CBIC formulates the GSTR-3B form, which consolidates the details about outward and inward supplies to be furnished every month by the Taxpayer. You are required to keep a record of each and every transaction mentioned under GSTR-1 and GSTR-2A/2B to tally it with the GSTR-3B form. This is the comprehensive step-by-step guide assisting GSTR 3B filing by the Gen GST software online variant. (Username: sagtest and Passward: sagtest)

Step 1:

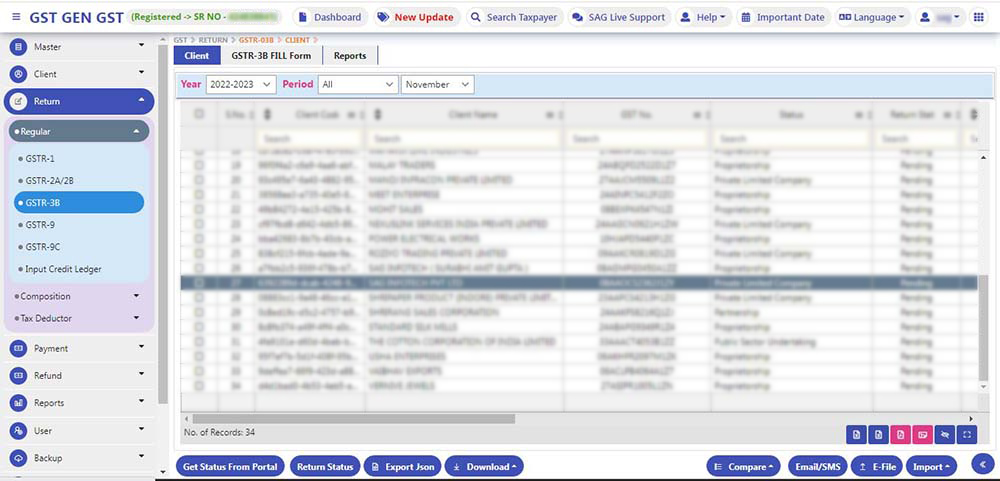

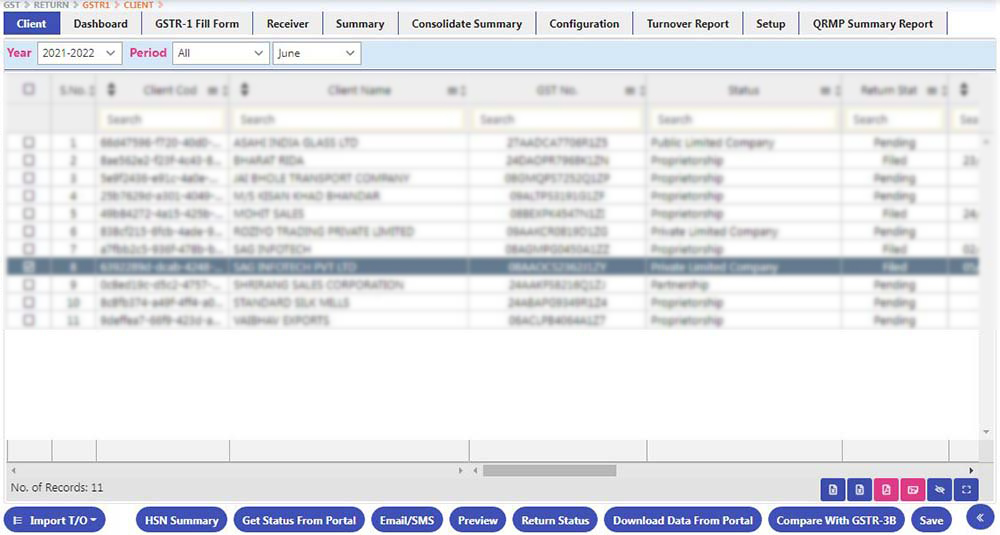

- Click on the Gen GST Software online application to file the GSTR 3B return. In the left sidebar, there is an option named ‘Return’, click on that tab. It opens with options like GSTR-01, GSTR-01A, and other return form choices.

- Select the ‘GSTR-3B’ option from the sub-menu. A new panel opens in the window with the ‘Client’ and ‘Fill form’ options. Click on the first option named ‘Client’ and select the client name for which you want to file a GST return from the given grid.

Step 2:

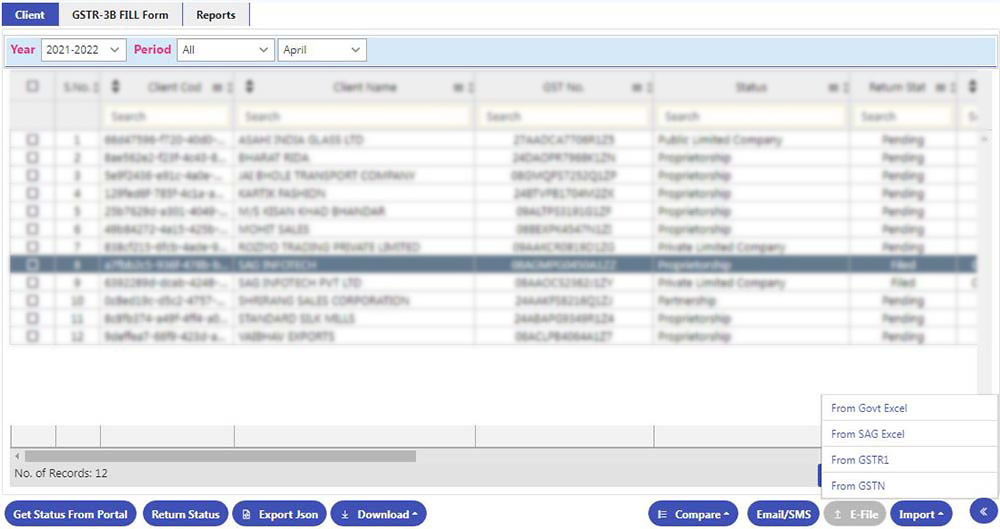

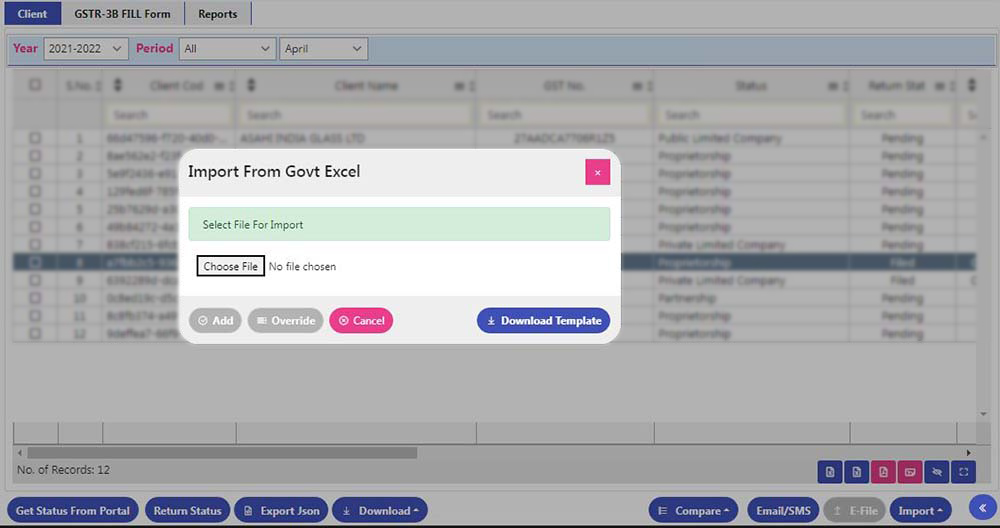

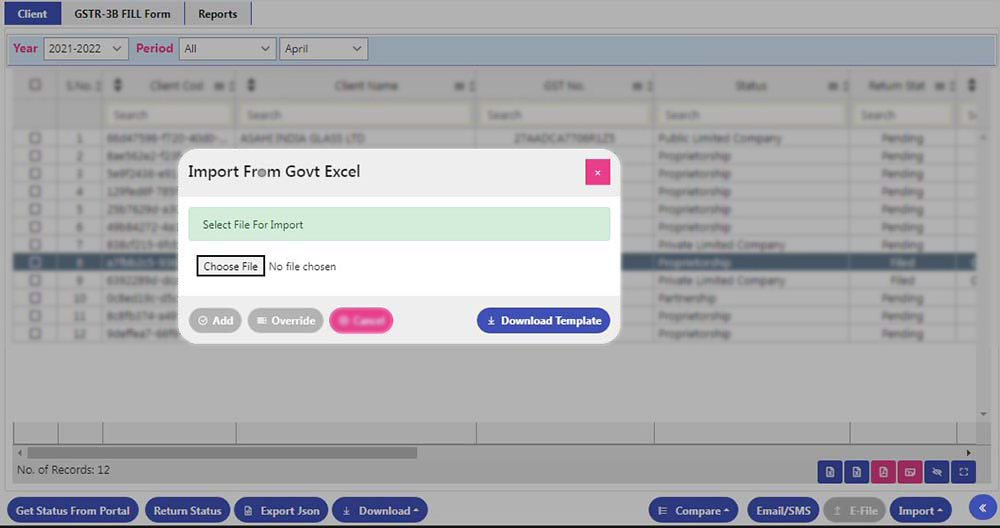

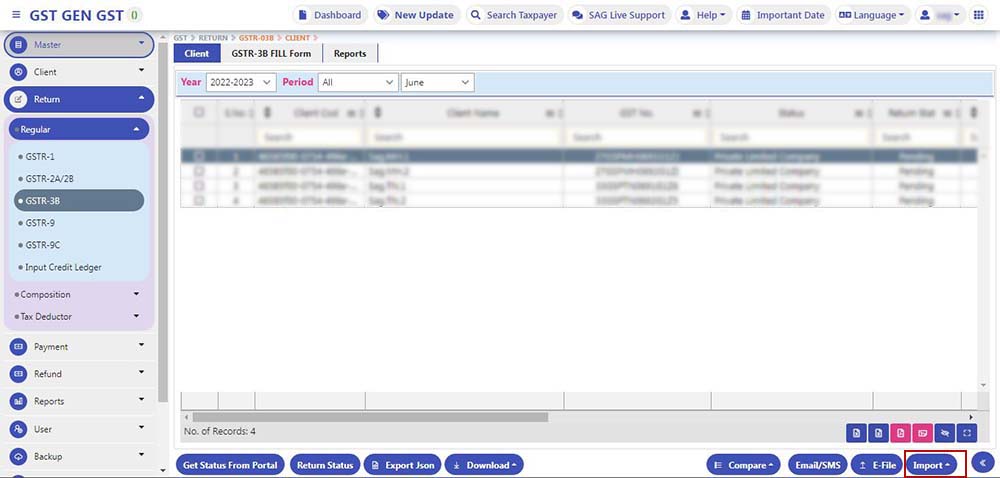

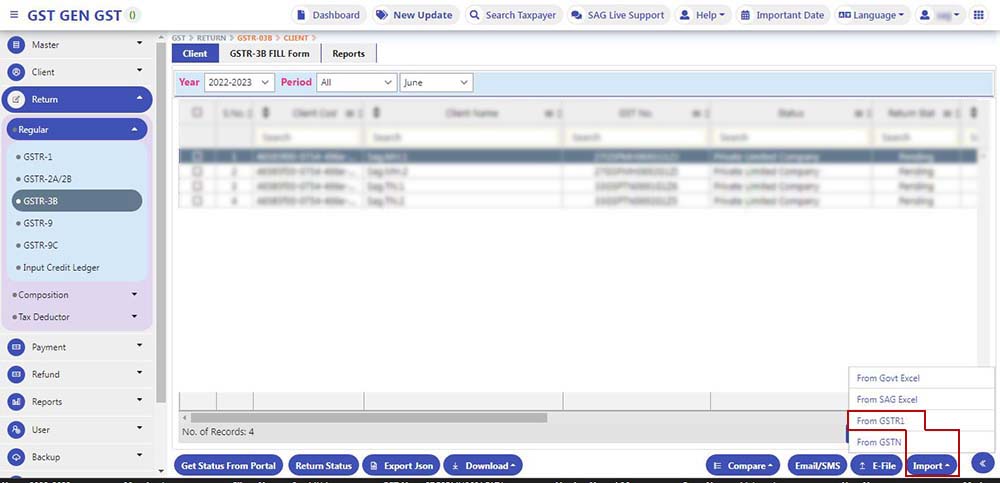

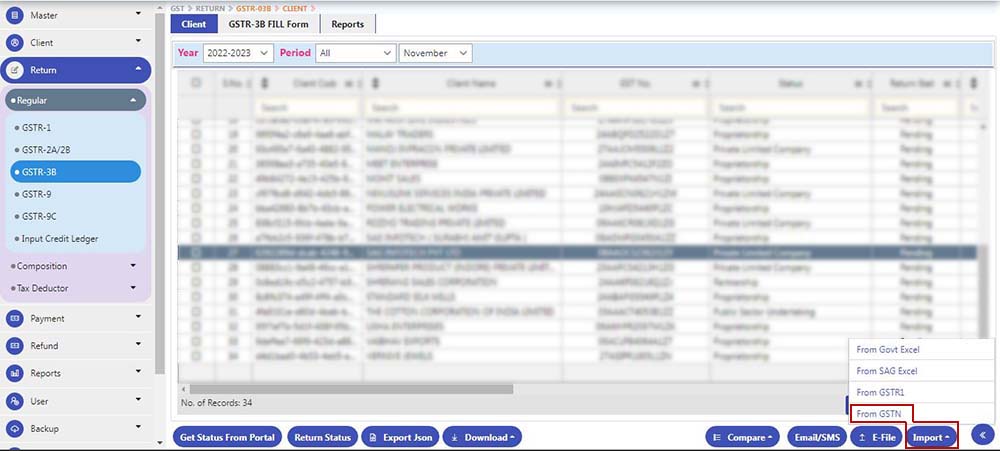

- Import:- We have the following option for filing data into GSTR 3B viz Govt excel, SAG Excel, GSTR-1 (Software data) & last GST portal

Government Excel

Sag Excel

GSTR-1

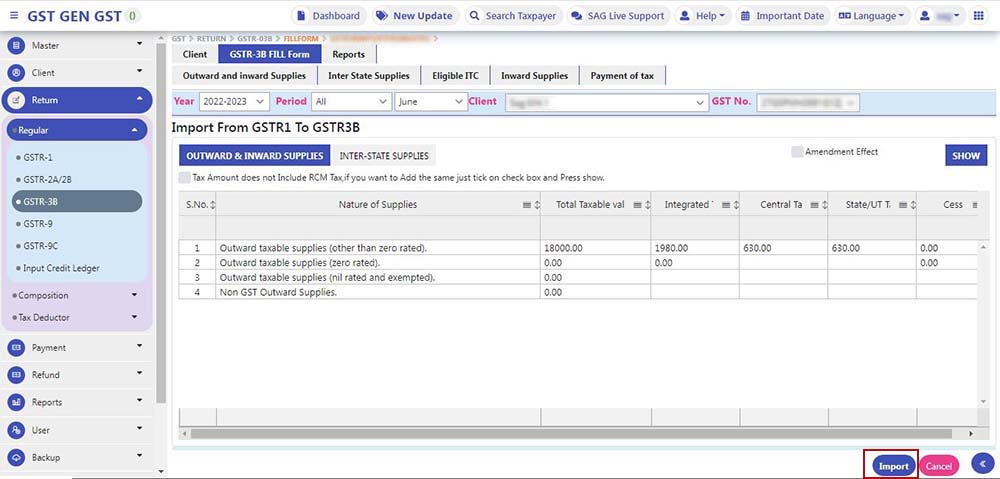

- After clicking, ‘Import’ Following Screen will be displayed

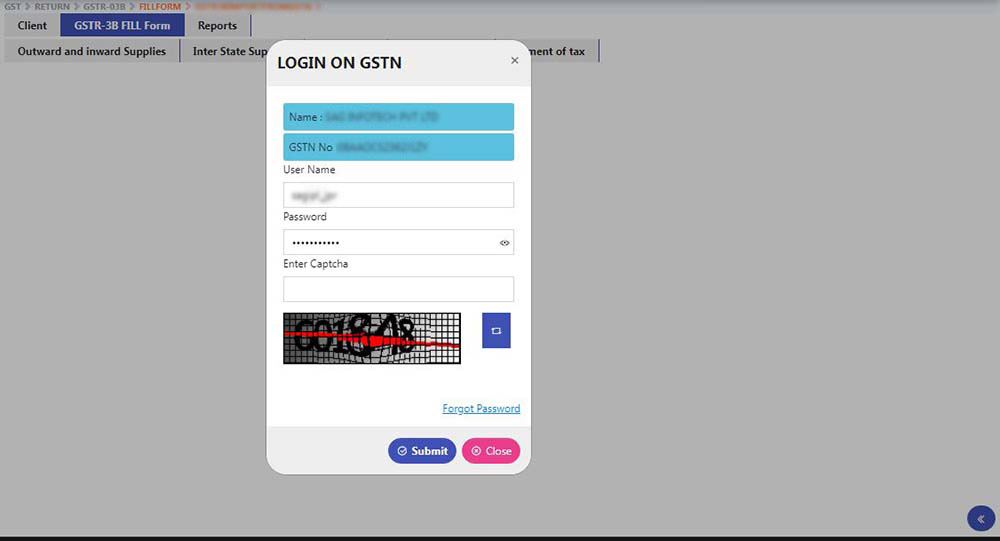

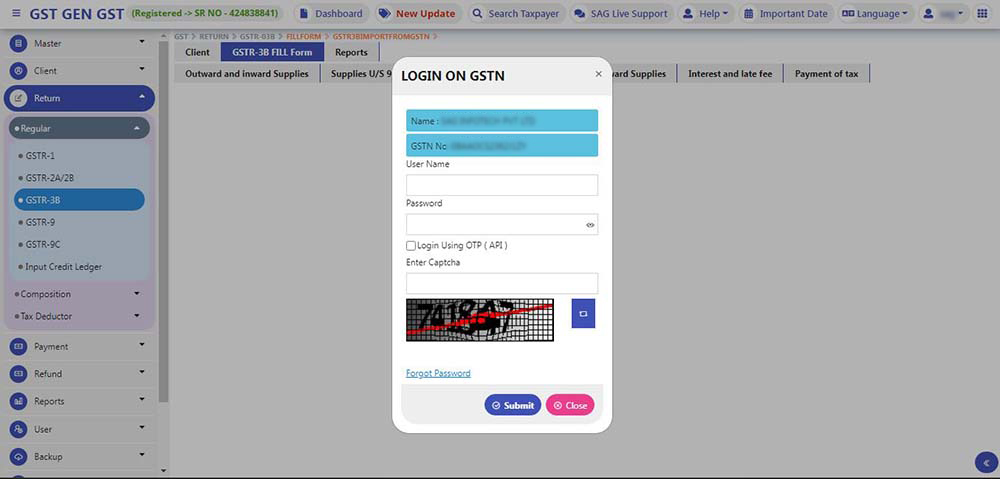

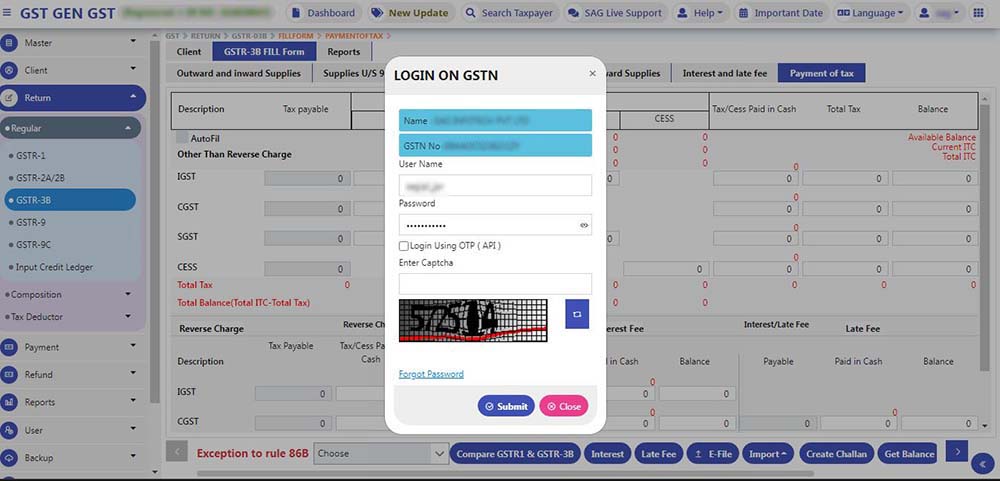

- If the user wants to get data from the GST portal then he needs to enter a username, password and captcha for getting the data into the software

- Preparing Draft GSTR3B:- The first client has to click on the ‘Import Button’

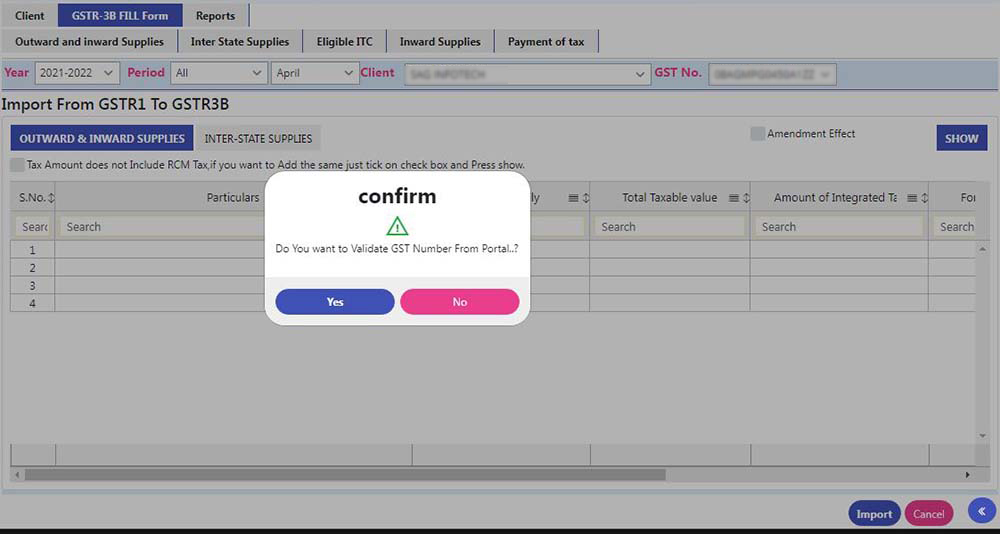

- Now click on From GSTR-1

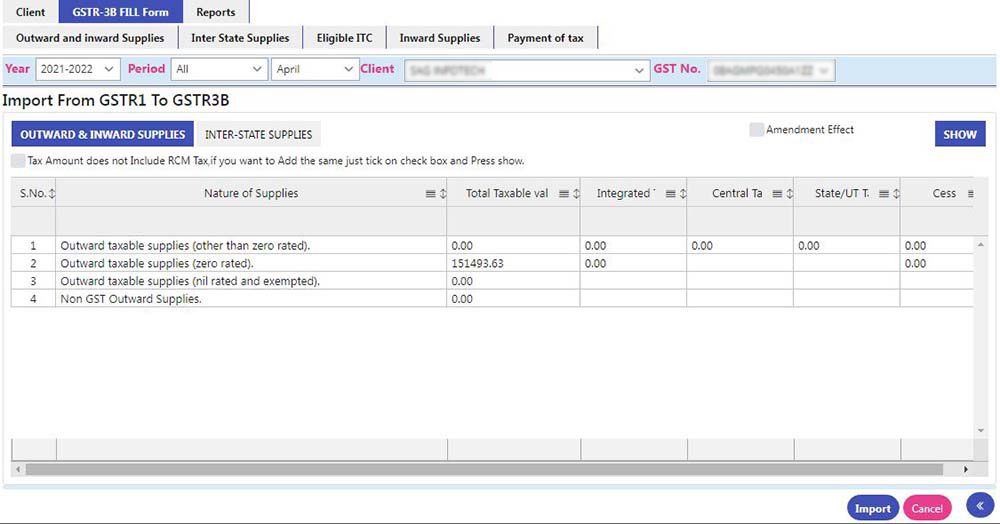

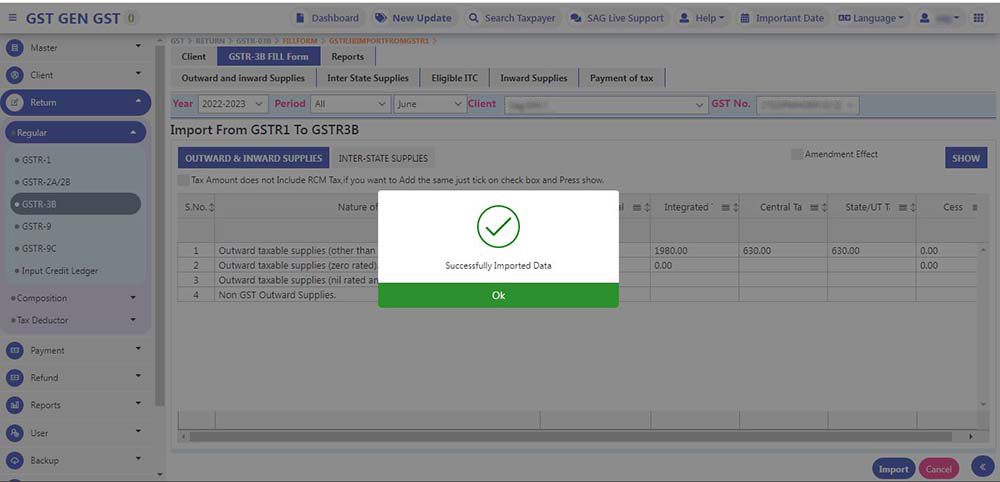

- After that, click on the show button to show Sales data derived from GSTR-1, Then click on the Import button

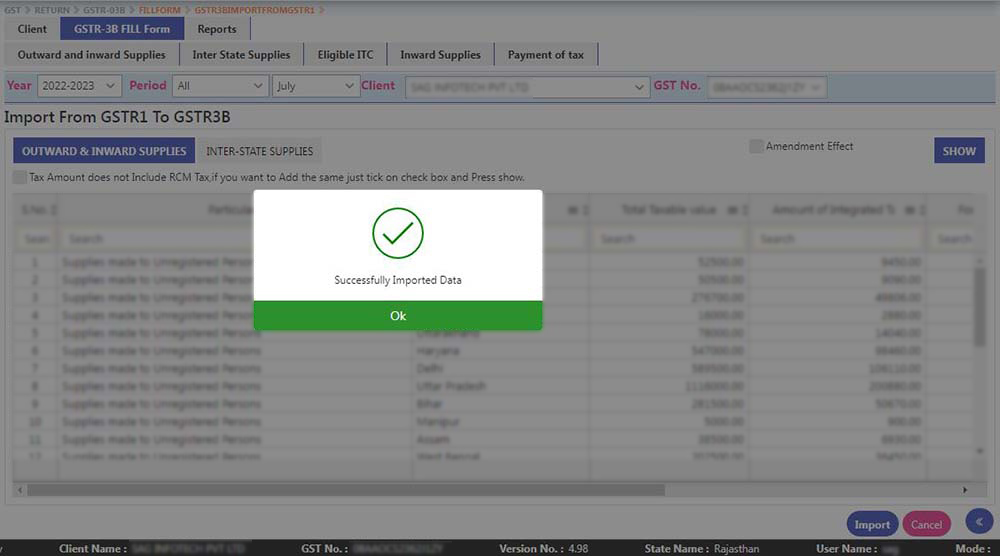

- Data Successfully imported in GSTR 3B, Click on the Ok button

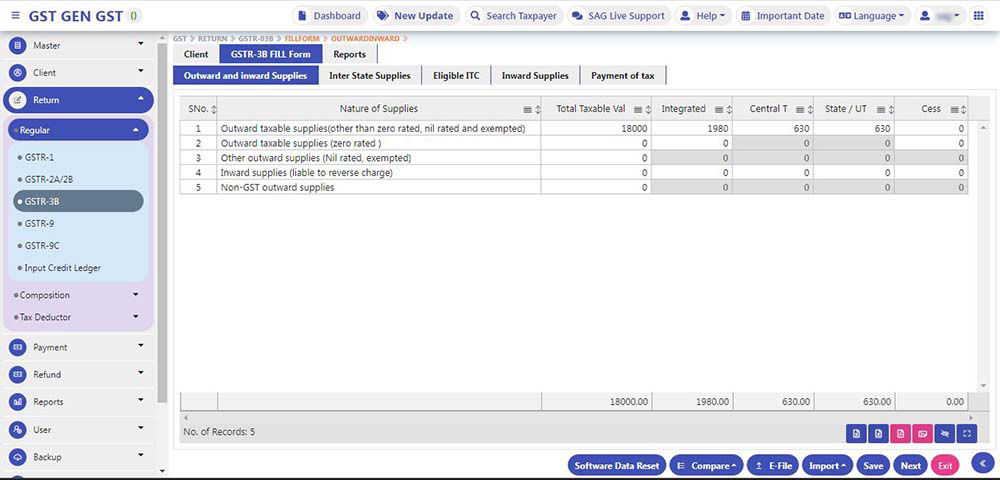

- After clicking Ok, the Following Sales figure is appearing on the below screen

Step 3:

- The Software also updates you with the status of the process from the portal such as Filed, Pending, Failed, Submitted, and Blank.

Step 4:

- To Import the details from GSTN website, click on ‘Import form GSTN’ which is available at the bottom with a green background. After furnishing the credential details and entering the captcha as shown, the data will be extracted.

Step 5:

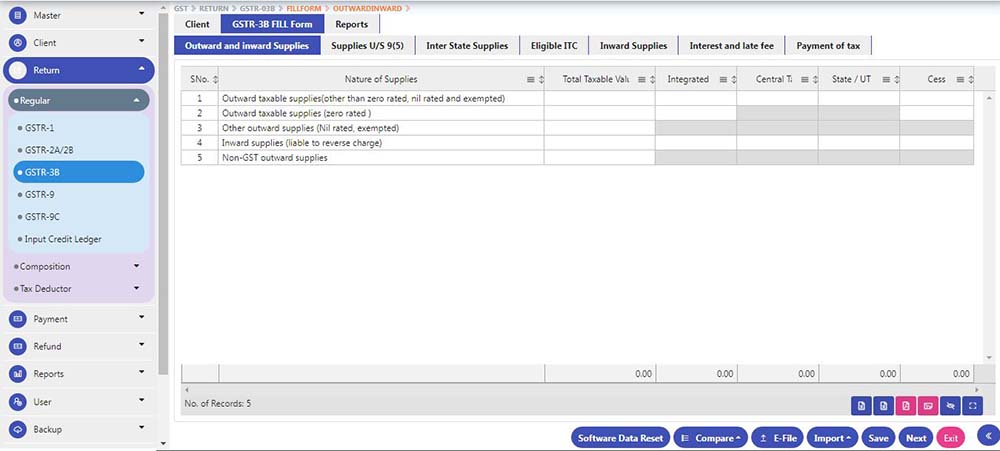

- The second option of the tab provided at the top left is ‘Fill Forms’, now click on this tab and you will be directed to a new panel where the ‘Outward & Inward Supplies’ option is auto-selected.

- Here outward supplies stand for goods sold/supplied or services provided within India and inward supplies are some notified goods and services which are liable to pay tax by the purchaser of goods or receiver of services.

- Under ‘Outward & Inward Supplies’ option, there is a grid with five options which require understanding in term of nature of supplies. Here is the detailing about the nature of supplies provided in options.

Outward taxable supplies (other than zero-rated, nil rated and exempted)

- This option is to be furnished with details of taxable value and payable on various goods sold/supplied and services provided to registered/unregistered individual in terms of total taxable value, IGST, SGST, CGST, cess and excluding nil rated, zero-rated, in a particular column against it.

Note: The Value provided in IGST must be equal to or greater than the interstate supplies mentioned in further sections of the form.

Outward taxable supplies (zero-rated)

- You are required to furnish the details of taxable value and tax payable under IGST or cess for the goods sold/supplied and services provided to Special Economic Zones(SEZ) and exports.

Other outward supplies (Nil rated, exempted)

- Furnish the details about the taxable value of goods sold/supplied or services provided in respect of the rate of tax notified is NIL.

Inward supplies (liable to reverse charge)

- In case, you have received any services and purchased goods which come under the head of reverse charge and the responsibility of tax payment is done by the receiver, furnish the taxable value and tax paid on them.

Non-GST outward supplies

- This option requires the details to be furnished with the information of taxable value on goods sold/supplied or services provided which are not part of GST liability to pay tax such as Petroleum, and Natural Gas.

Step 6:

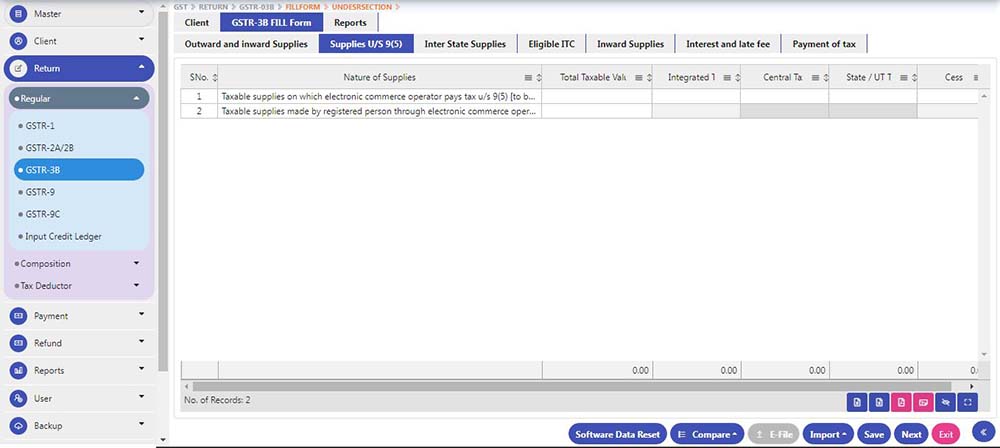

- If you have any e-com transactions then you can use this table where

- Tax paid by e-com operator u/s 9(5) will be shown in the First row and

- Taxable supplies made through e-comm operator by taxpayers will be shown in the Second row

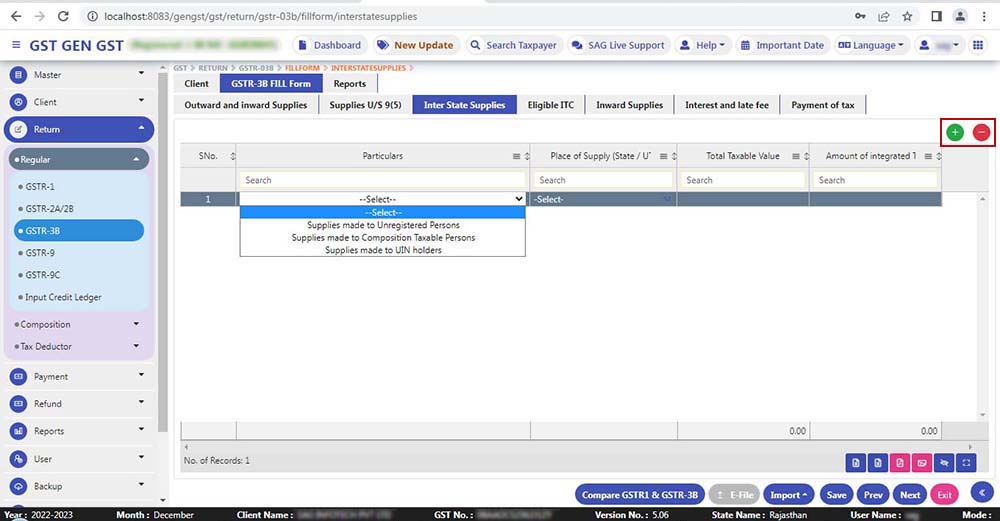

Step 7:

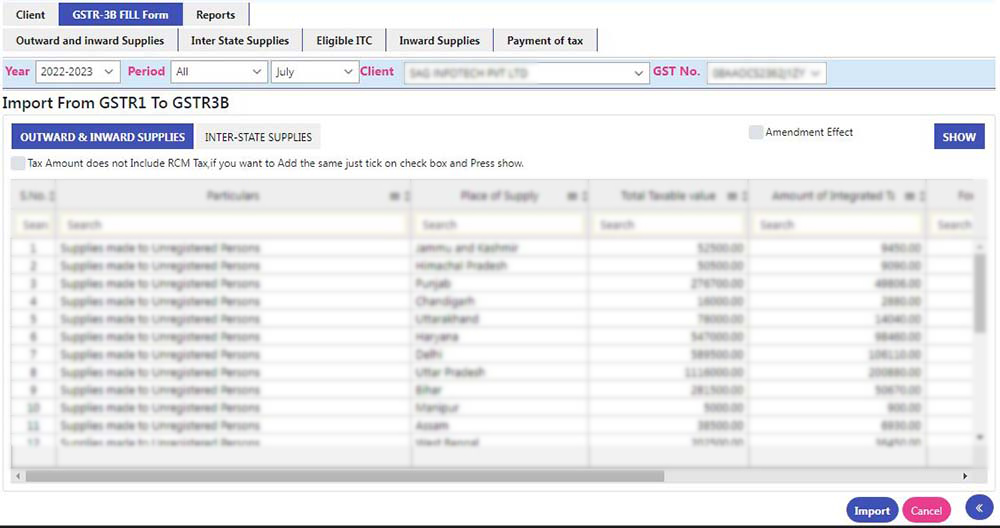

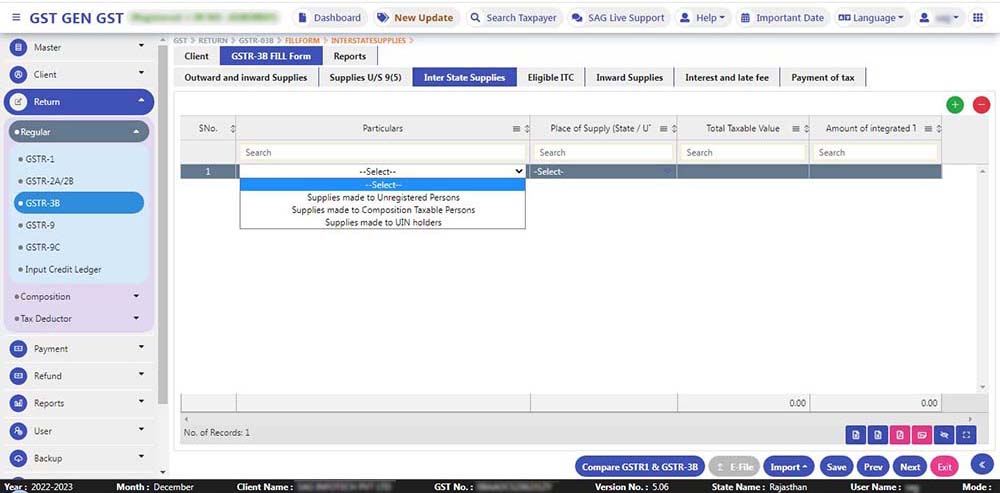

- Now just go to the ‘Inter-State Supplies’ option provided at the top. A new panel will open under this head. Interstate supplies here stand for services and goods rendered to composition taxable persons, UIN holders, and unregistered persons.

- A new panel has options like particulars, place of supply, total taxable value, and amount of integrated tax. Under ‘Particulars’ tab, choose types from a drop-down list with the provided options of Supplies made to Unregistered Persons, Supplies made to Composition Taxable Persons, Supplies made to UIN holders. Further also select the ‘Place Of Supply’ from the drop-down list.

Supplies made to Unregistered Persons: Unregistered persons do not have a GST registration under the new indirect tax regime.

Supplies made to Composition Taxable Persons: Composition Taxable Persons are registered taxpayers under the composition scheme and required to pay according to applied GST provisions.

Supplies made to UIN holders: The following come under the head of UIN eligibility listing:

- Any other person or classes of person notified by the Commissioner to have Unique Identification Number.

- Any specialized agency of the United Nations Organization(UNO).

Note: It is required to be aware that the total amount of integrated tax provided here should not be exceeded the figure mentioned in the Integrated tax in S. No.1 in Outward supplies and Inward supplies.

Step 8:

- Click on the ‘ADD +’ button provided at the top right to add the records. When you are done with addition, click on ‘Save’ button provided at the bottom right to save the records.

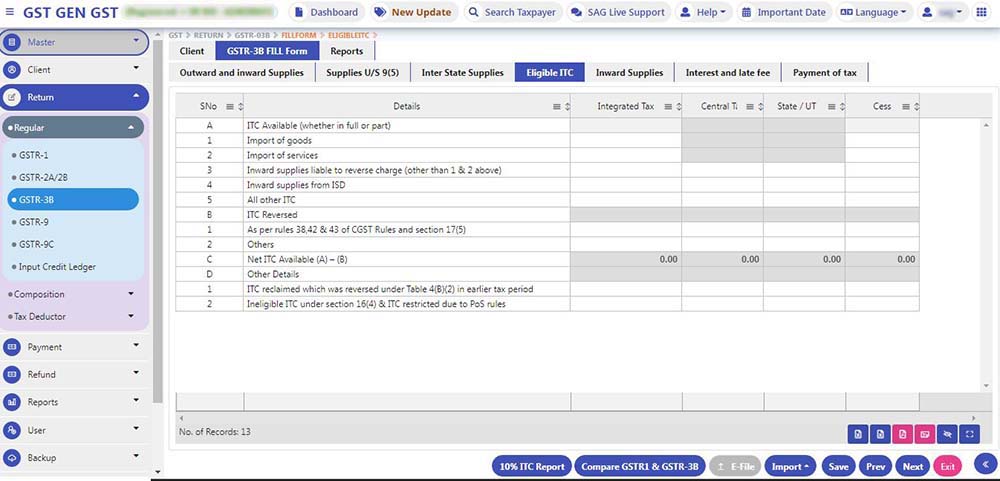

Step 9:

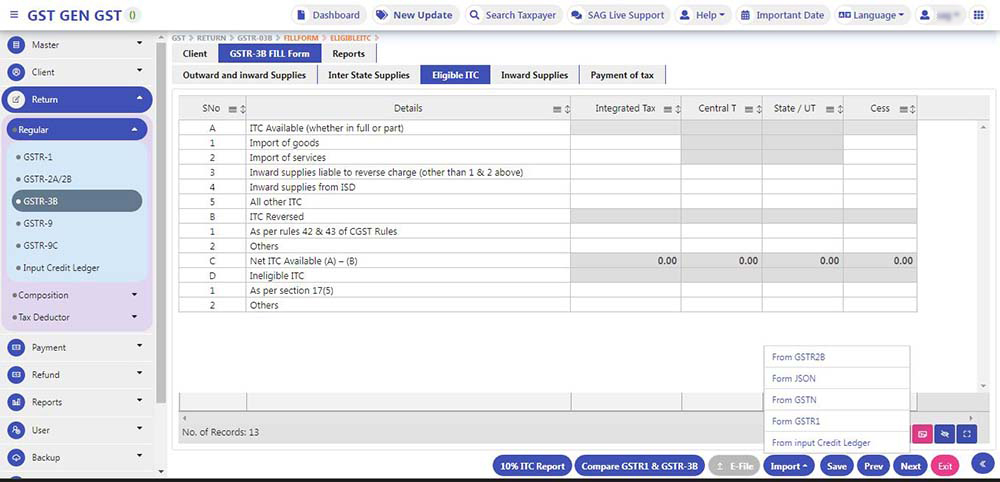

- Under the third tab ‘Eligibility ITC’, users have to furnish details about ITC (input credit) eligibility and claims. After feeding the information, save the data and proceed further. Finally, click on the upload button to upload the data to the portal.

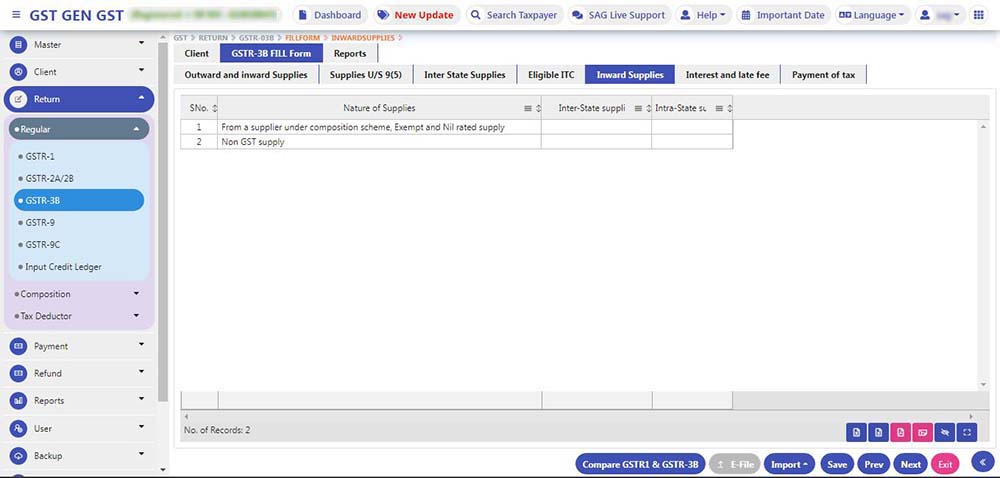

Step 10:

- To furnish the data of exempt supplies under GST for a particular month, click on the ‘Nil Rated Supplies’ tab and furnish the details regarding non-GST, GST exempt and nil-rated GST transactions. When you are done with details under this head, click on the save button.

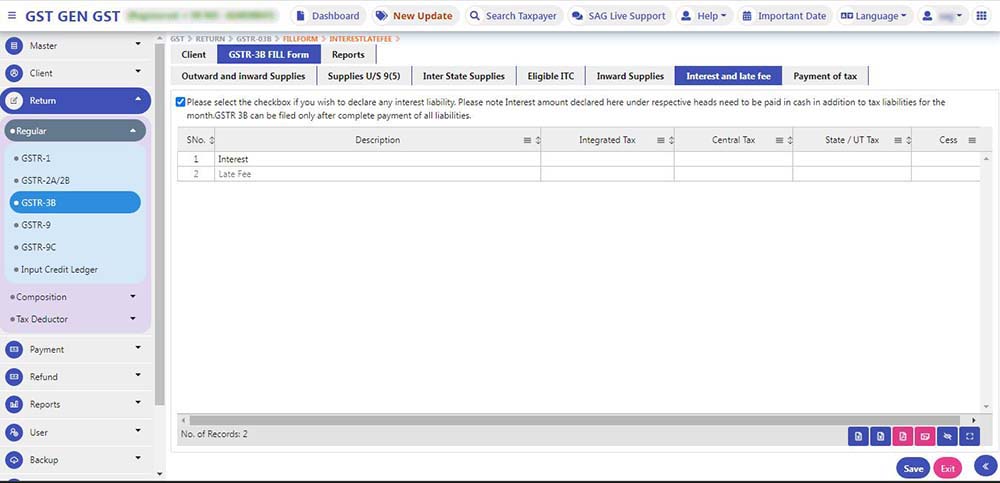

Step11: If you have ‘Interest and Late Fee’ then you need to use this tab where data comes auto-filled or you can manually edit the interest amount

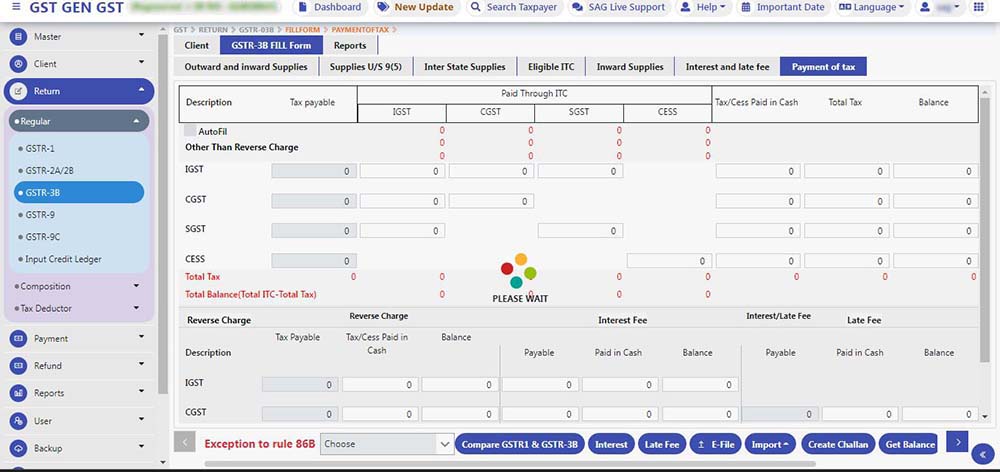

Step 12: In the ‘Payment of Tax’ tab option, details of the total tax payable after deducting the input tax credit are provided. Here are two columns where furnished details about ‘Other Than Reverse Charge’ and ‘Reverse Charge’ are shown.

- To know your current ITC, enter or get your eligible ITC Tax.

- To know to get the cash & credit balance, click on Get Balance Button.

- To check the opening balance of this month and also validate input data with available balance & current ITC, click on check online balance.

- In case you have not set the whole liability, check the balance sheet where the liability amount is available.

- To adjust the liability of IGST, CGST, SGST, and Cess automatically, click on auto-fill checkbox.

Step 13:

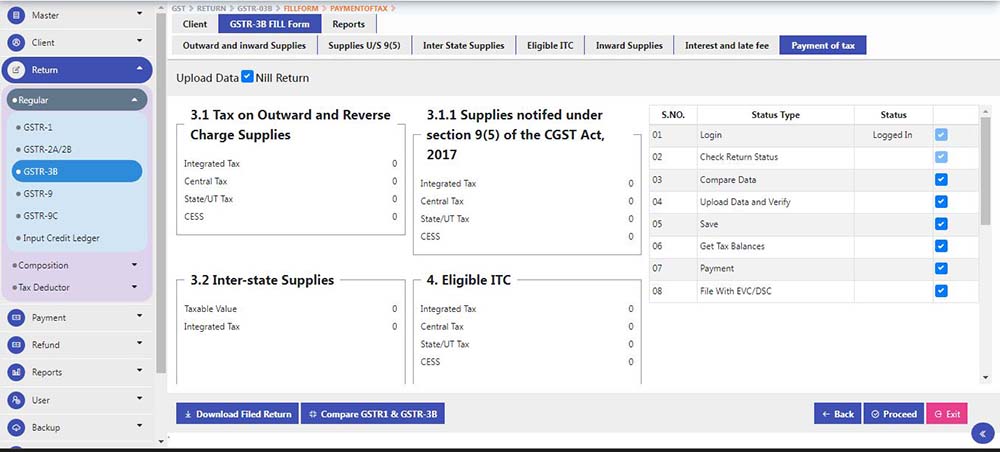

- After verifying and confirming the details, click on select all checkbox or select the particular checkbox from the right panel manually, now click on upload button to upload the information on the GSTN site.

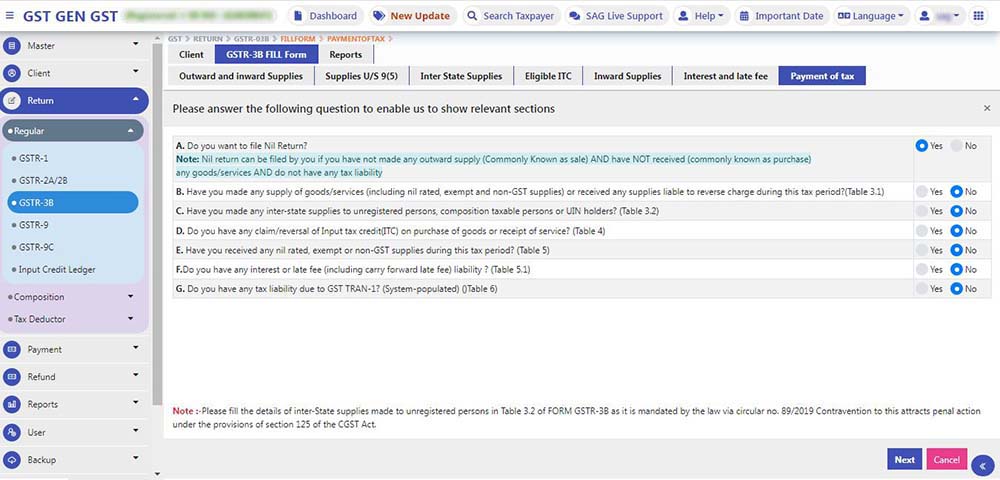

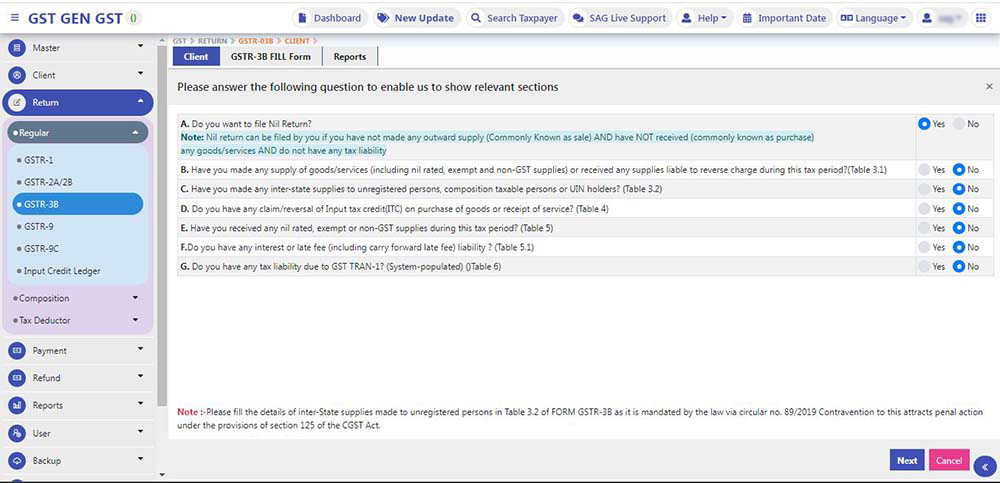

Step 14: After entering Captcha it will transfer you to a new window which asks for questioners

Step 15: After that click on the next button it lands on the last page where it will summarise and click on all check-boxes to file your return on a single click

- The GSTR 3B online filing procedure is explained in a full-fledged manner, still, if you are stuck somewhere or you have any queries regarding the filing procedure, feel free to contact us for any Gen GST software-related queries.

Reports

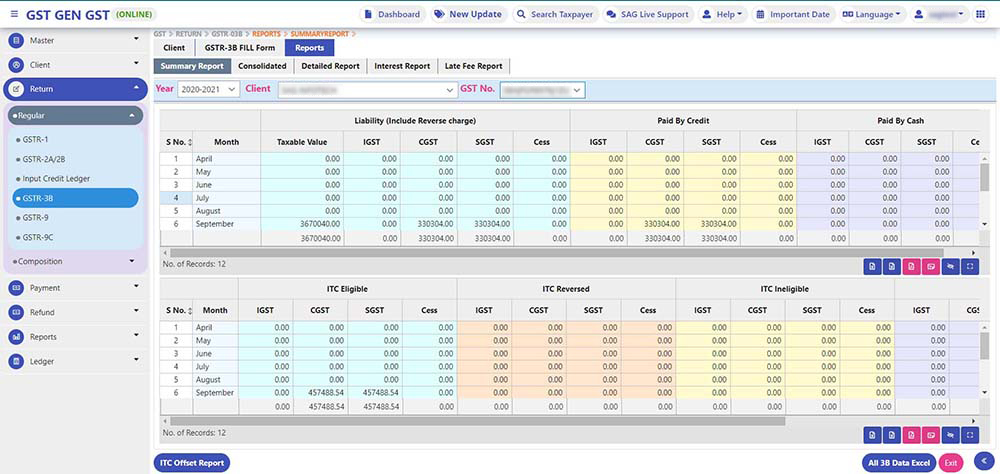

Summary Report: This report reflects liabilities and ITC information of GSTR-3B for the whole Financial Year.

ITC Offset Report: Shows the payment of liabilities with credit/Cash of GSTR-3B for the whole Financial Year.

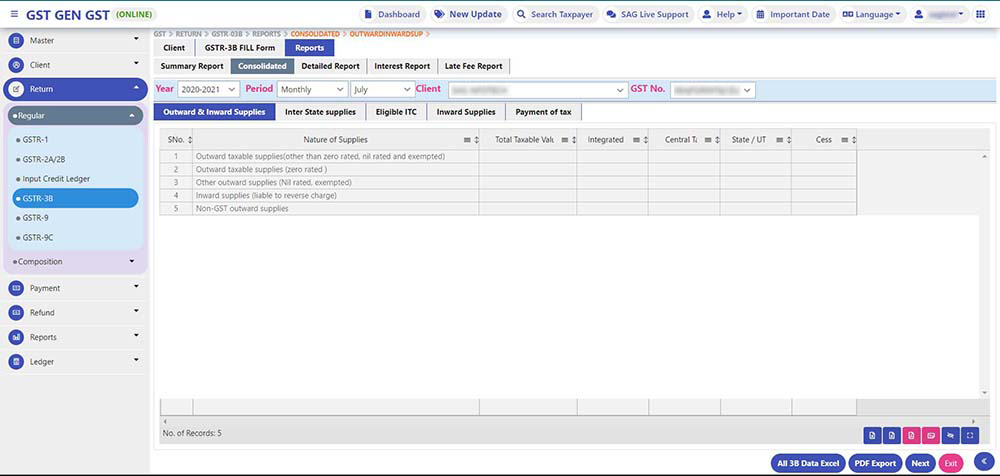

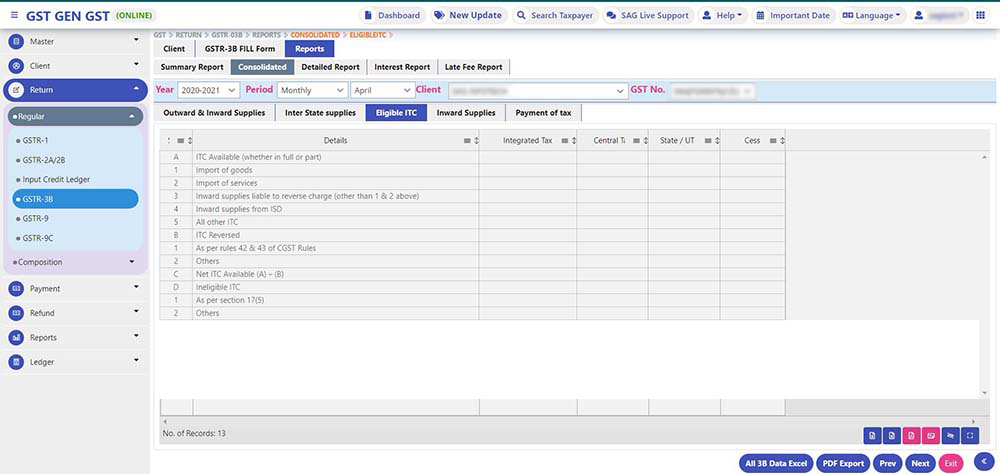

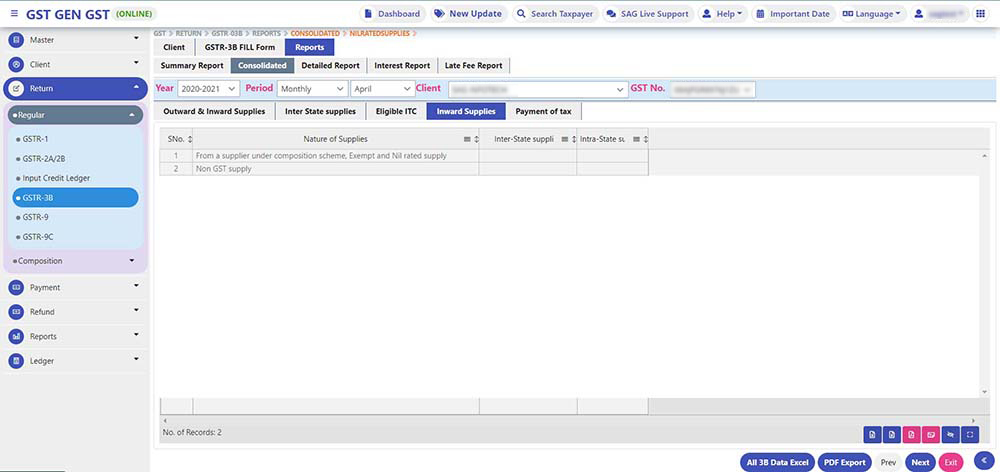

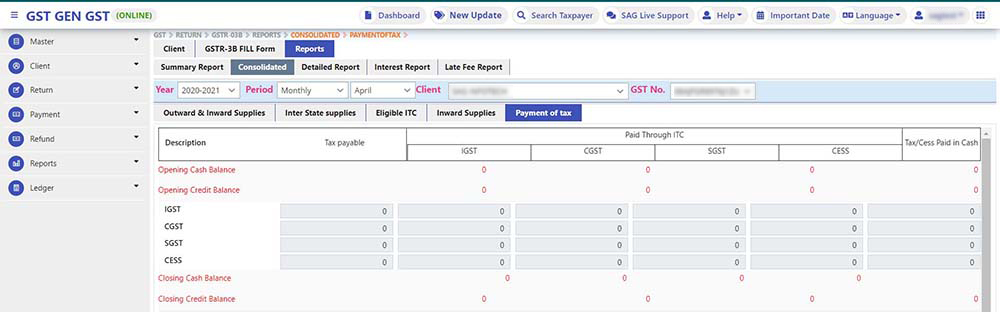

Consolidated Report: Includes

- Outward and Inward Supplies: Shows Outward and Inward Supplies for a selected period.

- Interstate Supplies: Show Interstate Supplies from the selected period.

- Eligible ITC: Shows Eligible ITC from a selected period.

- Inward Supplies: Shows inward supplies for a selected period.

- Payment of Tax: Shows payment of Tax for a selected period.

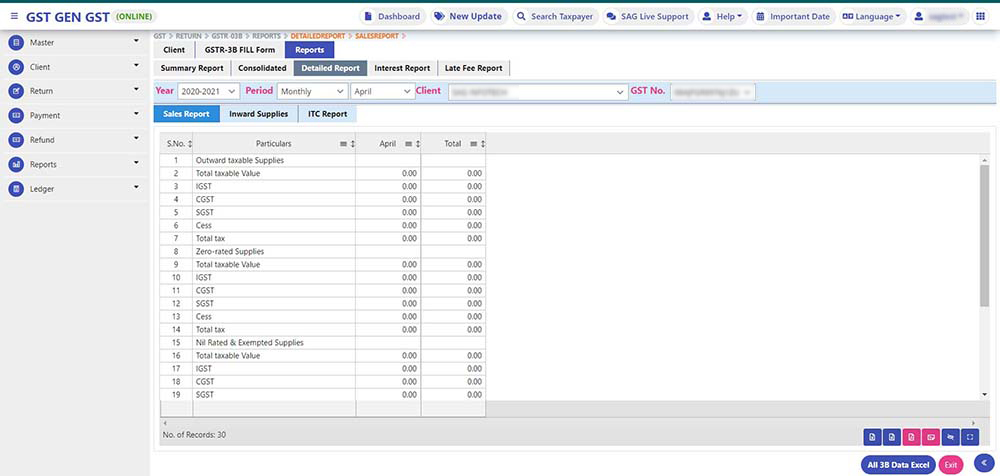

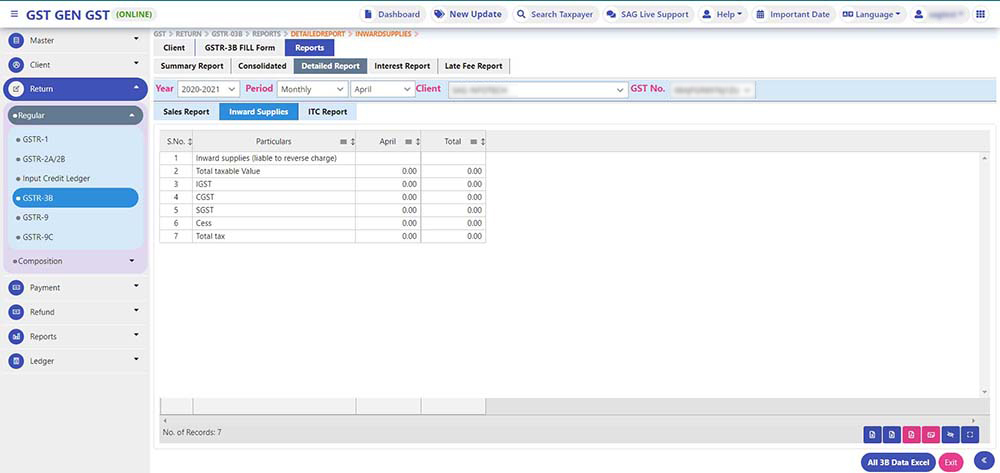

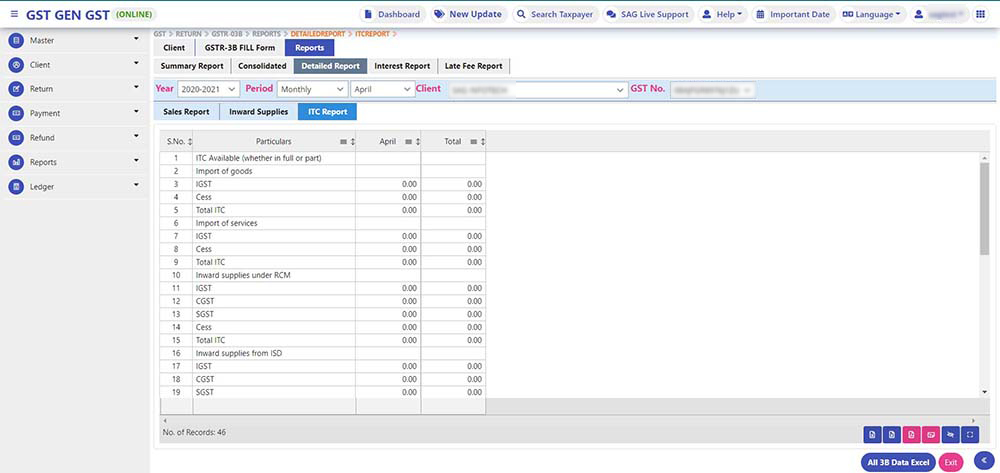

Detailed Report: Includes

- Sales Report: Shows the Total Turnover of the selected period. You can view the report on a Monthly / Quarterly / H.Yearly / Annual basis, as per your selection

Inward supplies

- ITC Report: Shows the Total ITC Available for the selected period. You can view the report on a Monthly / Quarterly / H.Yearly / Annual basis, as per your selection.

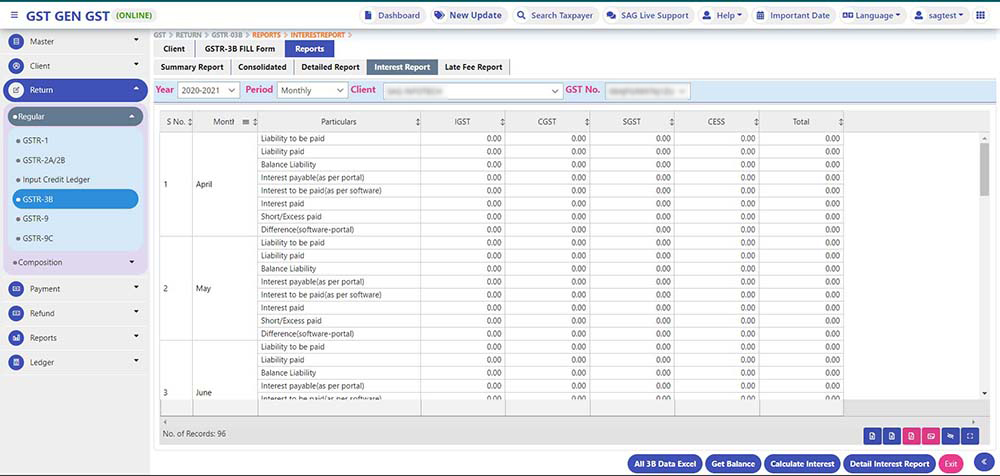

- Interest Report: Shows Total Interest Liability of the selected period. You can view the report on a Monthly / Quarterly / H.Yearly / Annual basis, as per your selection.

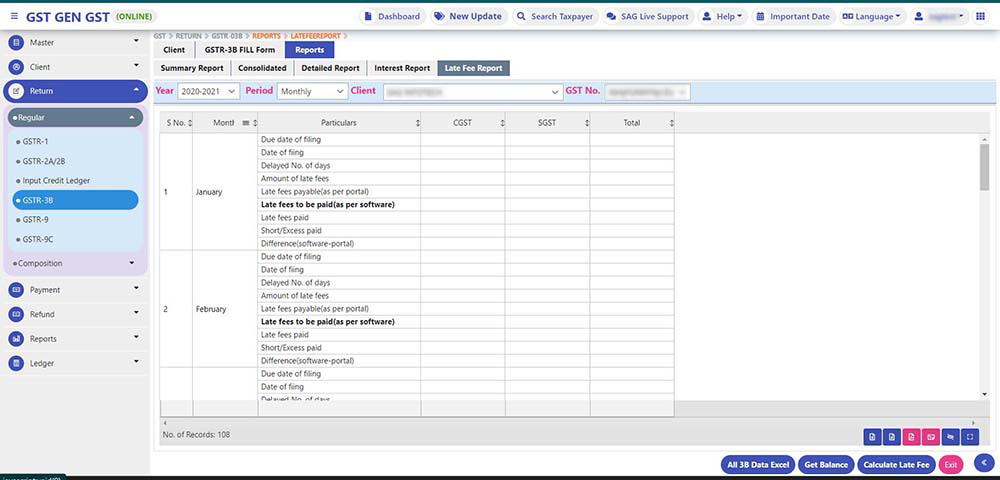

Late Fee Report

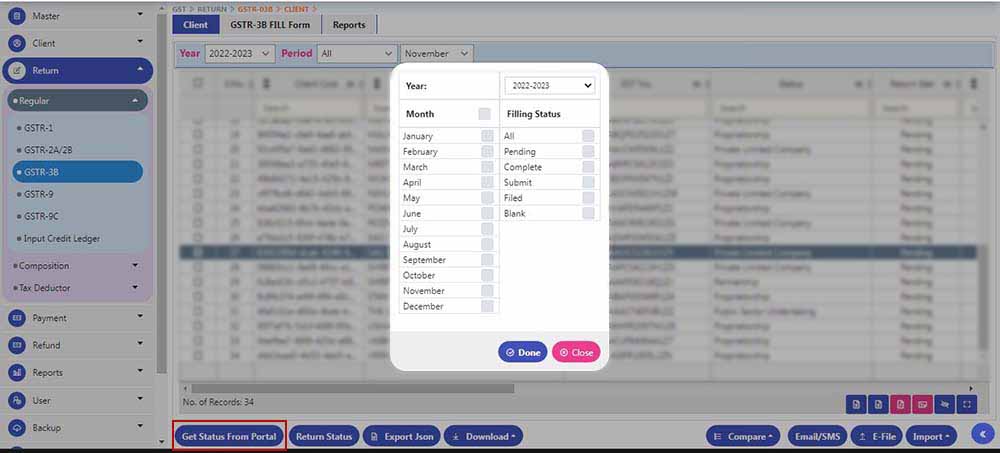

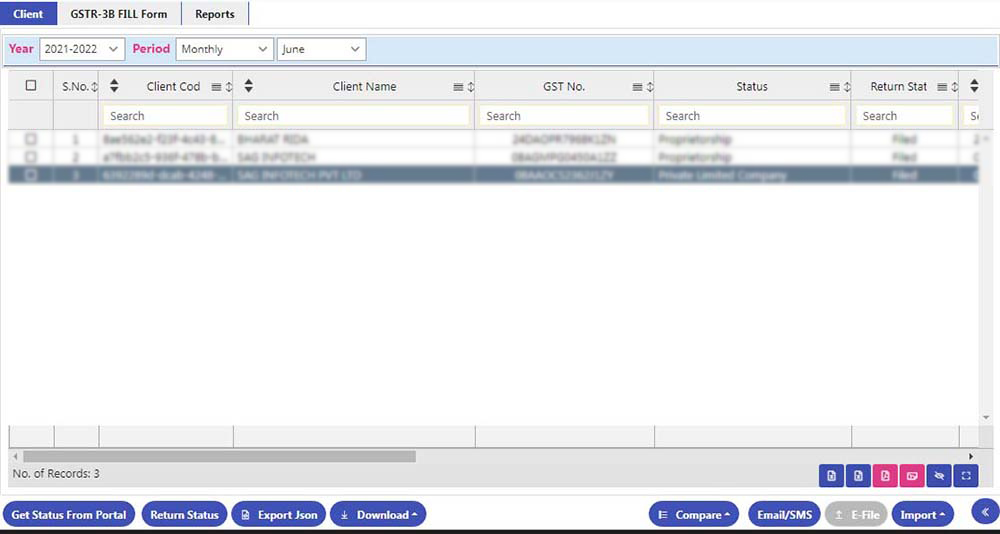

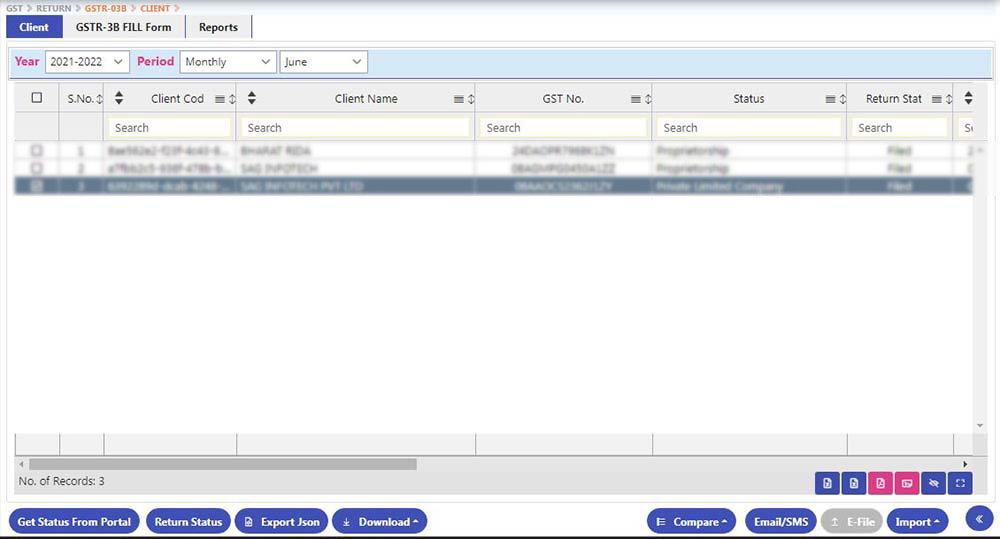

Get Status from Portal:

- If the user wants to get the Filling Status of All Clients at the same time, one can get the same from the “Get Status From Portal” tab

- For this Users need to Select Multiple Clients for which they want to get the return filing status details

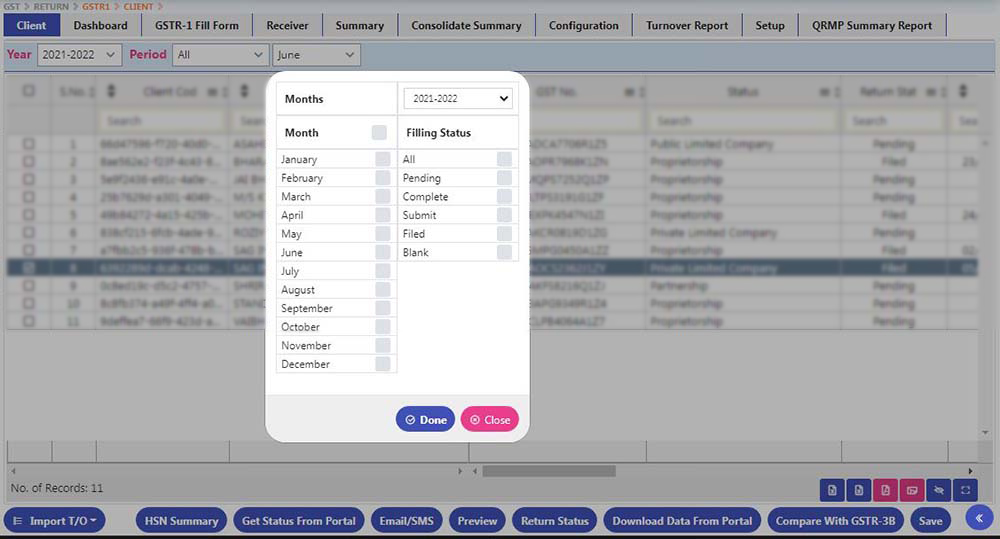

- After that click on months and filing status particulars to know the actual results

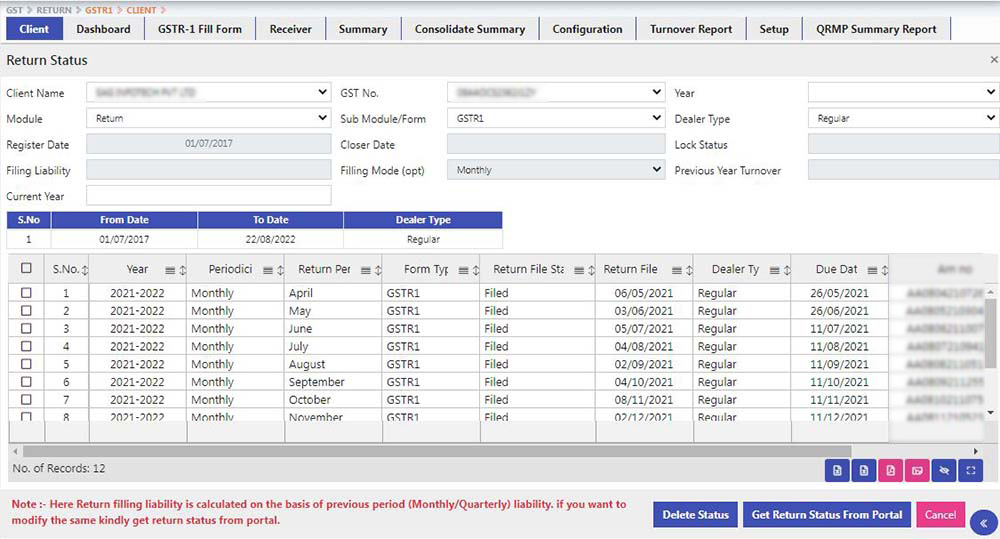

Return Status:

- If the user wants to get the Filling Status of Single Clients then he can get the same from the “Return Status ” tab

- For this user needs to select the Particular Client then click on Particular Period and go through the ” Get Status from Portal” tab.

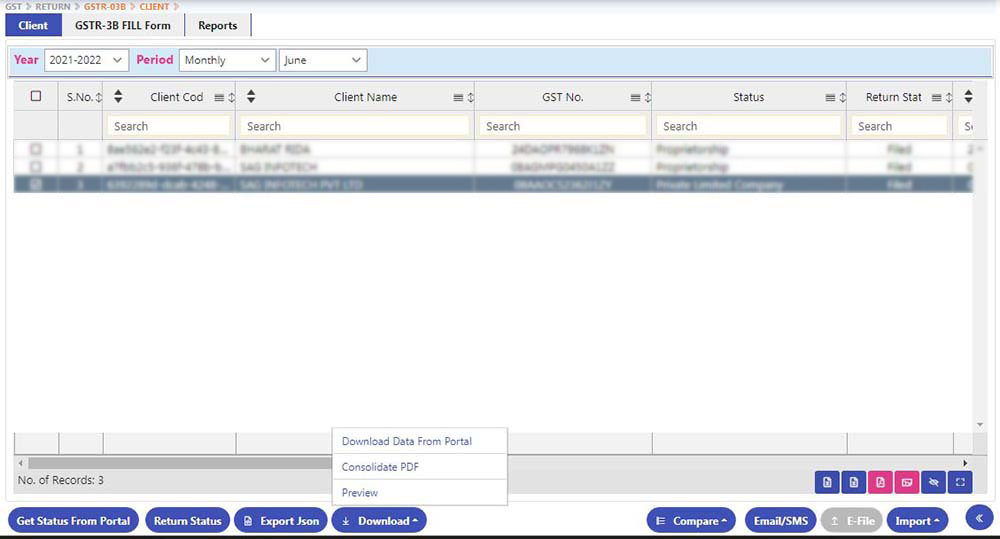

Export JSON:

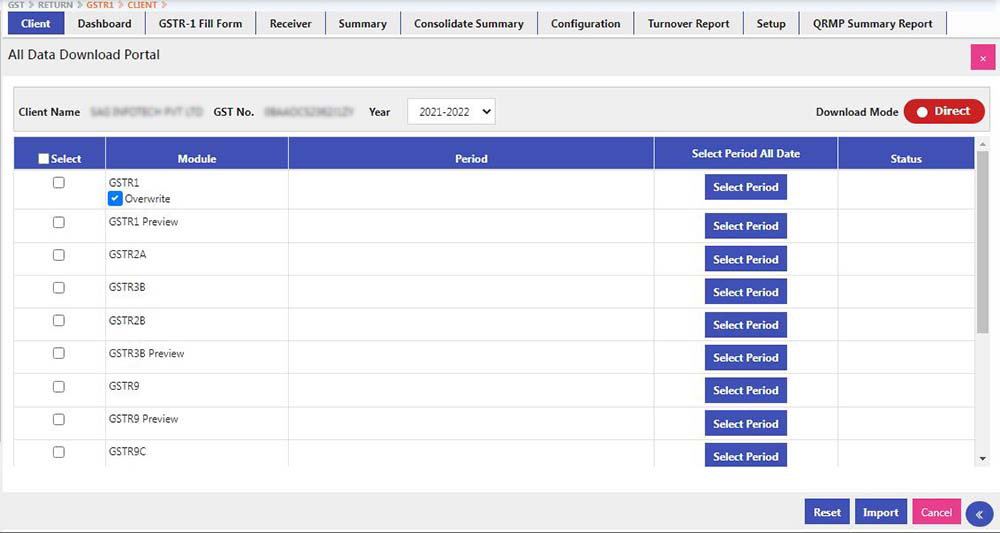

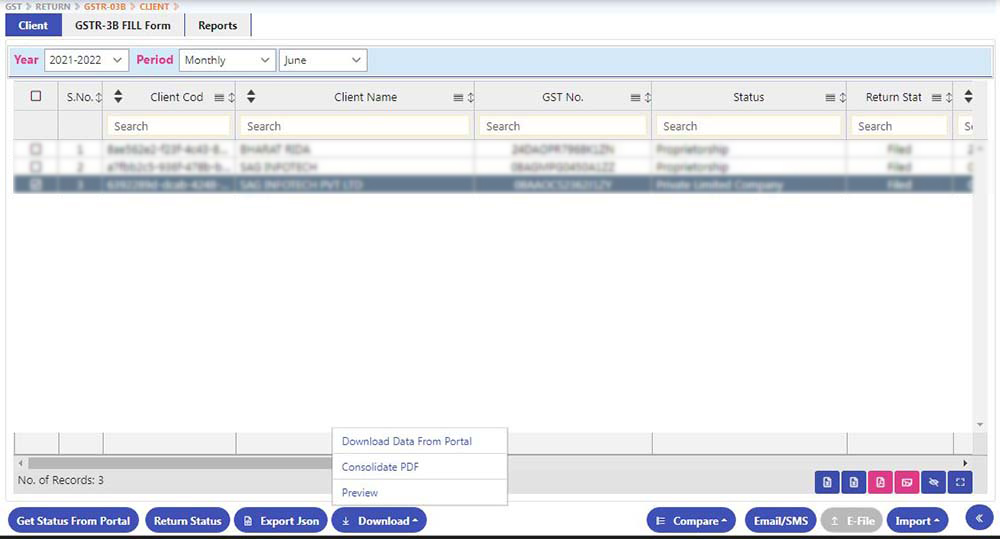

- If the user wants to get the Return data from the portal of multiple returns as well as multiple clients Then he can get the same from the “Download data from portal” tab

- For this client Needs to Select the respective return form as well as Select the respective period.

- After that user need to click on the Import button, and then a captcha is asked, the user needs to enter a captcha then he can get the required data from the portal into the software.

- Preview: This is GST Portal provided PDF

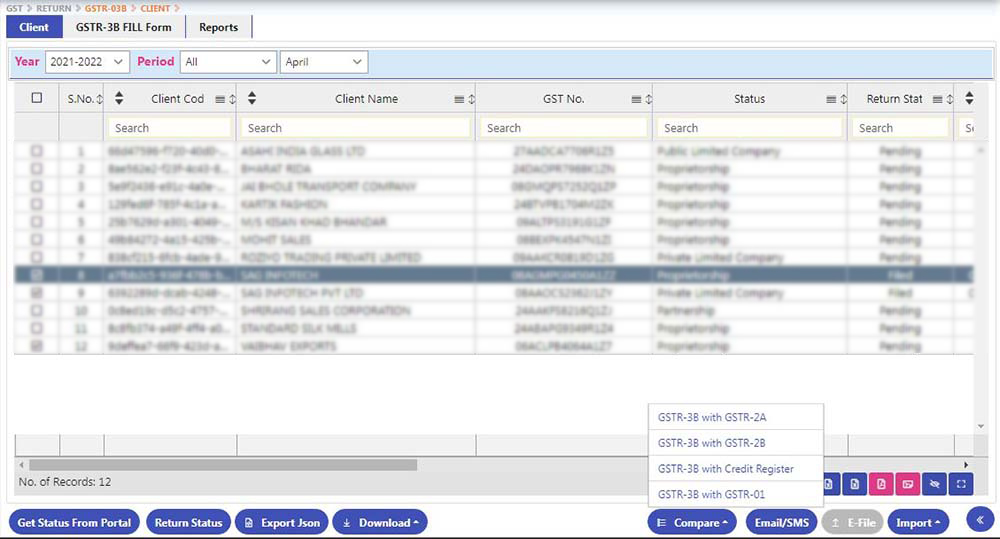

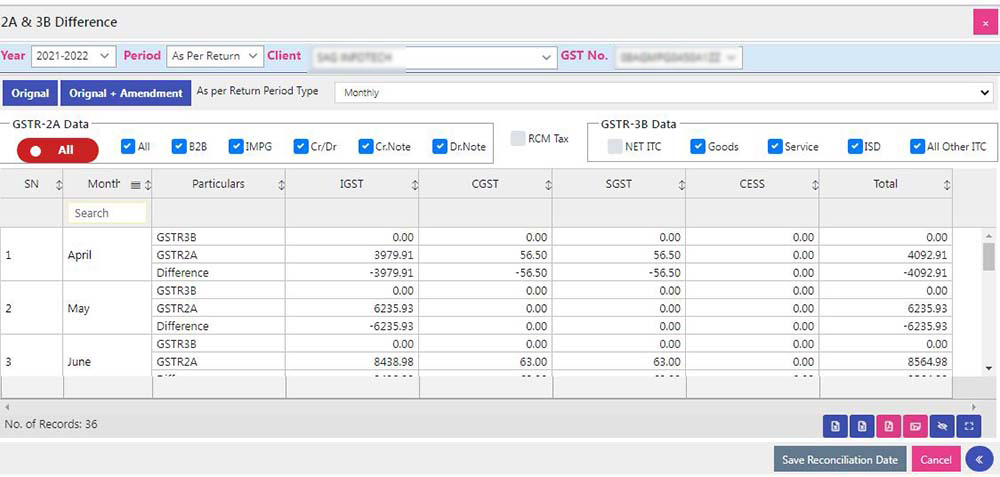

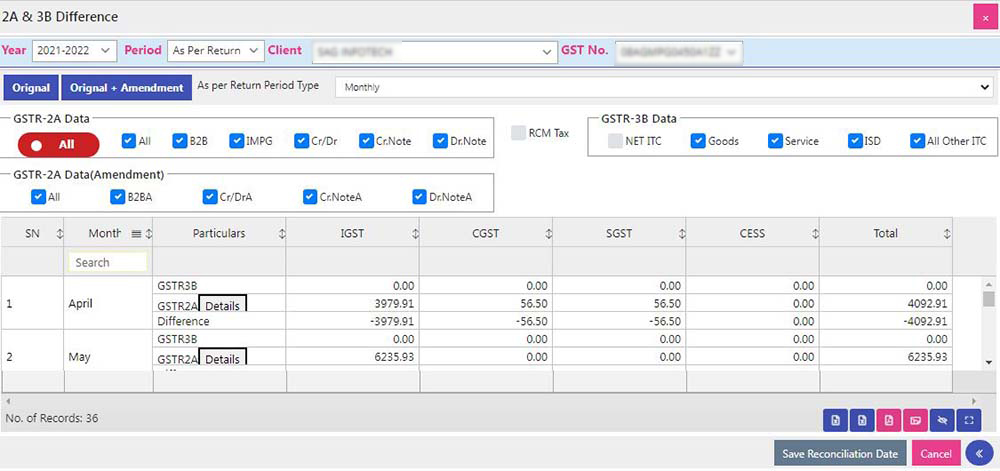

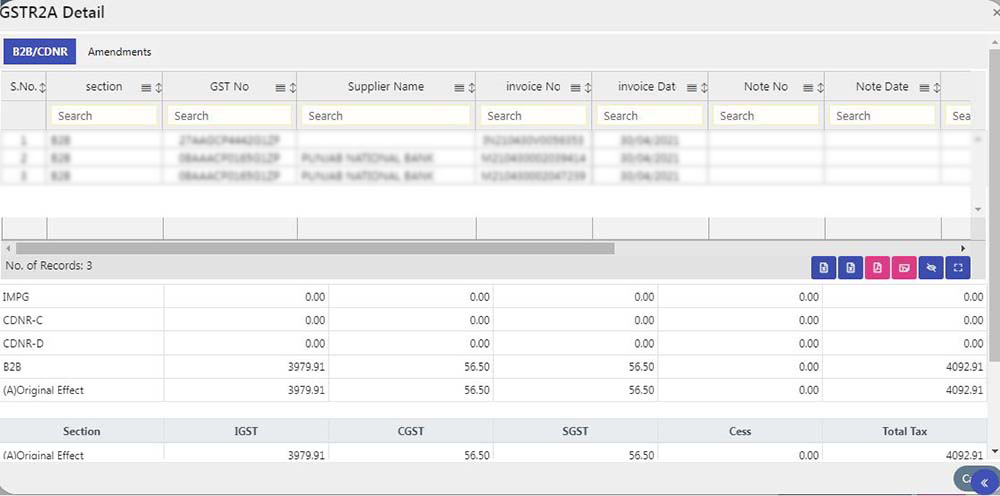

- GSTR 2A & 3B Difference: it can be viewed as per Return as well as As per Period

- Original + Amendment

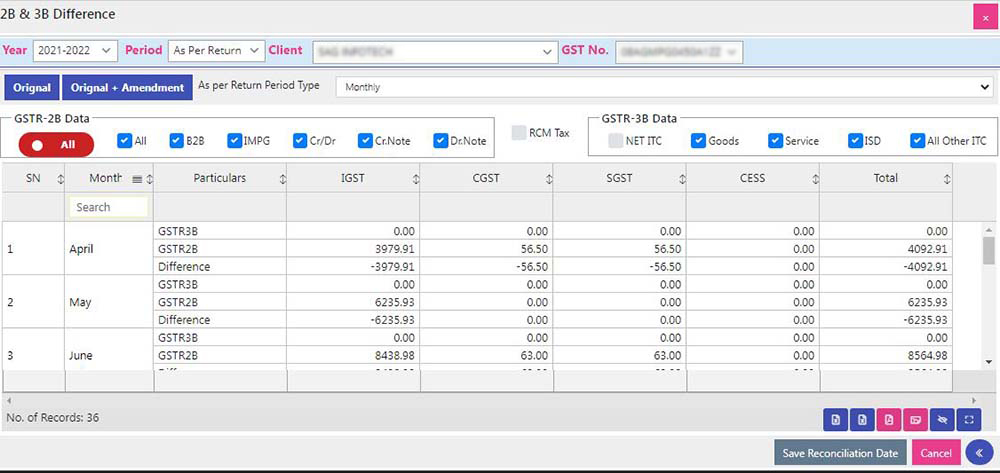

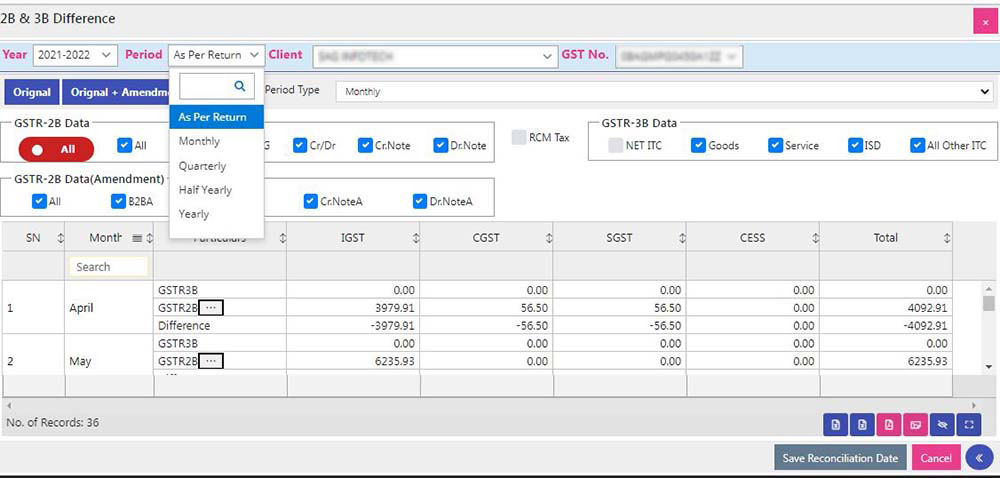

- GSTR 2B & 3B Difference: It can be viewed as per Return as well as As per return

- Original + Amendment

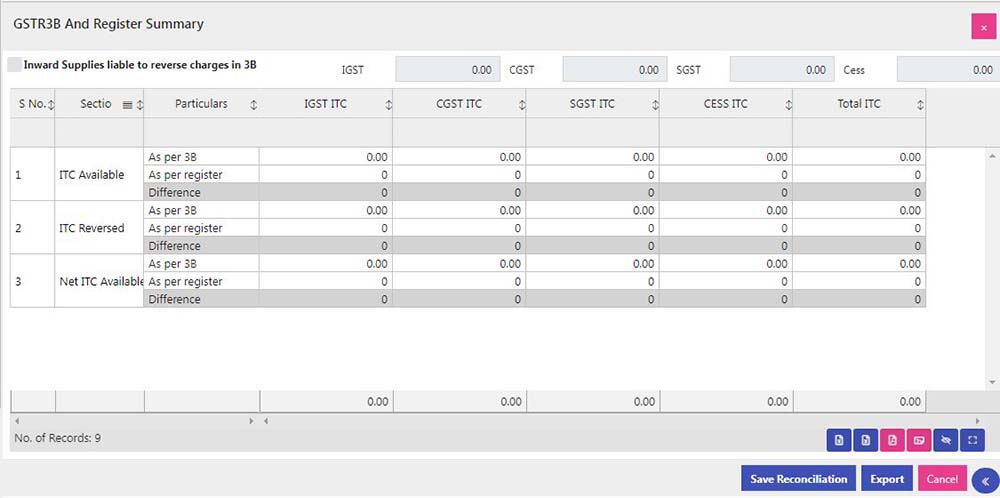

- GSTR 3B & ITC Register Difference

- At the Eligible ITC tab, we have provided the facility of importing GSTR2B ITC.

- After importing Data from Respective Returns click on E file Button, there Following Questions will be asked, After clicking Yes or No Click on the Next button

- We have provided the following Check box, to be ticked by the assessee for easy filling of GSTR-3B.