provisions of the constitution (question of unconstitutional levy).

In this class of cases, the refund claim emerges under the provision of the Act itself, since, these are the cases contemplated under the Act and regulations. Also, where the taxpayer files a tax return under a mistake of law. It is not a matter either of an unconstitutional levy or an illegal levy, but voluntary payment upon a mistake of law.

Recommended: IGST on Ocean Freight: No Review Petition Against SC’s Judgment

Therefore, the writ petition is to be furnished by the applicant asking for the refund of IGST is maintainable and is to be permitted as the levy has been ruled to be unconstitutional. Hence, the petition succeeds and is therefore permitted. Hereby, the impugned order is quashed and set aside.

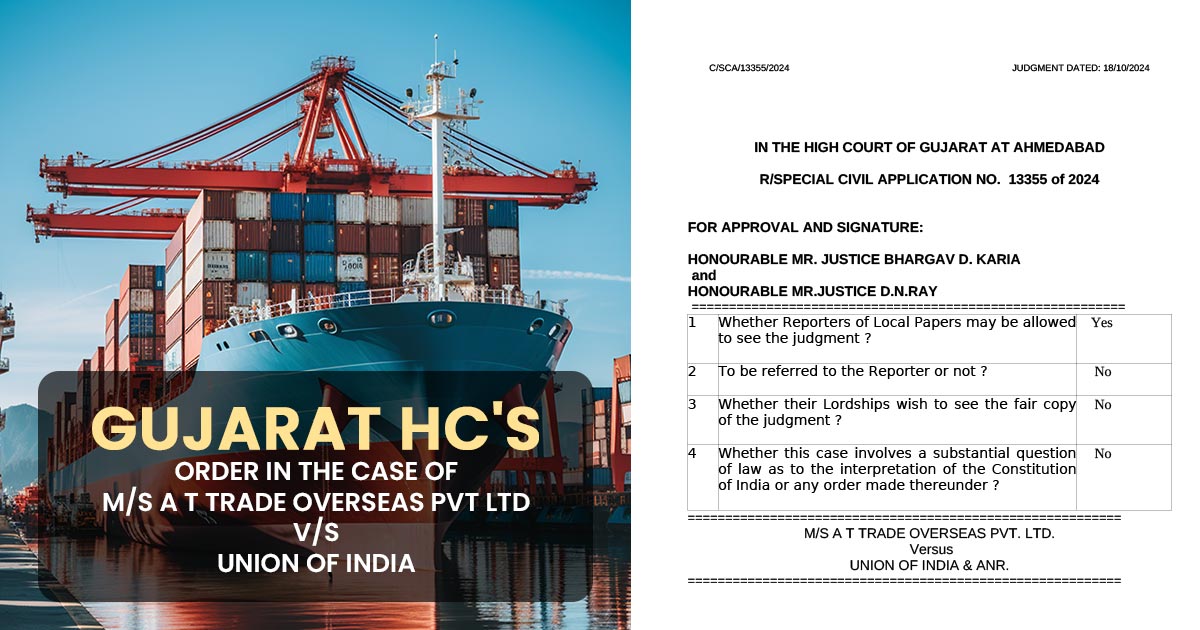

| Title | M/S A T Trade Overseas Pvt Ltd Vs Union of India |

| Citation | NO. 13355 of 2024 |

| Date | 18.10.2025 |

| For Petitioner | MR. SANKET GUPTA, and MR ANAND NAINAWATI |

| For Respondent | MR. HIRAK SHAH, MR NIKUNT K RAVAL |

| Gujarat High Court | Read Order |