On 25th September (Wednesday) the Gujarat High Court said that the applicable Goods and Services Tax (GST) to fly ash bricks and blocks with less than 90% fly ash content.

It was carried by the court that the products entitled to a lower GST rate of 5% than the 18% GST rate on products that do not fulfil the 90% fly ash threshold and quashed and made the order aside of the Advance Ruling Authority and Advance Ruling Appellate Authority.

Fly ash, a by-product from thermal power plants is utilized as a material in producing eco-friendly bricks, proposing a sustainable alternative to traditional bricks. Fly ash bricks are solid, uniform, and smooth with sharp edges, free of cracks or flaws.

They are eco-friendly, 28% lighter than clay bricks, and do not need plastering because of their smooth finish. Dissimilar to clay bricks, which differ in colour and are handmade from topsoil, fly ash bricks are moulded from coal combustion waste, making them cost-effective and environmentally beneficial.

A 12% GST rate was taxed on the fly ash under the GST Act of 2016. An amendment in 2017 set a lower GST rate of 5% for fly ash bricks. An application was filed by the applicant who is the director of M/S Shree Mahalaxmi Cement Products, which manufactures fly ash bricks and blocks, for the advance ruling, seeking a ruling on the true tax rate towards Fly Ash Bricks and Fly Ash Blocks.

Thereafter the petition proceeded to the High Court contesting the order of the Advance ruling Authority and Appellate Authority that carried fly ash blocks to be taxed under the 5% slab since it satisfies the criteria of carrying 90% fly ash content and fly ash bricks to be taxed under 18% GST slab as they held less than 90% of fly ash.

Counsel Contentions for the Company/Petitioner

The company’s counsel furnished that the petitioner has elaborated on the process of manufacturing. However, the GST Advance Ruling Authority and the Appellate Authority did not acknowledge such information when deciding that the fly ash bricks of the petitioner did not fulfil the 90% fly ash content pre-requisite.

Also, it mentioned that as per the 2009 Ministry of Environment and Forest notification, it is important for building materials like fly ash bricks to have 50% fly ash.

He claimed that the pre-requisite of the Advance Ruling Authority for 90% fly ash opposes this norm. Also, the Advance and Appellate Authorities wrongly applied a 90% fly ash content pre-requisite to categorize the bricks of the applicant under an 18% GST rate.

He said that the agenda of the GST council in this regard suggests a 5% rate for fly ash bricks and that a notification of CBIC mentioned that the 90% requirement applies merely to the fly ash aggregates, not bricks.

Also, he marked that fly ash bricks fall under a 5% GST under the Harmonized System of Nomenclature (HSN), supporting a 5% rate for the bricks of the applicant.

He then directed to distinct decision of the Apex court to support his claim that the tax must be levied at 5%, as per the legislature. He stressed the matter of the collector of the Central Excise vs Wood Craft Products Ltd. and Reckitt Benckiser (India) Ltd. vs Commissioner and proposed that there must be no dual interpretation of the tax laws.

He mentioned the suggestions of the GST council for categorizing Fly Ash Bricks and Aggregates with 90% or more fly ash content distinctly. Hence he contended that the authorities’ assertion that the petitioner’s Fly Ash Bricks do not have sufficient fly ash is unfounded.

Government Counsel Contentions

The government’s counsel claimed that as per the notification of July 2022, the GST rate for the Fly Ash Bricks made by the petitioner must be 5%, not 18%. He directed to an affidavit stating that in the 23rd GST council meeting, it was wished to reduce the tax rate on fly ash Bricks to 5% from 12% for those who have 90% or more fly ash.

The respondent claims the appeal is invalid as the applicant’s bricks merely secure 40 to 60 per cent fly ash.

He also mentioned that in the 31st GST council meeting an identical 5% rate was suggested for the fly ash blocks, but no particular notification was there for the same reduction, which makes the appeal unsustainable.

Indeed the respondent furnished that the Apex court in the matter of Wood Craft Products Ltd. (1995 (77) ELT 23 (SC)) carried that the tariff classifications must be aligned with the nomenclature of the HSN until mentioned otherwise and in the same matter no classification dispute will be there for the Fly Ash Bricks, rendering the arguments of the appellant wrong.

Courts Observation

The Division Bench including Justice B.D Karia and Justice Mauna considering the arguments of both parties and the case information noted that the problem in the same petition was solved under the Circular No. 179/11/2022-GST dated August 3, 2022. It was mentioned by the Central Board of Indirect Taxes and Customs (CBIC) that the 90% fly ash content pre-requisite applies merely before the fly ash aggregates, not before the fly ash bricks.

Earlier the fly ash bricks and aggregates with 90% or more fly ash content were levied to tax at 12%. The GST council confirmed that the same condition is applicable merely before the aggregates. the requirement for 90% fly ash content As of July 18, 2022, has been eliminated from the description of the fly ash bricks and blocks.

Advance Ruling Authority findings do not apply to this that Fly Ash Bricks or Aggregates with 90% or more fly ash content were taxed at 12%, confusing the 90% prerequisite.

Under the circular, it cited that this condition applies solely to Fly Ash Aggregates, not to Fly Ash Bricks or Blocks. The 90% requirement as of July 18, 2022, has been removed from the description of Fly Ash Bricks and Blocks.

The Division Bench in the order, Therefore, given above clarification, as per the Notification No. 04/2018-Central Tax (Rate) dated 31.12.2018 Entry No. 225B refers to applicability of levy of GST rate of 5% on Fly Ash Bricks and all Fly Ash Aggregate with 90% or more fly ash content or Fly Ash Blocks as per the clarification fly ash aggregate at 90% or more fly ash content will not be applicable Fly Ash Bricks or Fly Ash Blocks and as per the GST rate applicable to the products manufactured by applicant is 5% as per the Entry No. 225B.

After that, the court permitted the petition by quashing and setting aside the order passed via the Advance Ruling Authority and the Appellate Authority. It is indeed clarified by the court that the manufactured products via the applicant i.e. Fly Ash Bricks and Fly Ash Blocks are imposed to a 5% GST under notification No. 24/2018 dated 31.12.2018. The rule is made absolute to the above-said extent.

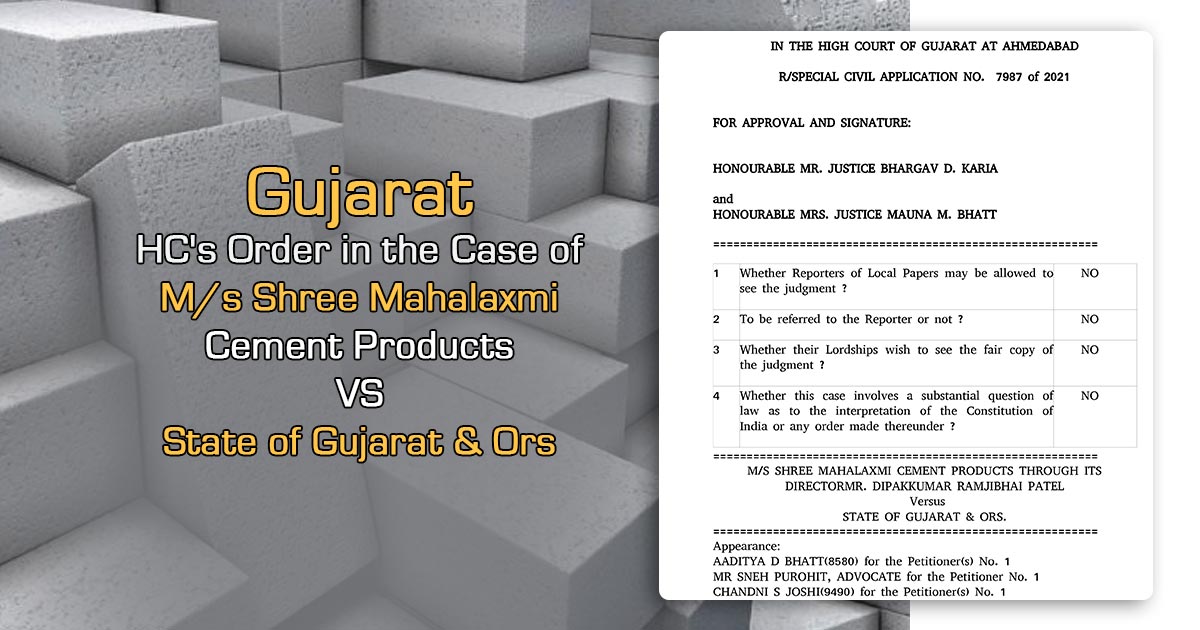

| Case Title | M/s Shree Mahalaxmi Cement Products vs. State of Gujarat & Ors |

| Citation | R/SPECIAL CIVIL APPLICATION NO. 7987 of 2021 |

| Date | 25.09.2024 |

| For the Petitioner | Aaditya D Bhatt, Mr Sneh Purohit, and Chandni S Joshi |

| For the Respondent | Mr Chintan Dave, Mr Hirak Shah, Mr Nikunt K Raval, and Served by Rpad (N) |

| Gujarat High Court | Read Order |