GSTR 1 is a return filing form for all the outward supplies done by the businessman. The GSTR 1 is to be filed every 11th of the month and includes all the regular taxpayers to file the GSTR 1 form.

Here, SAG Infotech will brief you on all the aspects of the GSTR 1 return filing form including the step-by-step procedure through the means of a PDF file having screenshots of the individual window where the filing process is carried out.

Gen GST software v2.0 is a complete solution for all the GST return filing compliance having unlimited client return filing, billing, and the GST e-way bill solutions like generation, updation & printing.

The Gen GST software version 2.0 has multiple features based on GSTR 1 such as Download bulk status of return filing details of GSTR-1, Reconciliation of GSTR 1, Getting return filing status of supplier or receiver, Export data to Govt. offline tool, Govt. portal & Gen GST excel and much more.

Step-by-Step Guide to File GSTR 1 Form Via Gen GST Software

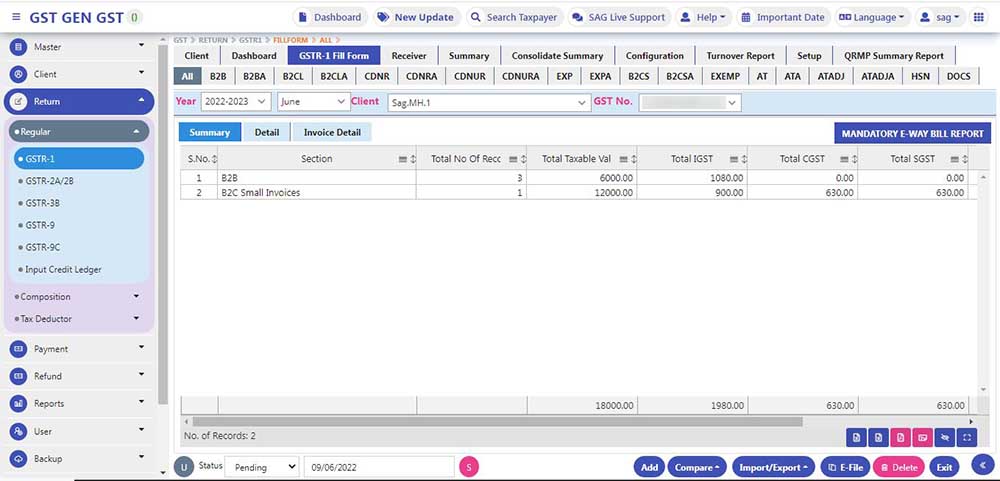

Step-1:- For this, firstly make the following Entries in our Software w.r.t. GSTR-1.

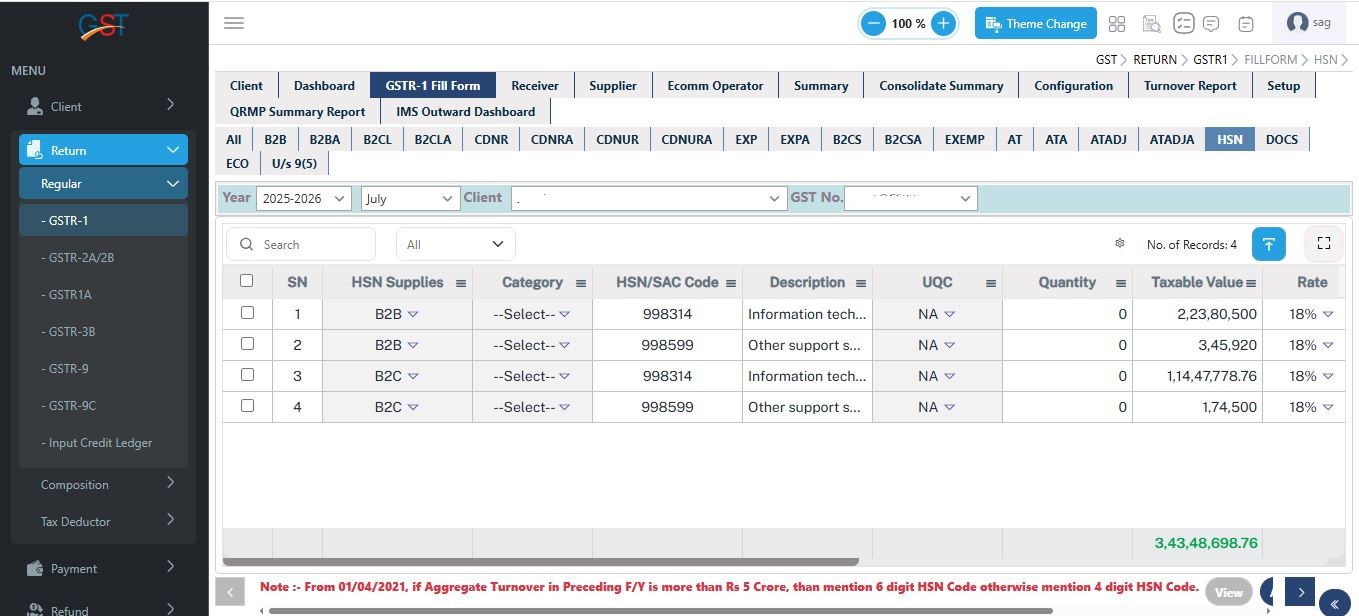

Step-2:- Currently portal has made changes in the HSN table where HSN entries have to be categorised into B2B and B2C sections we have implemented the same in our software, as shown in the image given below.

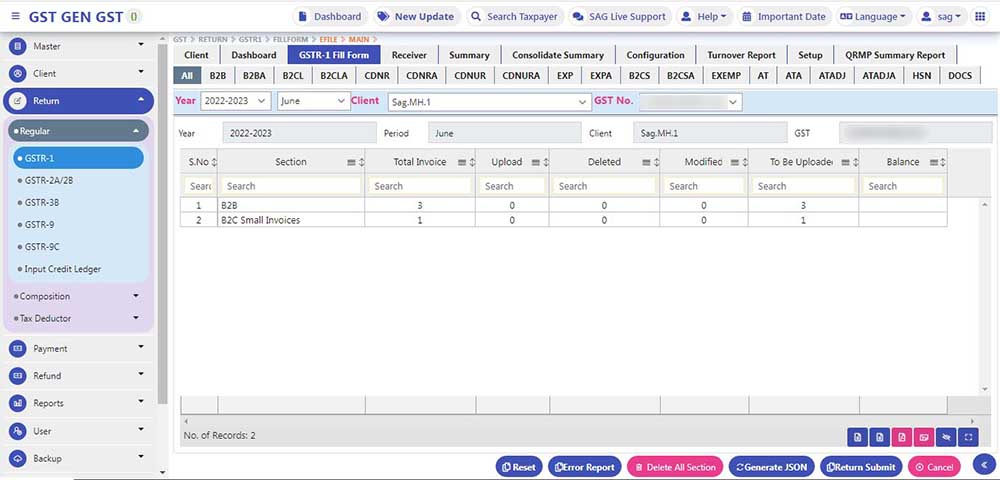

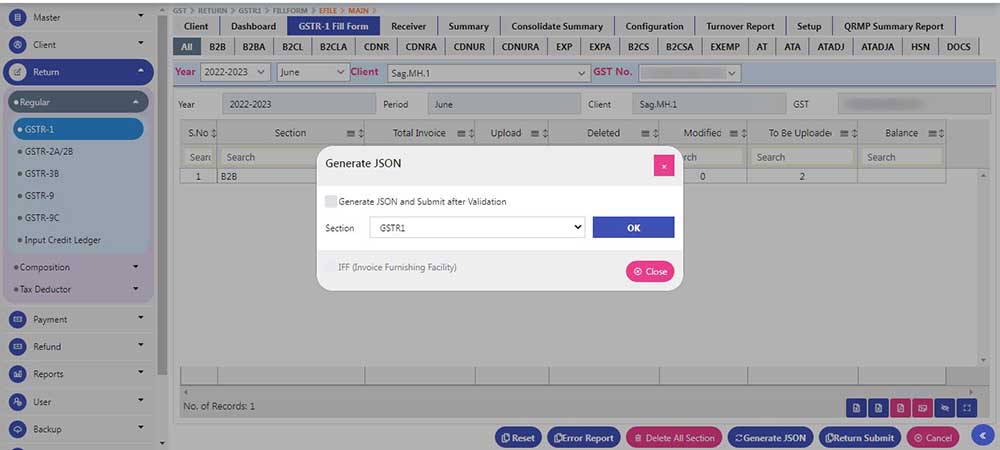

Step-3:- After that, click on Generate JSON Button.

Step-4:- After generating the JSON file, click on the ok Button.

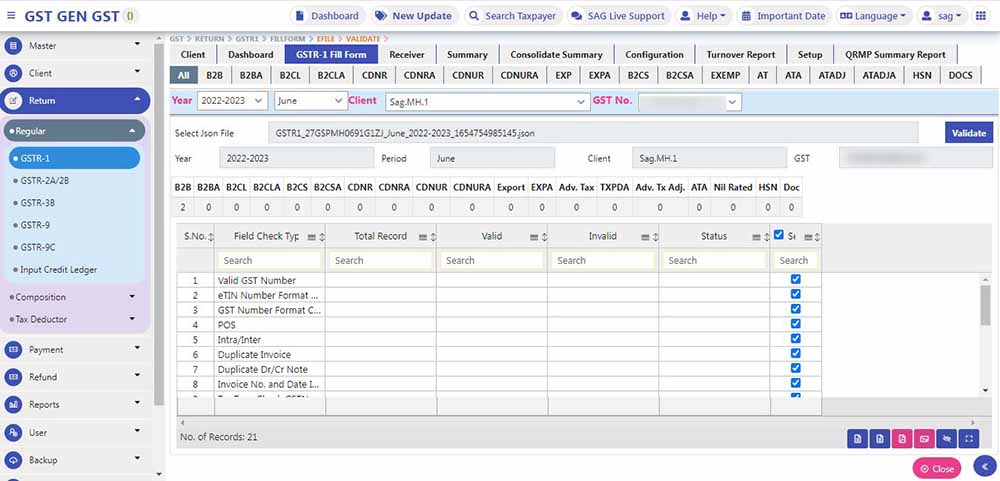

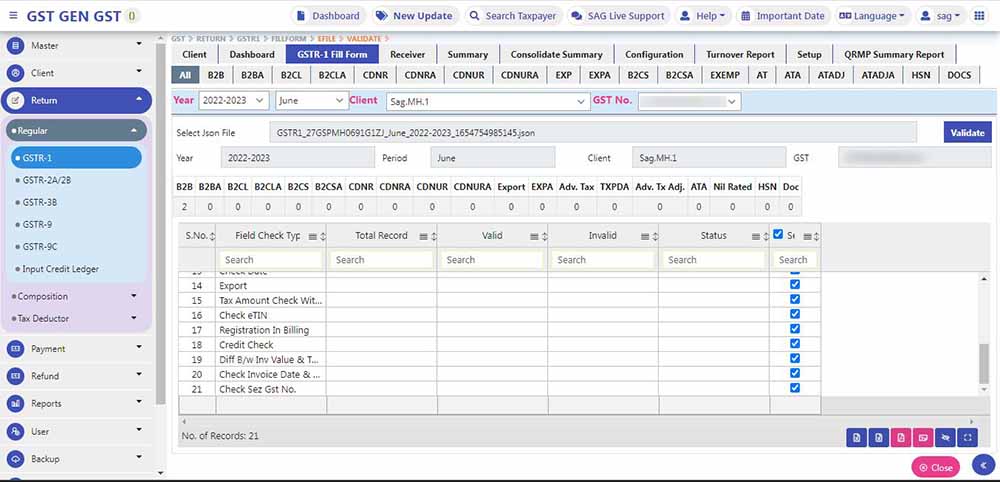

Step-5:- After clicking the Ok Button, JSON Go through the JSON validation process, where we have prescribed 21 points for validation, which helps in sorting out errors before uploading the return to the Portal.

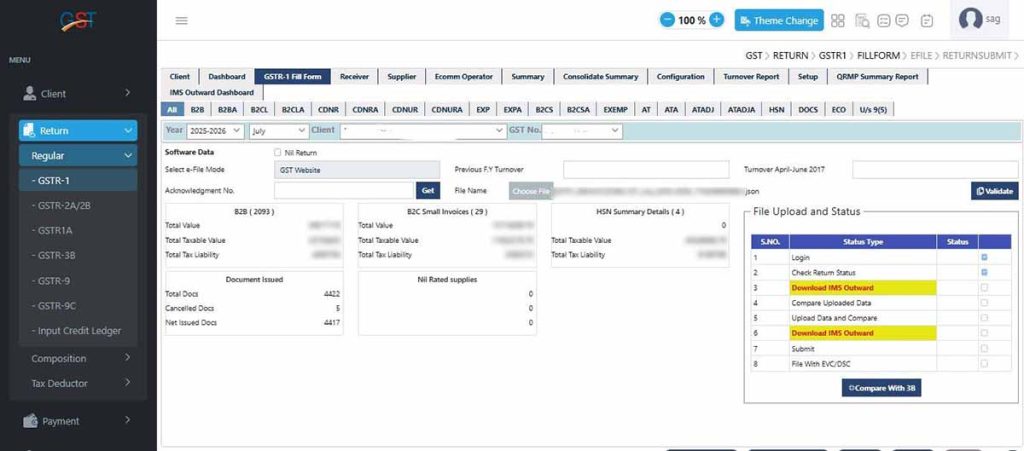

Step-6:- After that, click on the Validate button.

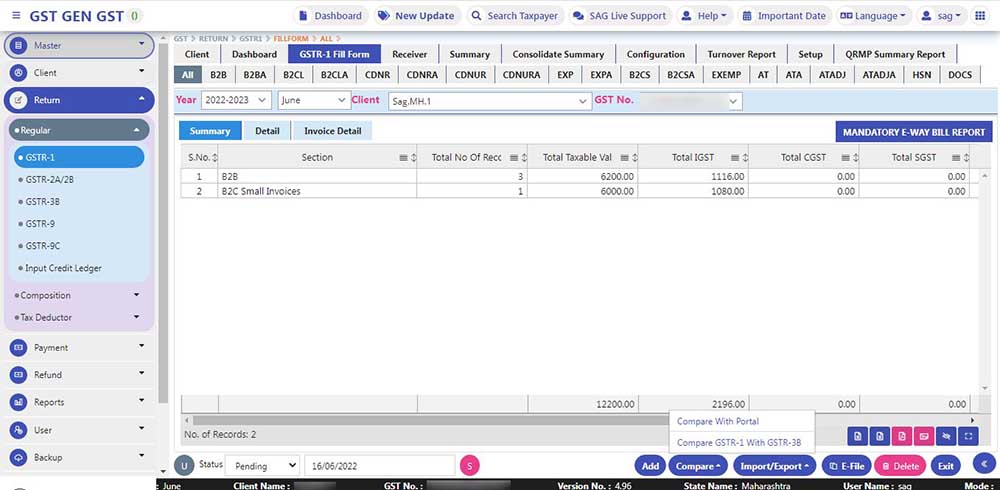

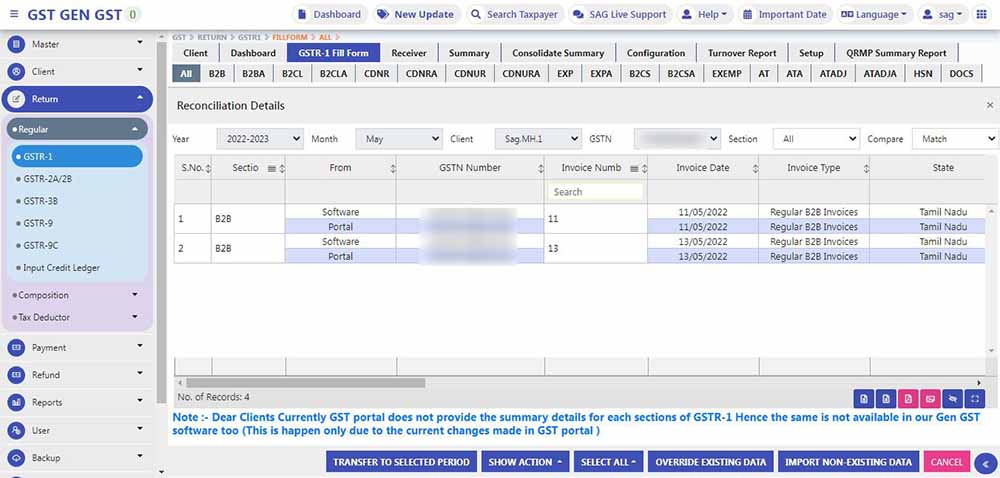

Step-7:- Reconciliation with sales register data: For this, we need to click on Compare with Portal under the Compare button.

Step-8:- Matched data between the software and portal will be shown in the first step.

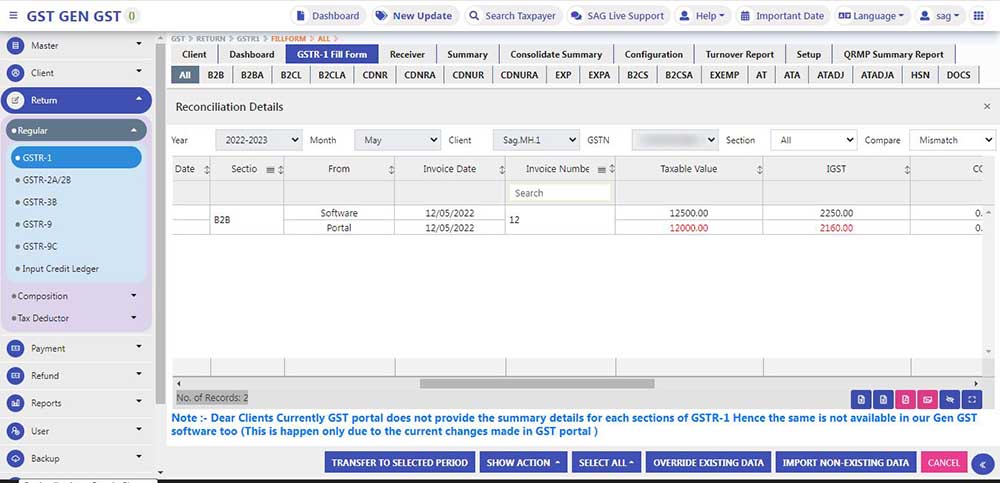

Step-9:- If we select Mismatch, then it will show Mismatch data between the software & Portal.

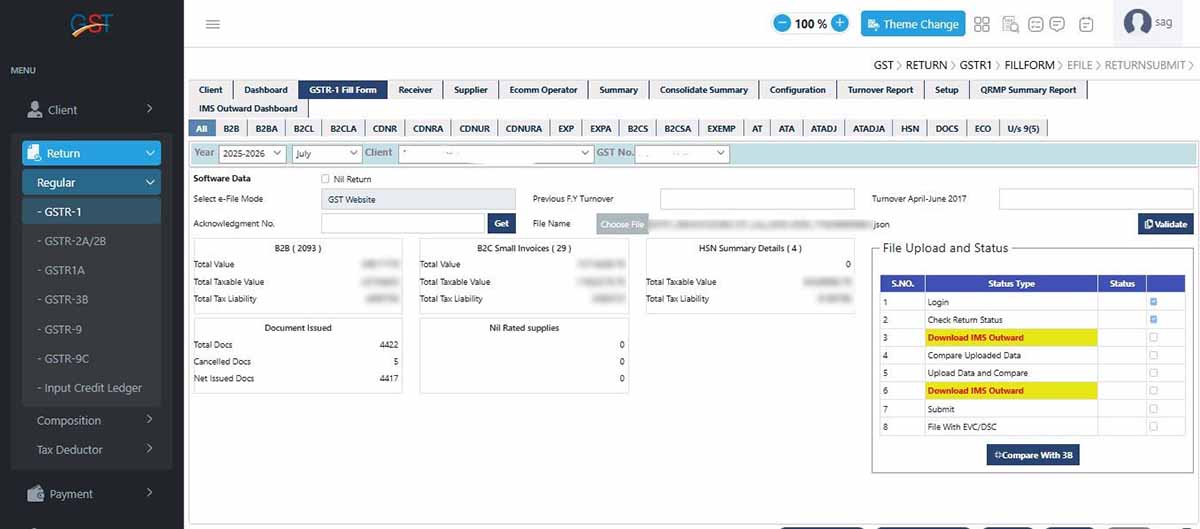

Step-10:- Preparation and filing of GSTR1:- After uploading of JSON file on Portal, We have provided the following Check box to be ticked by the assesse for easy filling of GSTR-1.

Step-11:- DSC integration for the signing of returns: We provided the following Check box to be ticked by assesse for easy filling of GSTR-1, For DSC signing, Click on Last point File with EVC/DSC, Then click on the Process button.

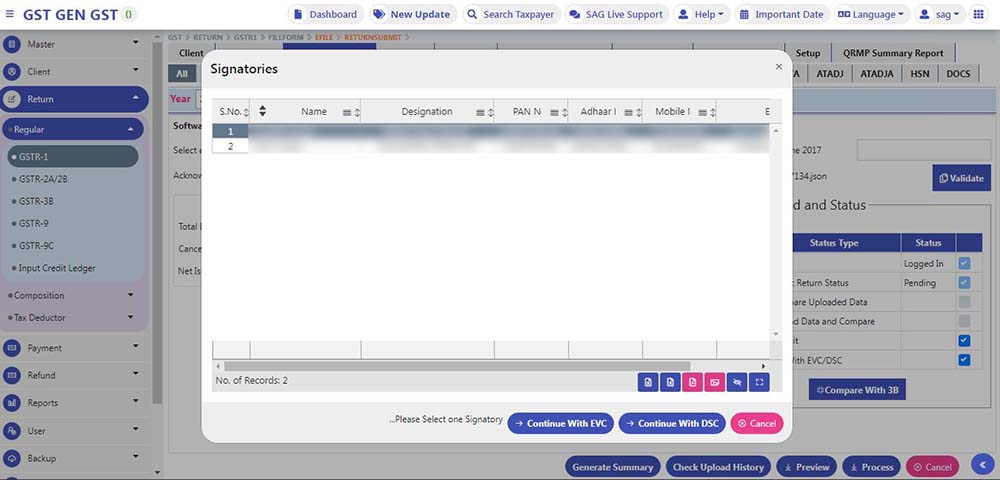

Step-12:- Then the following Window is opened, which shows the list of Signatories, Select the applicable signatory for DSC signing, by clicking Continue with DSC button.

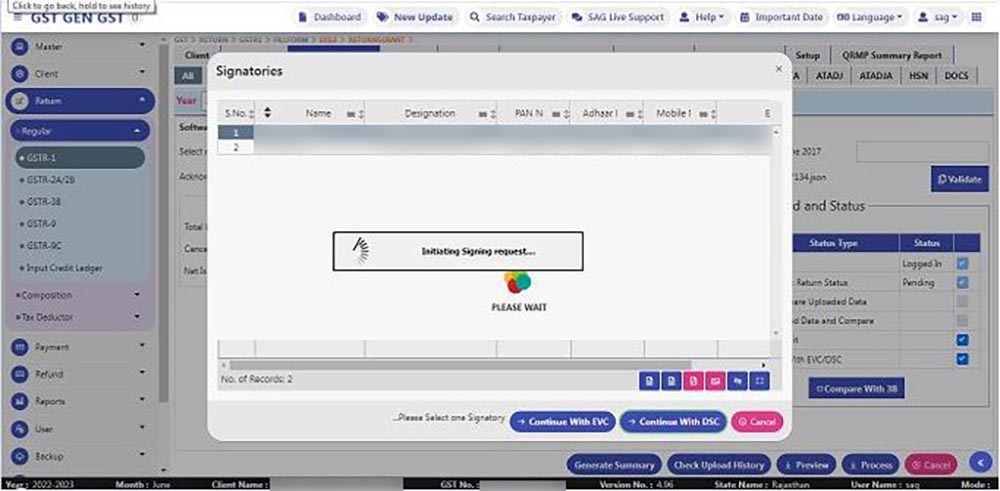

Step-13:- After that, Initiating Signing request page is displayed.

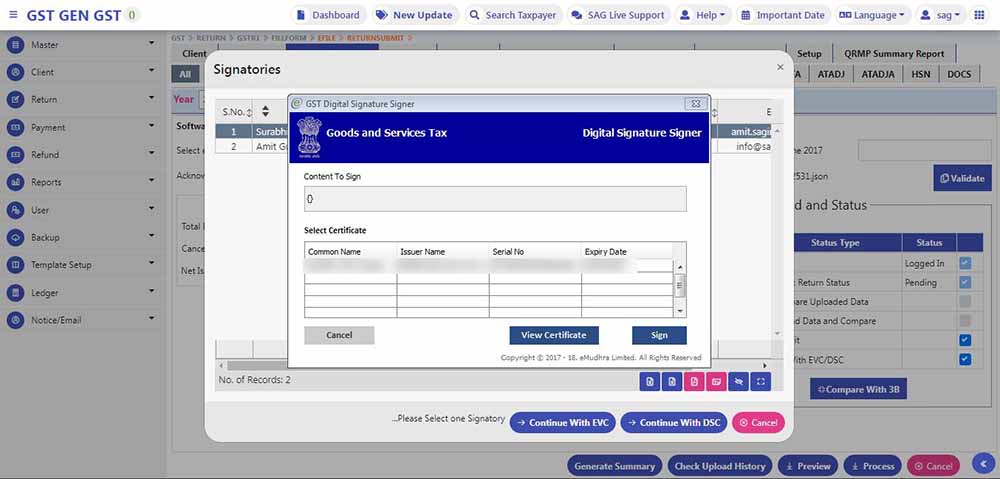

Step-14:- At the last Signing page screen is displayed to input the required password.

Read the Detailed Guide in PDF Format for GSTR-1 Filing:

Recommended: Free Download Gen GST Software for E-Filing GSTR 1 Form

HELLO, STEP 2 MAI MAINE RECEIVER NAME, GSTN NO AND ADDRESS FIELD KARKE SAVE KIYA. B2B MAIN ADD TRANSACTION MAIN USKI KOI DETAIL NAHI AA RAHI HAI. AUR USKE TOTAL RECEIVER CLIENT LIST MAI RECEIVER NAME AA RAHA HAI LEKIN USKA GST NO NAHI AA RAHA HAI.