In order to check GST evasion, frauds, and increase compliance under GST, the Government comes up with a new rule. According to this new rule, a taxpayer who has not filed the GSTR 3B for two consecutive months will get blocked to use the facility to generate an e-way bill. The E-way bill is an important document to be carried for the transportation of goods. The Blocked taxpayers can’t use the facility of e-way bill generation either as supplier, recipient or even as a transporter.

So from now onward, GST Network activated the blocking /unblocking facility for e-way bill generation

The implantation of the new rule in the Goods and Services Tax (GST) Network is not a sudden decision. It was notified by the GST Council a few months ago. And after that, taxpayers who are using the e-way bill portal were notified with the message that the facility will be withdrawn if two consecutive months GSTR-3B are not filed.

Read Also: Guaranteed Solved! GSTR 3B & GSTR 1 Common Errors

This rule is introduced with a recent update that almost 20.75 lakh GSTINs have not filed GSTR-3B of September and October, thus they are eligible to be get blocked from the e-way bill generation portal. But the government is taking immediate action against 3.47 lakh GSTINs out of these 20.75 lakh GSTINs, who had transactions in the e-way bill system for the same two months.

Additionally, the tex department can now cancel the registration of taxpayers who have not filed the GSTR 3B for three consecutive months. As per a recent conference Anand Kumar Tiwari, Addl. Commissioner Taxes, Delhi informed that Due to the same rule, the department had to cancel the Delhi registration of major airline because it failed to file the GSTR 3B return

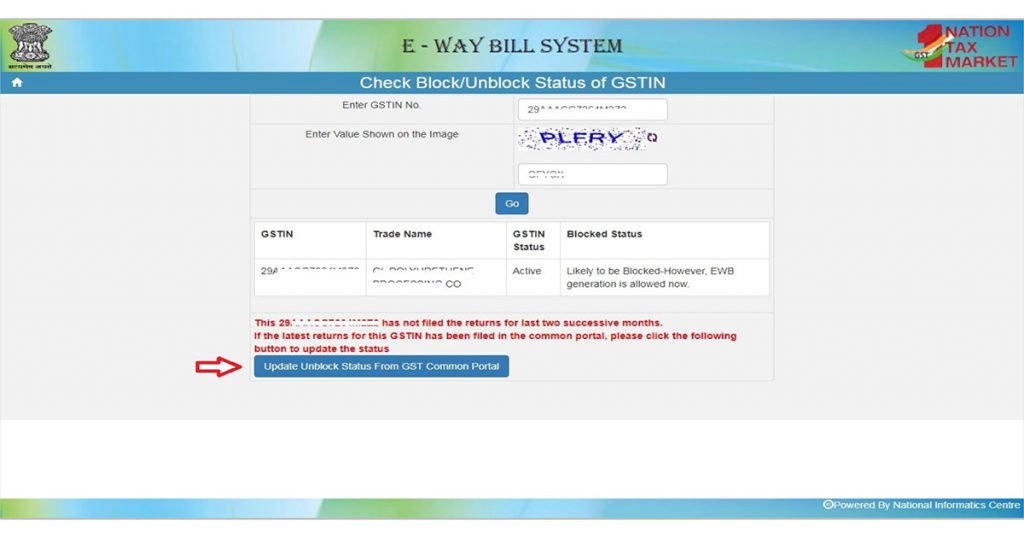

The new rule is implanted to reduce the GST evasion and frauds so all the taxpayers need to take care of these new rules. The Good news is that the Blocking is not permanent and a taxpayer can easily unblock it and get back into action.

It is also to be applicable for GSTR 1

Genuine tax payers continuously following up with suppliers ask them to file the returns