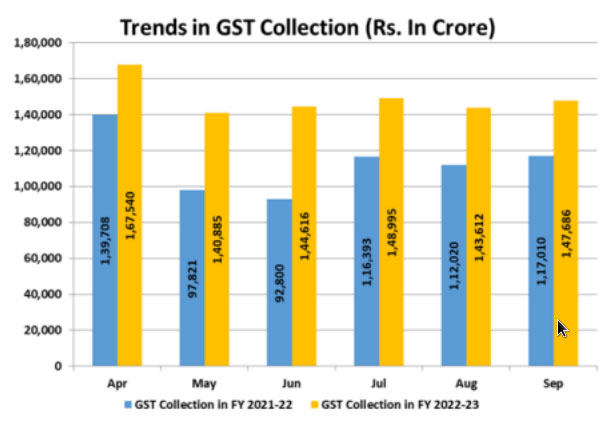

In the month of September, the GST collection surged to Rs 1.47 lakh cr because of the combined effects of the surged cost of goods and services the higher demand for them, the raised tax compliance by the traders, and the festive season.

The collection has been rose by 26% with respect to the identical quarter in former years that would have been recognized as anticipating and effective for the increase in the collection of the tax in the forthcoming festive months.

September month collection was increased to Rs 1.43 lakh cr as compared to the month of August. For the former 7 straight months, the GST collection has sustained above Rs 1.40 lakh cr. The same rendered the GST collection stable. The revenue would be anticipated to get increased with the coming festival of Diwali.

The economy is satisfactory compared to the other countries, on the GST revenue there incurred a positive impact, said Union Finance ministry. In the present financial year, April 2022 represents a record collection of Rs 1.67 lakh cr.

Rs 1,47,686 crore would be the cumulative GST revenue that has been collected in the month of September 2022. Out of total tax revenue in the current year, central Goods and Services Tax accounted for Rs 25,271 crore, State Goods and Services Tax accounted for Rs 31,813 crore, while Integrated Goods and Services Tax accounted for Rs 80,464 crore (including Rs 41,215 crore collected on imported goods) including that Rs 10,137 crores has been collected via cess (along with the cess of Rs 856 crore collected on goods import), the finance ministry has described.

In the collection of the state a rise of 2.5 thousand crores

In the month of September, the collection of Goods and Services Tax (GST) in the state augmented by 2.5 thousand crores as compared to August. The officials of the state finance department would eye that the state economy will be faster during the festive season.

Read Also: India Ratings: Higher Inflation Not Consumption, Reason for More GST Collection

Rs 21,403 crore goods and services tax has been collected by the state in the month of September. In the month of August Rs 18,863 crore was collected. The August collection was reduced nearly to Rs 3000 cr as compared to July however the collection would have been improvised again in the month of September. Rs 20,000 cr would be the average monthly collection in the state.

The month of August has been impacted harder. The international fuel price reduction would indeed support the collection of the state. An increase in shopping has been seen in the festive season.

It is anticipated to have much more collection in the month of October and November. Rs 16,584 cr would have been collected by the state in the month of September 2021. The same collection was Rs 21.403 crores in the current year.

Hence a 29% rise is there. Since the state has comes from the corona period and thus the financial transaction shall get easier. In the month of September Maharashtra leads the collection of GST in the country. Karnataka (9760 crores), Gujarat (9,020 crores), and Tamil Nadu (8,637 crores).