GSTN has recently released an advisory announcing the launch of its user-friendly E-Invoice Verifier app. This app provides a convenient solution for efficiently verifying e-invoices and related information, ensuring a seamless and hassle-free experience for users.

The NIC has released an e-invoice verification application that permits the users to validate the authenticity of the e-invoice which is based on the QR code emerging on the same. A QR code is a two-dimensional quick response code that could be readable by the machine. For furnishing easier access to the qualified GST invoices it is obligatory that the signed QR code would emerge on all the e-invoices. Learn more about the QR code verification app and the process of e-invoice verification.

What is the Requirement to Add a QR Code?

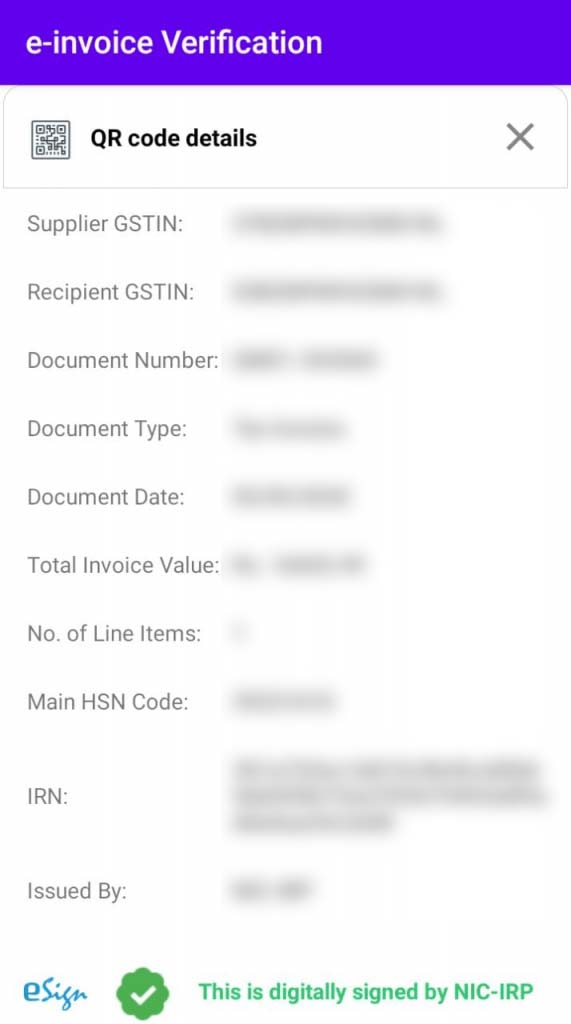

On the e-invoice portal or IRP, like NIC or Clear IRP, the e-invoicing system needs the applicable assessees to upload specific kinds of tax invoices for verification and authentication. The invoice information would get verified by the IRP after it gets uploaded, digitally signs the invoice, and shares it back as an e-invoice including the Invoice Reference Number (IRN) and a signed QR code.

The assessee should be needed to add/print the obtained QR code on the e-invoice at the time of sharing the same with the buyer. Regarding the matter of valid/correct QR code is not printed or not emerging on the final e-invoice, e-invoice, and e-way bill generated from there, both will be deemed invalid and useless. Tax authorities might levy heavy penalties. Subsequently claiming the correct ITC to the buyer could not work.

Through the use of the QR code, the e-Invoice verification will support buyers to determine if the e-invoice is valid or not

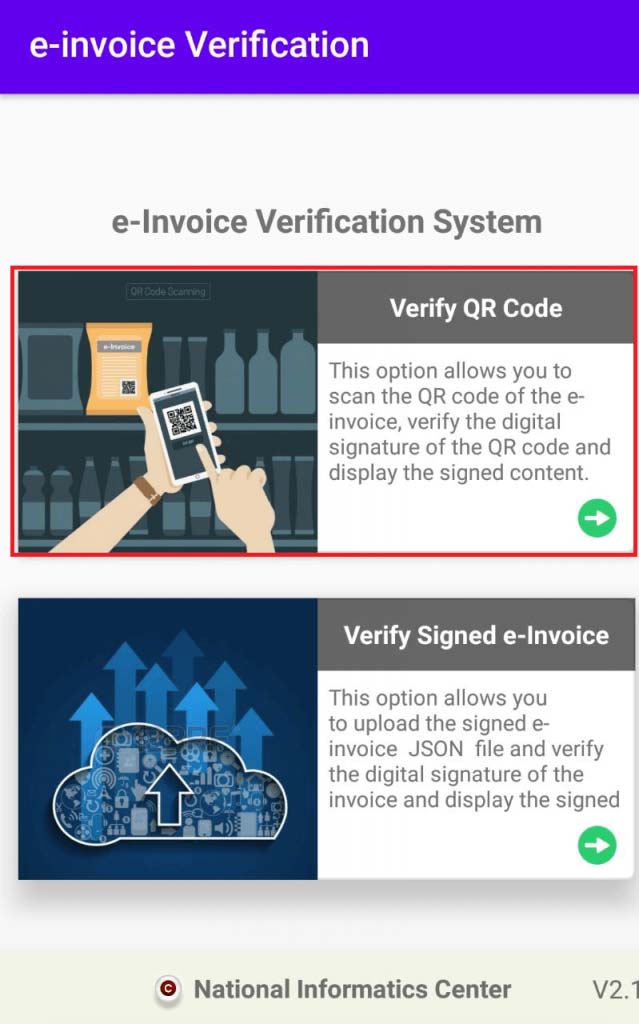

Let’s explore the key features and benefits of the E-Invoice Verifier app:

QR Code Verification: The app enables users to effortlessly scan the QR code on an e-invoice and verify the embedded value within the code. This feature ensures accurate identification and validation of the GST e-invoice’s authenticity.

User-Friendly Interface: With its intuitive and straightforward interface, the app offers a user-friendly experience. Navigating through its various GST features and functionalities is a breeze, making it highly accessible for all users.

Comprehensive Coverage: The app supports the verification of e-invoices reported across all six Integrated Reporting and Payment System (IRP) portals. This extensive coverage ensures convenience and reliability for users.

Non-Login Based: An outstanding advantage of this app is its non-login basis. Users are not required to create accounts or provide sensitive personal information to access the app’s functionalities. This not only simplifies the user experience but also enhances security and privacy.

Here’s a simple guide on how to use the E-Invoice Verifier app:

Download the App: Visit the Google Play Store and search for “e-invoice QR code verifier.” Download and install the app on your mobile device for free. The iOS version will be available soon.

QR Code Scanning: Open the app and utilise its built-in QR code scanner to scan the QR codes on your GST e-invoices. The app will verify the information embedded in the code, allowing you to compare it with the details printed on the invoice itself.

The step of launching the E-Invoice Verifier app by GSTN aims to enhance the user experience and simplify the e-invoice verification process. GSTN is actively working on Version 2 of the app, which will include the Search Invoice Reference Number (IRN) functionality, further streamlining the e-invoice verification process.

What is the Method to Download and Install the QR Code Verification App?

To download the e-invoice verification app comply with the below-mentioned steps:

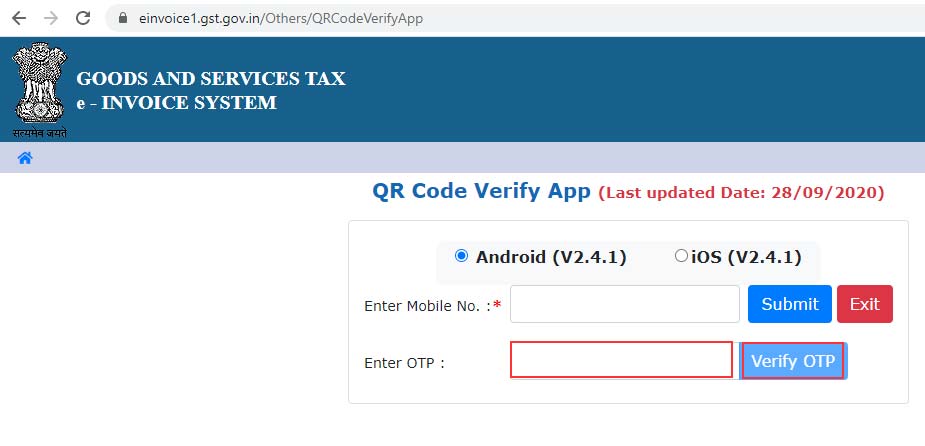

Step 1: Proceed to https://einvoice1.gst.gov.in/Others/QRCodeVerifyApp. You shall enable to view the screen below:

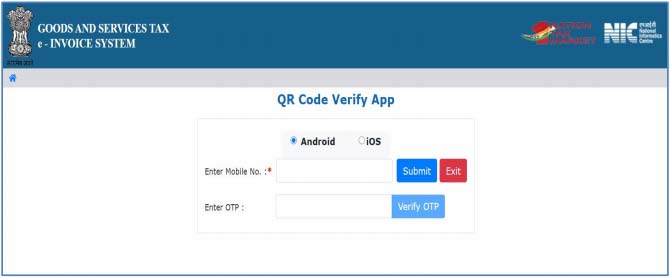

Step 2: Users should select if their mobile device runs an iOS or an Android operating system.

Step 3: Insert the mobile number and tap on ‘Submit’. The user shall obtain an OTP on the entered mobile number, valid for 10 minutes. Insert the OTP and confirm it.

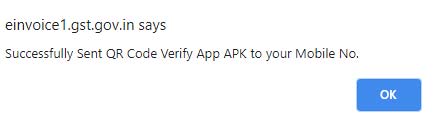

The e-invoice system will send a QR code post successful validation.

Step 4: Validate the App APK to the registered mobile number. A user can download the same app and install the APK and verify the QR code.

What is the Method to Scan the E-invoice QR Code?

A comprehensive user manual for the e-invoice verification app is provided by NIC. understand how to validate an electronic invoice. Within minutes, you may scan an invoice and receive findings. As you do the following:

Step 1: Post installing the APK, tap on the “verify QR code” button on the app which is the initial option. It is suitable when you require to verify one e-invoice.

Uploading the JSON invoice is the second choice. Tap on the “verify signed e-invoice” button located on the app’s home screen. When you need to verify several e-invoices, the choice is chosen.

To upload and obtain the invoice particulars as stated below browse the JSON:

Step 2: To obtain the invoice verification information as stated below scan the QR code on the invoice.

You’ll note that the message concludes with a statement confirming that the e-invoice was signed by an IRP recognized by the government, such as NIC or Clear IRP. It sends a message indicating that it is not a legitimate e-invoice if it is not.