Cancellation of GST registration is not a hard work as the Indian government GST Portal has provided a simple and easy step-by-step procedure to finally cancel the GST registration of migrated taxpayers through the newly implemented feature. Goods and services tax, which was implemented recently and to be exact on 1st July 2017 with a lot of promises and work in progress tagline, is known to be subsuming all the indirect taxes into one. All the business units are exempted from paying GST which are under the turnover of 20 lakhs annually and all the business units above this exemption limit have to be registered under the GST.

The registration part has been discussed everywhere and has been understood manifold by guides and articles, but now there comes a chance to cancel the registration under GST by the taxpayer itself or by any governing authorities. The cancellation option is for migrated taxpayer only who wants to cancel their registration on GST.

By far we have got the confirmation that the business organisation can cancel their registration by the means of the recently popped up feature on the GSTN portal, but the cancellation feature is limited to only 3 entities who can initiate the cancellation of registration:

- The taxpayer himself

- GST officer

- A legal heir of the taxpayer

The cancellation of the registration can be initiated in some cases like the death of the taxpayer. While the registration can also be done voluntarily but only after one or more years are elapsed starting from the date of GST registration.

Latest Update Under Cancellation of GST Registration

- GST registrations that have been revoked under a new procedure have been introduced. Applicants must file the application by June 30, 2023, after filing all returns with tax payments up to that date. Read Notification

- The Orissa HC has allowed an assessee to file GST returns previous to the cancellation of registration and directed the Government to modify the portal accordingly. read order

- “The CBIC has added the advisory about the new functionality of restoration of cancelled registration under GST via REG-21.” Read More

- “The GSTIN has enabled new features for the taxpayers to easily withdraw the application of GST registration cancellation.”

- The High Court of Gujarat has stopped the cancellation of registration under the GST regime on grounds of vague show cause notice (SCN) without any material particulars. read order

- The Rajasthan High Court issues an order for the petitioner, M/s. Avon Udhyog related to the cancellation of GST registration due to failure to file a reply within time. Read Order

GST Authorities Cancelled 1.63 lakh Registrations

Goods & services tax (GST) authorities have cancelled over 1.63 lakh registrations in October and November of taxpayers who have not filed their GSTR-3B returns for more than six months. The council started serving notices to taxpayers who did not file their GSTR-3B returns for the past six months or more and then cancelled their registration as per the procedure.

Conditions, When a Taxpayer Can Cancel the GST registration?

- Discontinuance or closure of the business

- Taxable person ceases to be liable to pay tax

- Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise

- Change in the constitution of the business leading to a change in PAN

- Registered voluntarily but did not commence any business within the specified time

- A taxable person not liable any longer to be registered under GST act

Who All Cannot File the Cancellation of GST Registration?

- Taxpayers registered as Tax deductors / Tax collectors

- Taxpayers who have been allotted UIN

Steps for Cancellation of GST Registration Online on GST Portal

The GSTN portal is live with the cancellation of GST registration for the migrated taxpayers. All the taxpayers who have not issued any invoice after registration can opt for this service. The individual can fill out form GST REG 16 in case he has filled any tax invoice.

Steps for cancellation of GST registration for the migrated taxpayer:

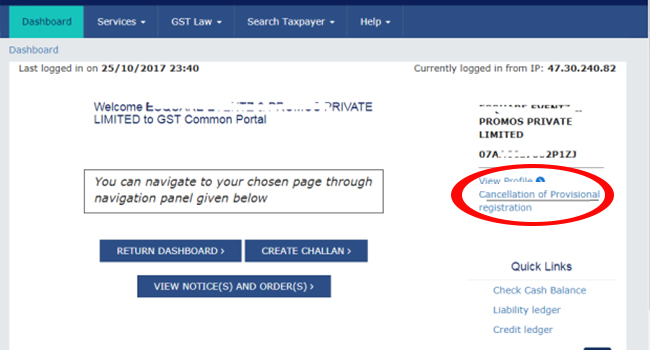

- Login with username and password on the GST portal

- Then click on the tab ‘Cancellation of provisional registration’

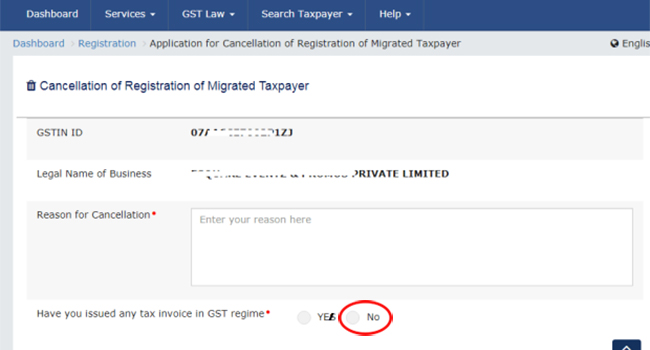

- After which a popup will ask that if a taxpayer has raised any tax invoices in the period of GST

- Select ‘No’

- After the selection, the taxpayer will have to go through verification and have to submit all the form-related details along with the digital signature/EVC

Forms used to cancel GST registration:

GST REG 16: The forms are applicable only when the taxpayer himself applies for the cancellation of registration and there is no consideration for the application other than the taxpayer’s application, which has elapsed one or more years after the GST registration.

GST REG 17: An authorised GST officer can provide the notice of show cause/cancellation to the registered taxpayer and its business entity by using the REG 17 form. The cancellation of registration by the authorised officer can be initiated after issuing the GST REG 17 form to the taxpayer, and he can ask for a show cause as if why the registration should not be cancelled.

GST REG 18: The show cause notice can be replied to by means of the furnished GST REG 18 form under the specified time period stated in the sub-rule (1). The taxpayer or the concerned party must reply to the notice within 7 days of issuance of the notice, giving an explanation of safeguarding the cancellation of registration.

Read Also: Goods and Services Tax (GST) Forms for Registration & Cancellation

GST REG 19: The GST REG 19 form is for the usage of GST officer for issuing a formal order for the cancellation of GST registration. The order for sending the notice must be under 30 days from the date of application or the response date in GST REG 18 form.

GST REG 20: The show cause notice when satisfied by the GST officer can direct for the revoke of any proceedings towards the cancellation of the registration and he should pass the order in the Form GST REG 20.

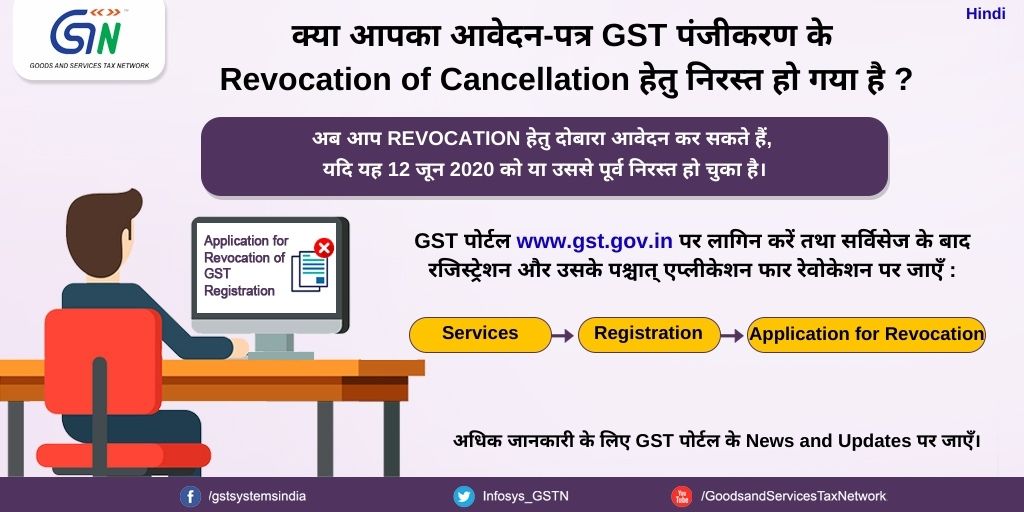

Application for Revocation of Registration on GST Portal